- Network Effects

- Posts

- Verse Medical: Emergence of Networked SaaS

Verse Medical: Emergence of Networked SaaS

How Verse Medical Solves the Healthcare User-Buyer Chasm

Welcome to the 22nd Network Effects Newsletter,

When developing solutions for user groups characterized by high-friction workflows and limited direct software budgets, the value proposition for traditional SaaS often becomes challenging. A powerful new business model is emerging to address this: Networked SaaS.

Unlike traditional SaaS, which may extend its product beyond a core customer after achieving substantial penetration (e.g., Mindbody, CCC Intelligent Solutions), Networked SaaS is designed as a multi-stakeholder platform, oriented around transactions from day one.

This week, we're spotlighting Verse Medical, a prime example of how Networked SaaS is revolutionizing industries long resistant to comprehensive digitization. Let's dive in.

Let’s dive in.

🩺 Verse Medical Company Overview

Founded in 2018, Verse Medical began by building critical infrastructure for the in-home healthcare equipment and supplies sector. The undeniable shift towards in-home care is driven by significant cost-effectiveness.

Yet, software for professionals in this space remains highly fragmented. Over 95% of Durable Medical Equipment (DME) orders are still faxed, and 75% require manual follow-ups. This isn't merely inefficient; it represents a critical bottleneck for timely patient care.

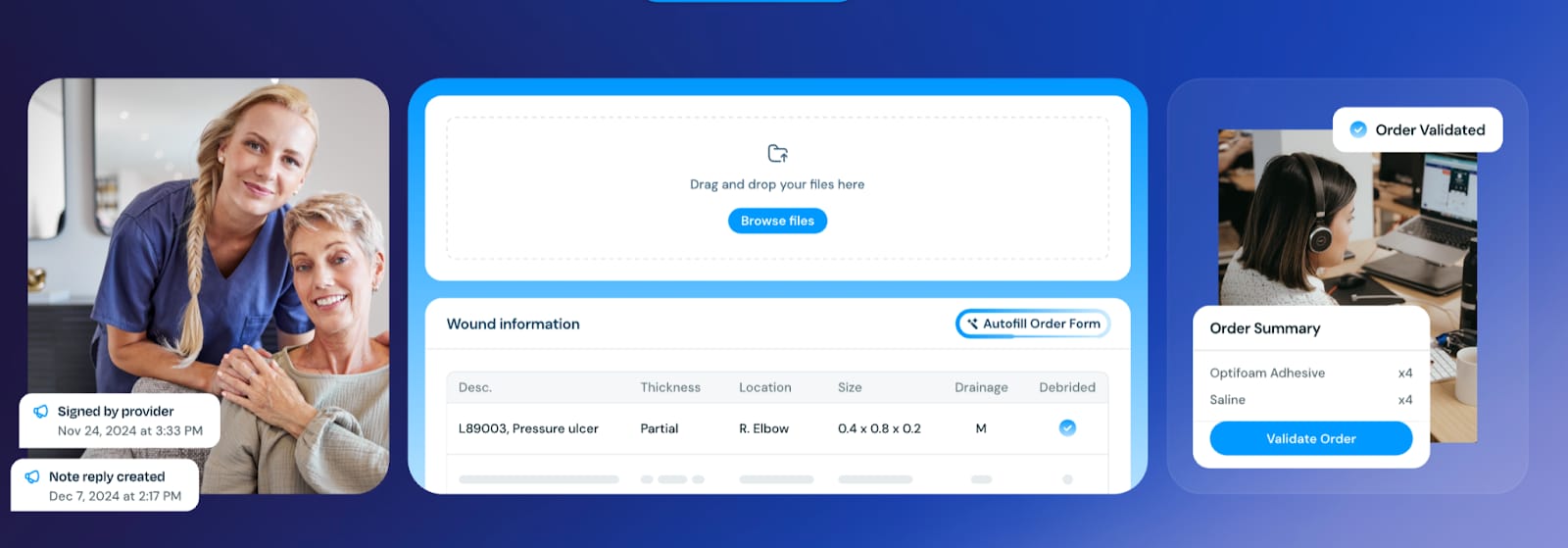

Verse Medical developed an intelligent platform for nurses, specifically streamlining DME transactions and communications with vendors and insurers. They provided the essential connective tissue for a previously broken process.

🔄 User-Buyer Chasm in Healthcare

In most SaaS contexts, the user and the buyer are the same. Marketing departments purchase marketing software; accounting teams acquire finance tools. Pain points, solutions, and budgets typically align.

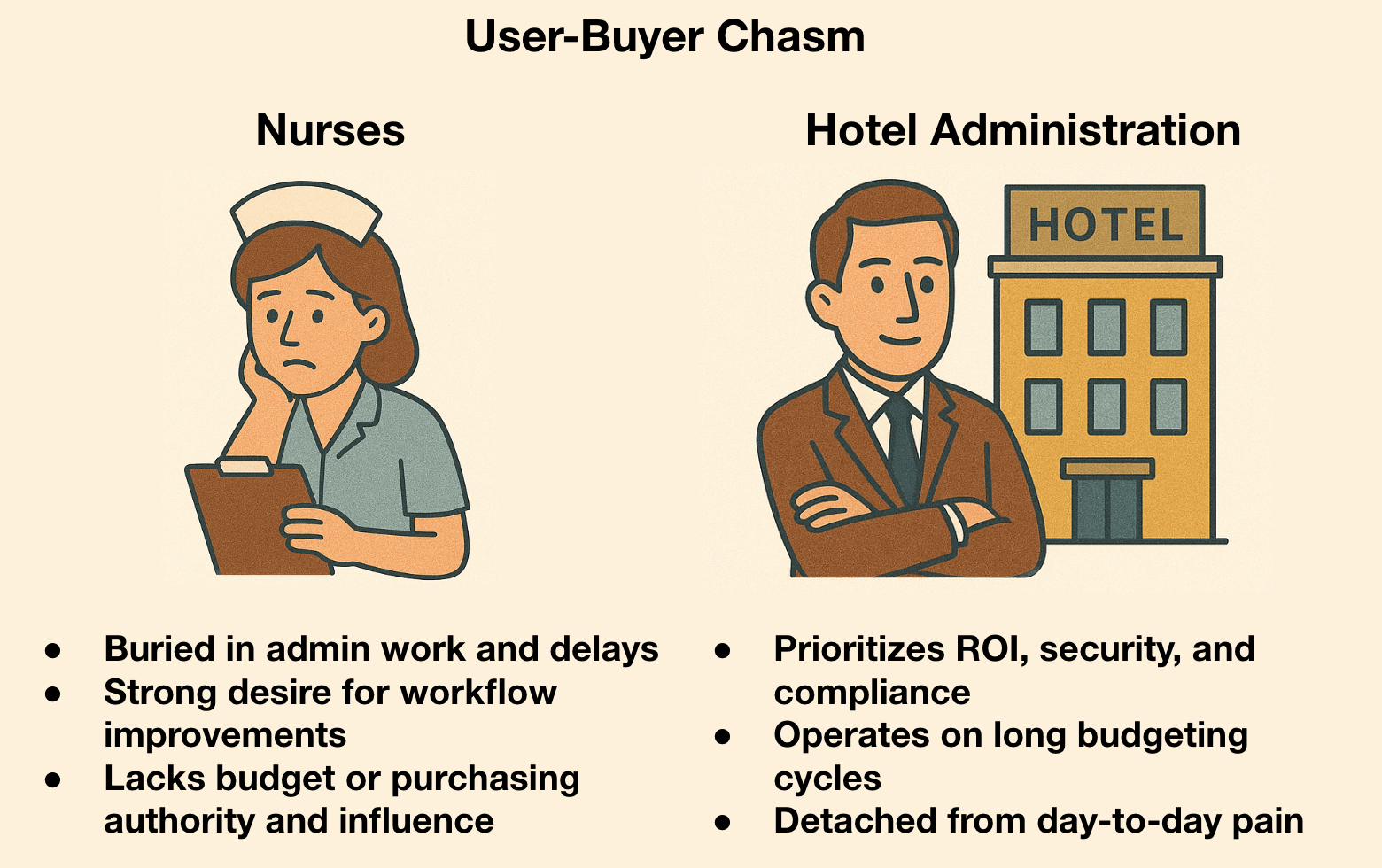

However, in healthcare procurement, this alignment rarely exists. The system is fundamentally split:

Nurse | Administration | |

Different Pain Points | “I'm buried in paperwork and delays. Will this tool help me save time and reduce frustration so I can focus on my patients?" | "Will this technology maximize our system's ROI, ensure security, and integrate seamlessly with our existing EHR?" |

Different Buying Processes | Adoption is based on direct workflow improvement and ease of use. The nurse lacks the budget or purchasing authority | Purchases are relationship-heavy with long sales cycles, focused on system-wide procurement and budget allocation |

Different Success Metrics | Time saved on administrative tasks, faster order fulfillment, and improved patient outcomes | Operational efficiency, system-wide ROI, and reduced vendor costs |

Traditional, per-seat SaaS encounters an intractable barrier here. It's impractical to sell expensive software directly to a nurse without a budget. Similarly, selling to a CFO based solely on a nurse's administrative burden presents a tenuous ROI conversation against billion-dollar system priorities

♟️ How Verse Medical Flips the Go-to-Market Model

Verse Medical recognized that traditional SaaS models meant a losing battle in healthcare procurement. They knew selling to the nurse was impossible, and to the hospital, a decade-long cycle.

So, they flipped the model, defining Networked SaaS:

Target the User, Not the Buyer: Verse went directly to the end-user – the nurse, solving their acute pain.

Remove the Cost Barrier: Their AI-powered platform is free for nurses. This is critical. No budget, no approval needed. Nurses adopt because it makes their job dramatically easier. Goal: rapid, viral adoption, not initial revenue.

Monetize the Transaction, Not the Seat: This is the core genius. By embedding at the center of DME transactions, Verse doesn't charge nurses or hospitals. They capture value from other stakeholders gaining immense efficiency:

DME Suppliers: Pay a small fee for clean, digitized, compliant orders, eliminating faxes and reducing their overhead.

Insurance Payers: Benefit from accurate, pre-verified claims data, reducing fraud and administrative waste.

Verse Medical's growth, handling billions in transaction volume annually, validates this. They found the true economic leverage point in a fragmented, high-friction market. As a result, nurses are able to save 15-20 minutes per DME order and the platform has achieved an 81 Net Promoter Score (NPS) from its user base.

🌐 Traditional SaaS vs Networked SaaS

The strategic divergence between Traditional and Networked SaaS is profound. Unlike prior previous case studies (e.g., CCC Intelligent Solutions, Mindbody), which began by digitizing a core workflow and then expanded outwards, Networked SaaS is built from Day 1 to facilitate the entire transaction layer between stakeholders. It fundamentally flips the expansion script.

Traditional SaaS | Networked SaaS | |

Primary Goal | Digitize a single stakeholder's workflow. Becomes the System of Record | Orchestrate the entire industry value chain. |

Target Customer | The budget holder (e.g., hospital administrator, department head) | The workflow owner/influencer (e.g., the nurse), who may not have a budget |

Monetization | Per-seat, per-license subscription fees | Transactional take-rate, revenue share, marketplace fees |

Defensibility | High switching costs due to embedded workflows and data | proprietary transaction data, and superior ecosystem intelligence. |

📌 Benefits of Networked SaaS

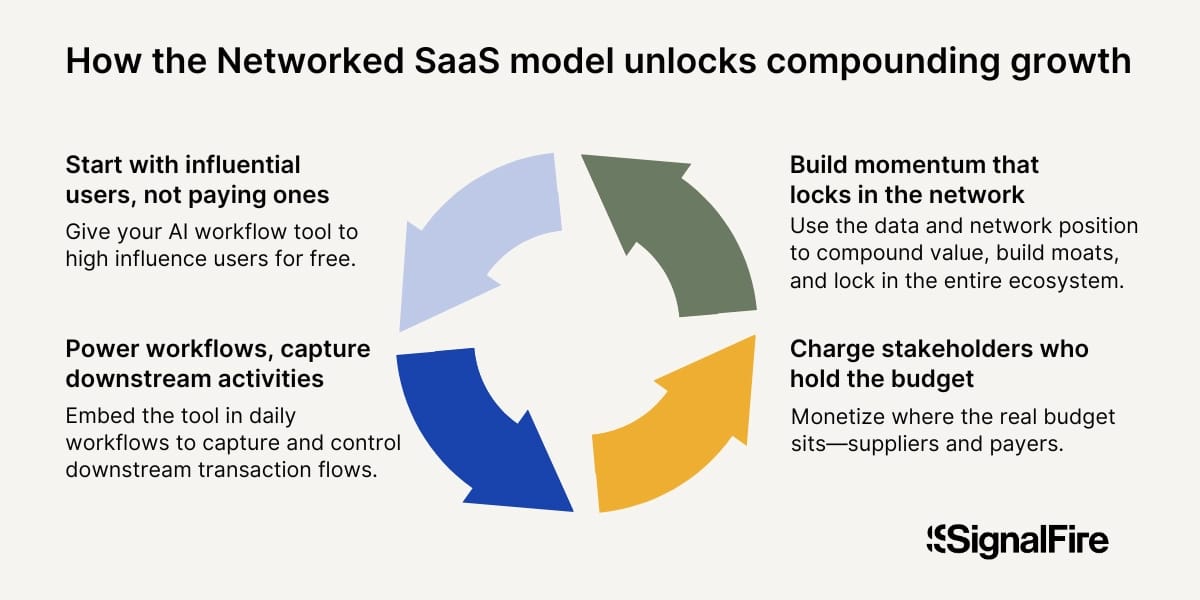

Networked SaaS begins by offering a powerful, AI-driven tool for free to a key stakeholder with high-friction workflows but no budget. This indispensable tool automates tedious, document-heavy processes, serving as the initial wedge.

Once embedded, the platform gains visibility and control over the broader downstream transaction flows. Monetization shifts from the free user to taking a cut from budget-holding stakeholders (suppliers, payers) in these larger transactions. AI is the critical catalyst, making possible the automation of previously untouchable, complex workflows (e.g., prior authorizations, RFPs), thereby pulling the entire ecosystem onto the platform.

By embedding deeply, leveraging AI for automation, and orchestrating the connective tissue between parties, Networked SaaS becomes both the System of Record and the System of Engagement for entire industries. This generates immense value and creates a powerful flywheel:

Source: SignalFire

⚠️ Challenges in Building a Networked SaaS

This model, while immensely powerful, is a high-wire act. It requires more than just technical skill; it demands deep domain fluency and a willingness to operate a multi-sided business from day one.

Monetization Risk: The core gamble is converting free user adoption into paid downstream transactions. Founders must deeply validate that budget-holding stakeholders will pay for the network's value, understanding the economic incentives for every party.

Operational Complexity: A Networked SaaS company is a multi-product enterprise from day one. It demands building and managing distinct, highly effective user experiences and workflows for each stakeholder on the network, from the frontline user to the back-office payer.

Compliance & Regulatory Complexity: Deep verticals are synonymous with deep red tape. Scaling requires a robust, dedicated compliance infrastructure to navigate unique regulatory burdens (e.g., HIPAA) and maintain unwavering credibility with enterprise buyers.

🌟 Lessons for VMS Operator

Understand The Difference Between Buyers and Users

Don't assume the person who needs your product also pays for it. If a chasm exists, a free workflow tool as an entry point, monetizing the downstream transaction, is your path to scale.

Growing Irrelevance of Seat-Based Subscription Model

Move beyond the limitations of per-seat pricing. True value is captured where money flows and work gets done across the ecosystem. Your platform should become the essential conduit for these transactions

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources