- Network Effects

- Posts

- Navan: Bundling Travel & Spend Management (S-1 Deep Dive)

Navan: Bundling Travel & Spend Management (S-1 Deep Dive)

How Navan Disrupts the B2B Travel Industry with AI

Welcome to the 27th Network Effects Newsletter

Founded in 2015, Navan (formerly TripActions) is a unique end-to-end platform consolidating corporate travel booking and expense management. For years, the industry has separated these functions—travel with players like Expedia and Booking.com, and spend with platforms like Ramp and Brex. Navan’s core innovation is bundling these services, offering a seamless, unified experience.

Navan filed its S-1 with the SEC on September 19, 2025. In this deep dive, we break down the company's play across four key components:

Overview

Market

Model

Margins

(This is the launch of a new series covering S-1 filings in depth. I would love to hear any feedback or requests for future companies!)

Let's dive in.

Navan Business Overview

Navan (formerly known as TripActions) was founded in 2015 by Ariel Cohen (CEO) and Ilan Twig (CTO). The co-founders were both technology executives and worked at HP and Mercury Interactive before founding their first company together in 2012. This company, StreamOnce, was an internet software business that was later acquired by Jive Software.

Cohen first had the idea of tackling business travel during one of his business trips to Ukraine. Upon checking into his hotel, he realized that his travel agency had not booked his room properly. Despite attempts to contact the agency, he could not resolve the issue as no software was available then. Consequently, Cohen had to move between hotels in the frigid weather, looking for open rooms until he eventually found a room.

When Cohen and Twig later discussed their next startup idea, they decided to tackle the opportunity of making business travellers' lives easier by providing offerings such as mobile/web online booking tools, 24/7 customer support on the go, and gamification that incentivizes business travellers to save their companies' money.

As of September 2025, Navan has achieved major financial milestones, including

Gross Booking Volume: $7.6B (34% YoY Growth)

Revenue: $613M (32% YoY Growth)

LTM Gross Margin: 71%

CSAT 96%

Active Enterprise Customers: 10,000+

Product NPS: 43

Average Time to Book a Trip on Navan: 7 mins (compared to 45 mins average)

Average Realized Median Savings: 15% (compared to travel budgets)

Market: Corporate Travel Industry

According to Navan’s S1, the market opportunity for the global corporate travel industry amounts to $185 billion, segmented into four categories:

Managed and Unmanaged Business Travel Management

Bleisure

Expense management

Payments

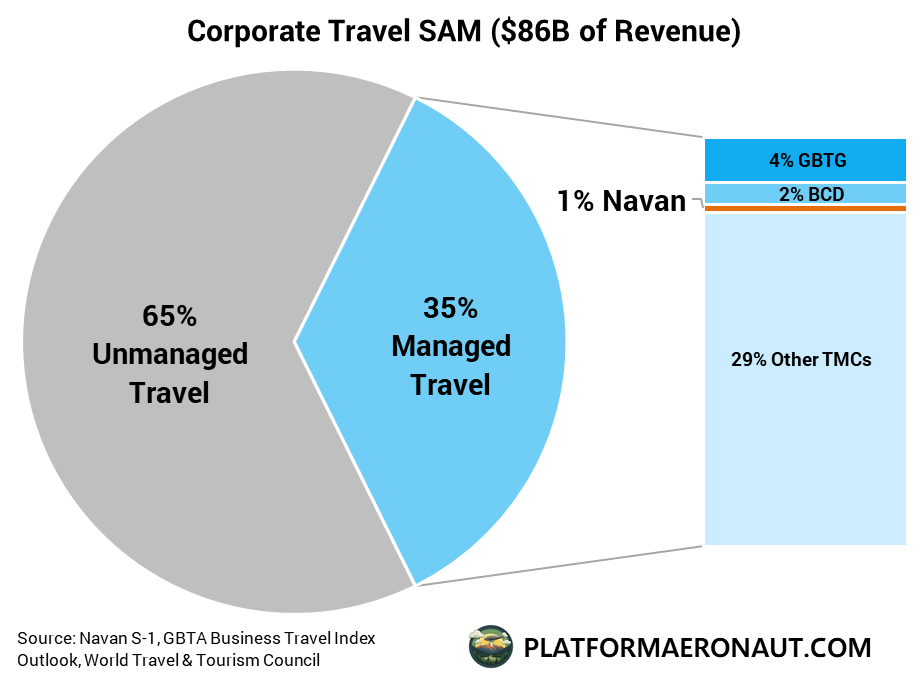

The largest travel management segment is defined by the split between:

Managed Travel (35%): Centrally governed programs where employees use approved tools (TMCs) under enforced policies.

