- Network Effects

- Posts

- Stan: The Operating Platform for The Creator Economy

Stan: The Operating Platform for The Creator Economy

How Stan Become the #1 Platform for Creator Monetization

Welcome to the 7th Network Effects Newsletter,

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world’s leading tech companies.

Today, we’re exploring Stan, which was founded in 2021 by John Hu (CEO) and Vitali Dodonov (CTO).

📝 Overview

Stan is founded with the mission to empower anyone to make a living working for themselves, and positions itself as an all-in-one operating platform for creators. For $29/month, Stan provides creators with a link-in-bio application, digital product sales channel, calendar booking platform, course builder, audience analytics, etc.

Since inception, creators on Stan have earned over $200M. Stan has demonstrated a rare combination of strong growth and profitability simultaneously, with revenue doubling from $14M in 2023 to $28M in 2024, and maintaining a 5x+ LTV/CAC and a 40% EBITDA margin. The company serves over 300,000 paying customers with an average revenue per customer of $491, significantly higher than competitor Linktree's $144 ARPC. The platform is quickly earning a market leadership position for the emerging creator economy.

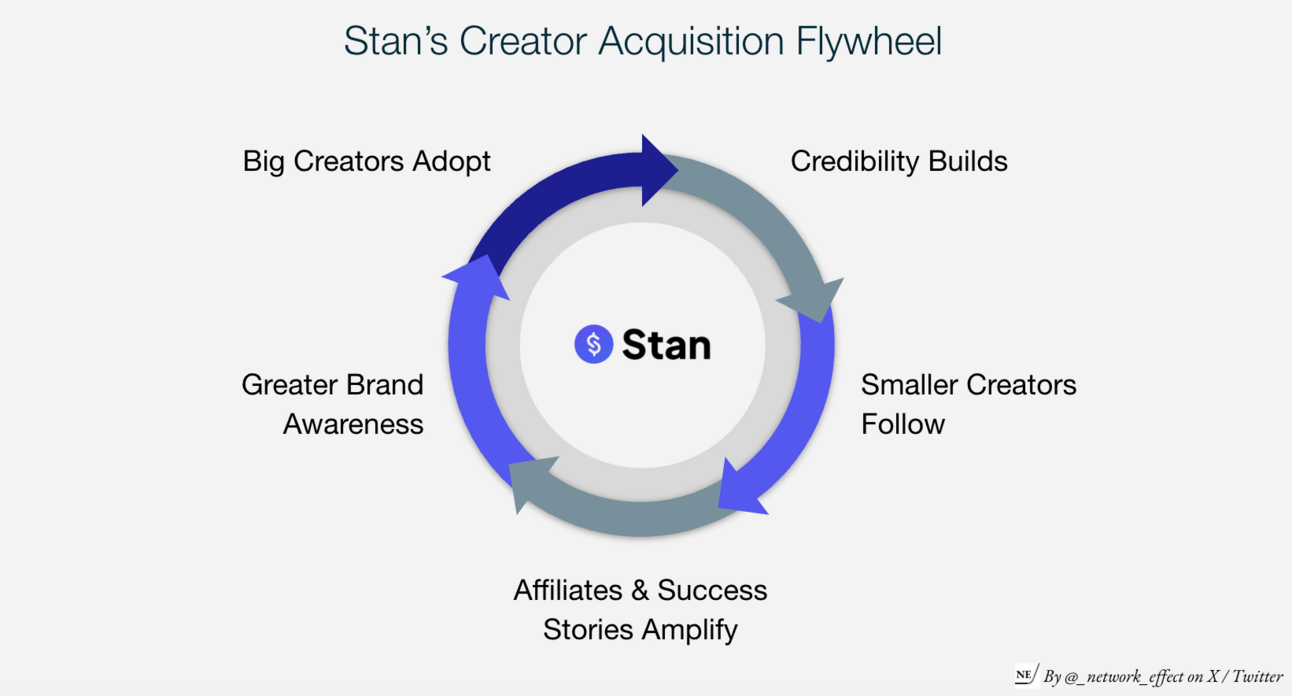

📌 Thesis 1 – Creator Acquisition Flywheel as a Moat

Stan's strategy of partnering with large creators such as Alex Hormozi, Dan Koe, and Justin Welsh early on has the potential to create powerful creator acquisition flywheel. When prominent creators adopt and actively use Stan, their followers are naturally exposed to the platform. This can lead to a cascading effect, encouraging smaller and medium-sized creators to join the same platform as their favourite creators to access similar operations and monetization tools.

Every major creator using Stan brings an embedded audience that seeds organic adoption down-market. Measuring cohort retention and follower migration patterns will be critical to assessing the strength and compounding nature of the network effects.

Case Study: Karat, the Banking Platform Built for Creators

Karat adopted a similar approach by targeting some of the largest creators, such as Logan Paul, Graham Stephan and Alexandre Botez, to be their earliest customers and investors. This has built Karat’s brand trust and seeded their go-to-market strategies as their customers are some of the leading creators in the industry.

📌 Thesis 2 - Repeatable Unit Economics Poised for Scale

Stan shares some of the best acquisition engines in the consumer SaaS industry, with over 5x Lifetime Value (LTV) / Customer Acquisition Cost (CAC) ratio. Notably, Stan’s distribution is primarily driven by word of mouth, organic marketing channels and its affiliate program (with lifetime revenue sharing incentives).

Over 57% of the customers have converted to a paid subscriptions after the free trial, and Stan shares 2-3x industry average customer success rates, pointing to the effectiveness of the Stan platform in helping creators achieve their goals.

However, over 90% of the market doesn’t know Stan exists yet, which highlights the significant untapped potential and runway for future growth within the creator economy.

🌱 Genesis Story

The inception of Stan traces back to 2020, as the content creators gained widespread popularity with platforms such as TikTok, John Hu, who was studying his MBA at Stanford GSB, noticed a problem with the fragmented and expensive toolkit available to new digital creators, posing a major limitation to creators

John took a user-centric approach by posting content on TikTok and speaking with other creators to understand their needs. This firsthand research validated the demand for a streamlined solution, leading to the initial concept of Stan as a focused link-in-bio platform.

Source: Stan’s 2022 Shareholder Letter / John’s TikTok Profile

Creators are forced to spend $100s a month, we were stuck patching together dozens of software subscriptions that were hard to use, and even harder to make money with. It boggled my mind that a simple, all-in-one solution didn’t exist.

A pivotal early step was the introduction to Vitali, Stan’s technical co-founder, facilitated by an early user, @investwithross. The combination of business and technical expertise gave Stan the foundation to scale from idea to category leader.

🖥️ Products & Services

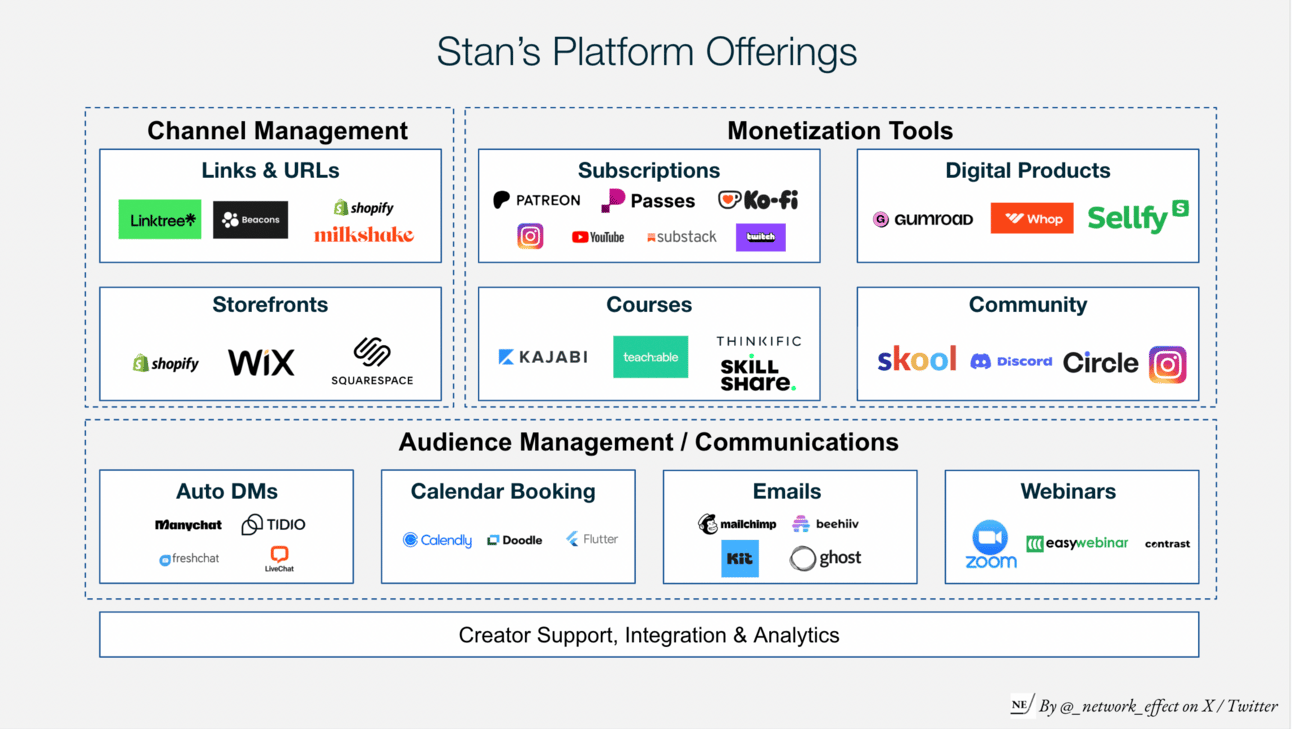

Stan has built its platform around creators' operational needs, to help creators own, operate and scale their content businesses. Stan began with a link-in-bio platform, then extended into various operational domains, including channel management, monetization tools, and audience management and communication.

Channel Management: Centralizing Digital Footprints

Most creators maintain a presence across multiple platforms (e.g., TikTok, Instagram, YouTube, newsletters, private communities). Their link-in-bio serves as a nexus, directing traffic to their diverse offerings.

Stan offers customizable templates that empower creators to strategically organize their digital presence. These templates guide their audience toward key engagement points, such as private communities, service promotions, newsletter sign-ups, digital storefronts, and affiliate opportunities.

Monetization Tools

Creators monetize their brand in various ways, including services, digital products, subscriptions, courses, and paid calls. However, the digital infrastructure supporting these monetization options is often siloed and fragmented. This forces creators to juggle multiple platforms to manage their offerings and cash flows, leading to higher costs, disjointed analytics, and a lack of a holistic view of their income streams.

Stan provides the infrastructure and allows users to build their monetization engines directly within the Stan Store. Sales and leads are recorded in a singular interface, enabling creators to manage their entire creator business in one place.

Audience Management / Communication:

One of the key risks creators face is platform risk, stemming from their heavy reliance on social media platforms. Algorithm and platform changes, such as a potential TikTok shutdown, can pose a significant threat to their careers. Consequently, creators seek to build direct relationships with their audience through private channels, including communities, messages, and emails.

Stan provides the tools to transition these relationships from rented platforms to owned assets. Automated direct messages, community features, and integrated email management allow creators to scale their communication and foster deeper connections with their audience.

🏢 Markets

Rise of the Creator Economy

The creator economy is still undergoing exponential growth. According to Goldman Sachs research, the market size of the creator economy, measured by digital advertising and brand deals, is projected to grow from $250B in 2023 to $480B in 2027.

Supply-side dynamics are accelerating as today there are over 200 million creators creating content online, with 57% of Gen Z now aspiring to be Creators, depicting a generational shift towards entrepreneurship through content creation.

From a demand perspective, brands on average are spending over $800k+ in influencer marketing in 2024, marking a 143% increase from 2021, and 94% of organizations believe that creator content drives more ROI than traditional digital advertising.

While digital advertising has been the primary fuel for creators, 70% of creators’ revenue is generated through brand deals, the next era of the creator economy is shaped by direct monetization from followership rather than relying on brand deals and platform revenue.

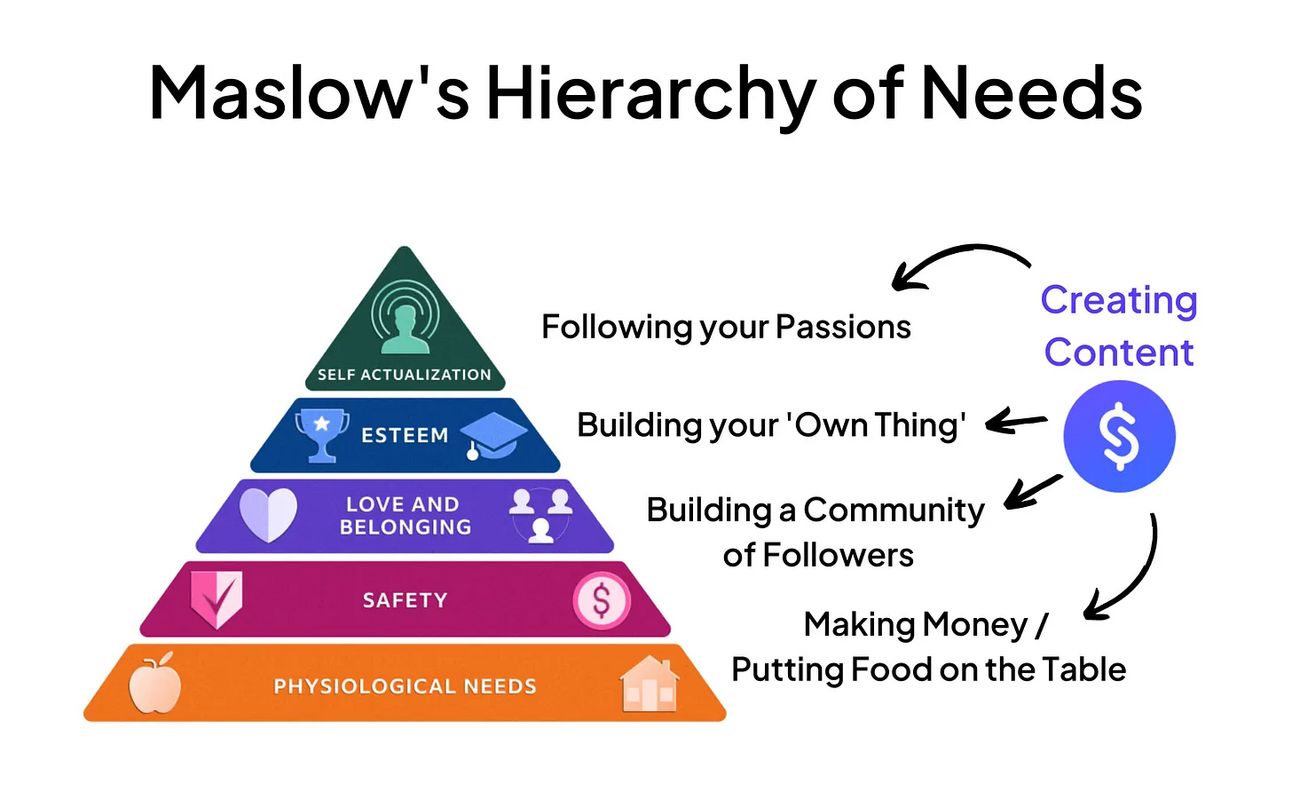

Social-First Creators to Entrepreneur Creators

One of the largest tailwinds for the creator economy is that creators are no longer just building audiences on social media—they’re building and scaling businesses beyond social media.

According to Kajabi’s 2025 State of Creator Commerce, Creators are now seeing a significant decrease in platform payouts (-33%), affiliate marketing revenue (-36%) and brand deals (-52%), with economic instability. However, creators are witnessing growth in direct channels, including digital product sales (+20%), educational content (+14%), membership communities (+10%), etc.

Diversifying from platform- and brand-related income, a proprietary income stream allows creators to mitigate against economic turmoil and have full control of their products and service offerings, providing greater flexibility and stability.

Rented to Owned Channels

The temporary disappearance of TikTok in January 2025 served as a major wake-up call for creators. The uncertainty forced a lot of people to confront the reality of platform dependency. 55% of creators say that audience ownership is the most important factor for success.

It was an important reminder that building a business on a single social platform is risky. Creators should develop ways to build their platform and own their audience. Communities, emails, and messages are some of the best examples of doing so.

⚔️ Competitions

The competitive landscape within the creator economy tooling sector has begun a phase of consolidation following the proliferation of startups and VC funding in 2021. Despite this trend, the market remains notably fragmented, characterized by distinct categories of solutions and increasing attempts at cross-vertical integration by existing players.

Link-in-Bio Tools (Linktree, Beacons, Shopify’s Linkpop)

These tools primarily address the foundational need for creators to consolidate multiple links into a single interface. Leveraging their first-mover advantage, these platforms have achieved significant user adoption. However, their core functionality remains largely superficial, primarily serving as traffic redirection points rather than facilitating direct monetization or audience management capabilities within the platform.

Monetization Tools (Kajabi, Patreon, Gumroad)

These platforms offer robust features tailored to specific monetization models. Depending on the platform, they provide tools for content delivery, payment processing features. While they are highly effective within their domains, these platforms operate in silos. Creators often need to adopt multiple such tools, resulting in fragmented workflows, disparate data sets, and increased operational complexity in managing various platforms and revenue streams.

Owned Platform Infrastructure (Mailchimp, ConvertKit, Discord)

These platforms empower creators to cultivate direct, sustainable relationships with their audience beyond the algorithmic constraints of social media. They offer essential features for email list growth and management, fostering community engagement, and enabling direct communication channels.

⚙️ Business Model

Stan monetizes through subscriptions, with a creator plan at $29/month and creator pro plan at $99/month with additional features. A 14-day free trial is provided for free to onboard users to the stan ecosystem. A key differentiation for Stan is that they don’t take transaction fees from creator product sales.

Stan has achieved significant growth over the last few years. For example, Stan’s revenue surged from $1.7M in 2022 to $14.7M in 2023, doubling again to over $33M in 2024. Creators on Stan have earned over $200M in revenue, with the first $100M took two-and-a-half years, and the second $100M took 6 months.

💰 Valuations & Fundraising

Stan has secured over $5 million in funding across its pre-seed and seed rounds. The company's most recent funding round, a seed round, took place in January 2022 and was led by Forerunner Ventures, with participation from Lightspeed Venture Partners and Pear VC. This capital infusion is being utilized to further develop Stan's platform and expand its reach within the creator economy.

♟️ Key Opportunities

AI & Automation Features

The integration of Artificial Intelligence and automation presents a significant opportunity to streamline workflows and enhance productivity. Stan has already rolled out Stanley, an AI assistant to help onboard users to the Stan ecosystem, assist with their copywriting on product & services, and provide product feedback based on engagement and sales:

Other potential applications include

Content recommendations for product copywriting & email flows (which is currently in-flight, read more here)

Email campaign generation and customization

Custom report generation from text prompts

Enhanced DM automation with personalization and contextual adaptations

Tax & accounting automation feature to provide the necessary information

Allow AI to run A/B testing on copywriting/application interface

As a result, Stan users can spend less time on administrative, operational work, and provide higher quality experiences to their audience.

Pricing Model

Stan's current flat-fee subscription model, while offering predictable income, inherently restricts its ability to fully capitalize on the success of its top-tier creators. The creator economy often exhibits a power-law distribution, where a small percentage of creators generate the majority of the revenue. With a fixed monthly fee, Stan's financial upside becomes decoupled from the significant earnings potential of these high-performing users, limiting its overall revenue growth as these creators scale. This creates a scenario where Stan provides immense value but doesn't fully participate in the financial success it enables for its most impactful users.

Case Study: Shopify's Shift from Subscription to Revenue Share

Shopify began with a tiered subscription model. However, as the platform attracted large, high-volume merchants generating substantial sales, the fixed subscription costs became a relatively small expense compared to the immense value derived from Shopify's infrastructure. Recognizing this misalignment, Shopify introduced Shopify Plus.

While retaining a higher base subscription, Shopify Plus strategically incorporated a variable platform fee, a small percentage of a merchant's monthly revenue exceeding a significant threshold. This effectively transitioned their monetization strategy for top-tier clients towards a revenue-sharing model, allowing Shopify to directly benefit from the substantial growth and transaction volume of their most successful merchants, ultimately surpassing subscription fees as a primary revenue driver for this segment

⚠️ Key Risks

Scaling GTM Distribution Beyond Founder-Led Marketing

As Stan leverages a founder-led distribution strategy to drive brand awareness and distribution to arrive at this stage. The next phase of growth may require more vertical/niche-driven campaigns and GTM strategies.

As each vertical may have unique operational needs (e.g., physical goods logistics for DTC/F&B merchant creators, booking systems for fitness coaches and blue collar workers, complex drip-content scheduling for educators). Different GTM strategies are required to build depth with their target demographics

We had essentially built a machine around leveraging “me” as our GTM channel: I had landed our biggest customers, thought up our biggest campaigns, and made all of the strategic decisions — a “founder-led” sales model. This model works great to grow quickly to ~$10M ARR, but really breaks down at scale.

Dependency on Consumer Spending

Stan’s growth is deeply tied to the health and continued expansion of the creator economy. A major cyclical downturn could shrink the total addressable market for creator products and services materially.

In recessionary environments, creators may experience reduced spending from their audiences, lower success rates in launching new products or services, and diminished brand deal opportunities. This could lead to higher churn rates or a slowdown in net new creator sign-ups on platforms like Stan.

Potential Competitive Threat From Shopify, Kajabi, or New Entrants

The competition in creator tooling is intensifying as larger incumbents recognize the sector’s high growth and attractive unit economics.

Shopify, which already serves a broad base of independent merchants, could increasingly extend its ecosystem to better serve creator-led businesses. Similarly, platforms like Kajabi are expanding horizontally, layering in community, CRM, and monetization features that begin to overlap with Stan's offering.

Maintaining High-Quality Customer Support at Scale

Stan's high-touch creator support has been a key differentiator for the product. However, as the creator base expands, maintaining this level of service quality will require strategic investment and proactive planning. Increased creator volume risks overwhelming the current creator success team, potentially leading to slower response times and a decline in service quality

Stan would need to ensure the customer success team can effectively scale alongside user growth without compromising service standards. This includes exploring scalable support solutions (e.g., asynchronous guidelines/FAQs/SOPs, use of AI support) to augment human support efforts while preserving the personalized touch that has been a hallmark of Stan's success.

Thanks for reading till the end of the issue. Subscribe to receive our next deep dive on Clutch, Canada’s first and largest verticalized used car marketplace

Resources