Unmanaged Travel (65%): Employees book independently on consumer/direct channels, leading to fragmented data and payment issues.

Traditional Travel Management Companies (TMCs) focus heavily on the managed space. Navan’s flywheel is designed to convert unmanaged spend into “lightly-managed” travel, where travelers can book anywhere, but all data, receipts, and policy checks are automatically ingested, providing policy nudges and duty-of-care coverage.

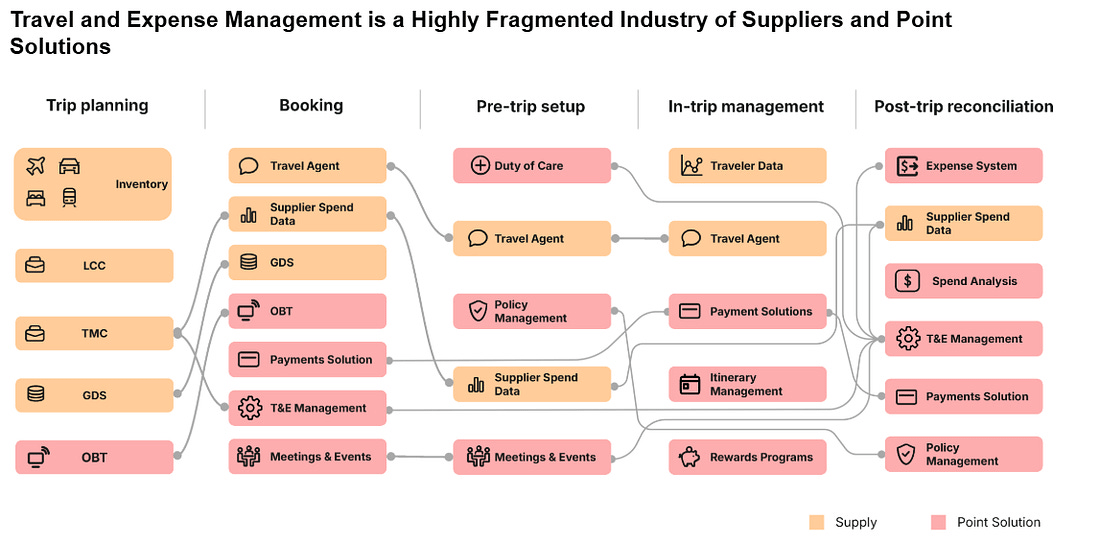

The current process for corporate travel is a fragmented process involving:

Global Distribution System (network for flights/hotels e.g., Google Flights)

Booking tools (through agents or marketplaces e.g., Trivago, Booking.com)

Expense Software (expense systems, sometimes manual)

Other invisible stacks (analytics, communications, and payments)

The incumbent solutions are mostly designed for finance teams, travel managers, and HR teams and can serve both small businesses and enterprises.

The challenge of delivering a seamless user experience for travel is exacerbated by a highly fragmented industry that imposes high costs and significant inefficiencies on businesses. A single business trip may require over ten different tools, systems, and workflows to book travel and manage expenses for one traveler

The key players in the industry include Amex GBT, CWT, and DirectTravel. These companies are service-heavy and have primarily grown through acquisitions. For instance, Amex GBT has acquired over 10 companies since 2016 (including SMT, KDS, Egencia, and CWT) to become one of the leading travel platforms for enterprises.

Their EBITDA margins hover between the high 20s and low 30s, assisted by scale and some automation. However, this creates massive opportunities for new entrants like Navan to take a technology-first approach and reinvent the service-heavy B2B travel management industry.

Navan began by targeting scaling tech companies (1K-5K employees, $10-50M+ revenue) and now serves over 10,000 customers, including tech giants and global enterprises like Unilever, Netflix, and Adobe.

Navan’s core offerings span three solutions:

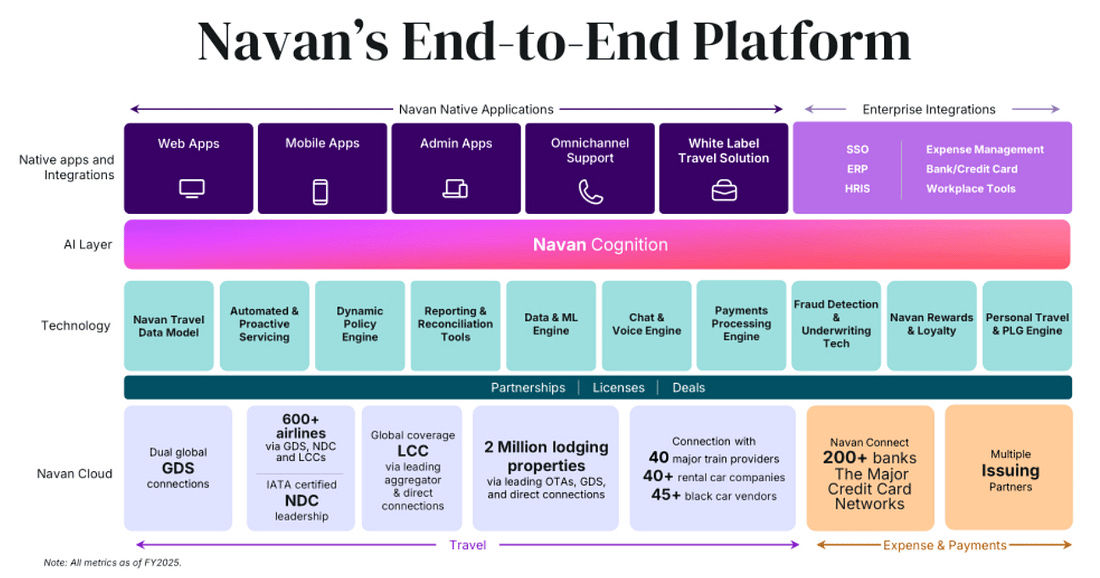

A. Navan Cloud - “Proprietary Travel Algorithm”

Navan Cloud is an in-house global distribution system (GDS) that provides a global, real-time inventory of travel products (flights, hotels) for its users. Its direct connections and integrations enable access to sell over 600 airlines and over 2 million individual lodging properties.

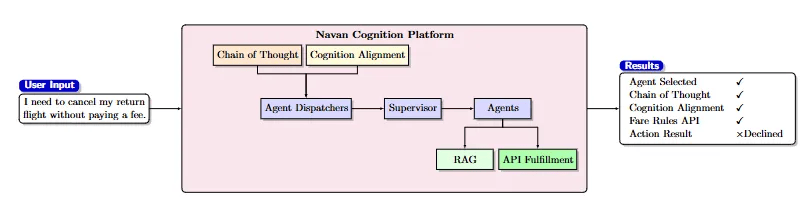

B. Navan Cognition - “Travel Agent Automation Suite”

Navan Cognition is Navan’s AI framework that combines the precision and predictive power of ML with the reasoning capabilities of LLMs. Navan Cognition orchestrates and operates a modular framework of virtual agents using a graph-based workflow, allowing its specialized agents to handle complex tasks that previously required human intervention.

C. Navan Native Apps and Enterprise Integrations

We have developed simple and intuitive web and mobile experiences for travel, payments, and expense management. It also offers deep enterprise integrations with leading HRIS (e.g., Rippling), ERP systems (e.g., Oracle), and financial systems (e.g., Ramp), which enable real-time syncing of employee directories, expense categories, and policy controls.

If you ask me what the real case is for Navan?

Navan’s core proposition is to automate the travel service industry. Similar to Ramp automating finance operations, Carta automates fund administration. Navan uses AI to provide travel services with software margins.

Navan’s recent Cognition Whitepaper describes how Navan integrates a suite of AI dispatchers, supervisors and specialists and how it was architected to combat 5 types of hallucinations. Currently, Navan’s AI agent Ava absorbs 50% of interactions, and this has directly translated to operating leverage.

Case Study: Future Application of MCP & Agentic Commerce

Model Context Provider (MCP) can convert APIs and data feeds to hotels and travel suppliers into callable tools that an AI can use in real-time. For example, an MCP can ask your system, “Do you have a one-bedroom suite with an ocean view available on August 30th under $500?”, and get a structured answer back from a hotel's inventory in real time.

As a result, an AI agent can book a stay, cancel or modify a reservation, offer concierge services, check loyalty points, book ancillary services like a massage or local tour, and answer detailed questions. Navan, with the AI capabilities and platform, is well-positioned to be first-to-market with agentic travel commerce offerings.

Margins: Sizing Against the Giants

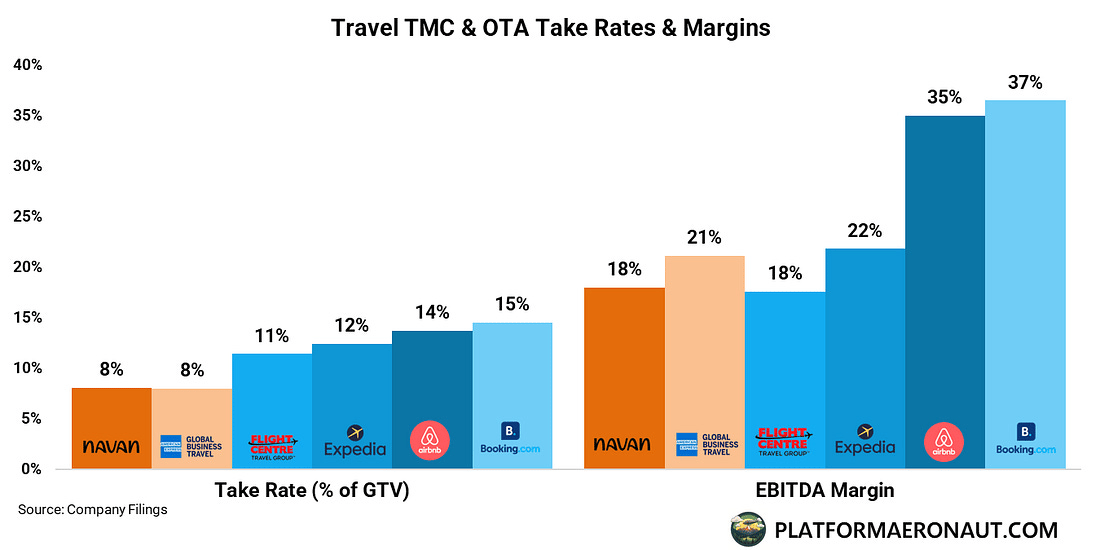

In the travel industry, coincidentally, or may not coincidentally, the largest companies have the highest take-rates. Airbnb and Booking.com have enjoyed massive pricing power because of their ability to bring demand to these hospitality providers and airlines.

If you compare Navan against leading booking platforms such as Airbnb and Booking.com. Despite being significantly smaller in their scale of operations, Navan has achieved similar EBITDA margins with their peers while having the lowest take-rates.

In Clouded Judgement’s analysis, Navan’s key metrics include:

LTM Revenue: $613M LTM Revenue (32% YoY Growth)

Net Revenue Retention: 110%

Gross Margin: 71%

CAC Payback: 20 Months (Median: 35 Months)

The $1B IPO question for investors is whether Navan gets treated like closer to venture-backed software like Ramp, that can trade at an 8-10x EV / Revenue or 35-40x EV / EBITDA multiple or whether it trades more in-line with traditional TMCs that trade at 2x EV / Revenue and 8-10x EV / EBITDA.

Conclusion

I found it really fascinating that great companies have gone through multiple S-curve innovations. For Navan, the first S-curve was achieved by bundling travel booking and expense management, and its second S-curve is by automating travel management services with AI. While the former serves as an interesting proposition, the latter builds a defensive moat.

It reinforces the thesis around the convergence of software and services; the next generation of vertical companies will be able to deliver services with software.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources