- Network Effects

- Posts

- Stackadapt: The Quiet Revolution in Ad-Buying

Stackadapt: The Quiet Revolution in Ad-Buying

How Stackadapt Captures the Privacy-First Future of Ad-Buying

Welcome to the 3rd Network Effects Newsletter.

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world’s leading tech companies.

Today, we’re exploring StackAdapt, which was founded in 2013 by Vitaly Pecherskiy (COO, now CEO), Yang Han (CTO), and Ildar Shar (former CEO).

Let’s dive in.

📝 Overview

StackAdapt is a programmatic advertising platform built for performance marketers. It allows brands and agencies to plan, execute, and manage data-driven digital advertising campaigns across all devices, inventory, and publisher partners from a single interface. The platform’s self-serve tools and machine learning-driven optimization are designed for speed, control, and efficiency.

Amid shifting industry regulations that prioritize privacy and transparency, StackAdapt excels in contextual advertising, leveraging advanced AI to optimize ad placements without relying on behavioural data (e.g., cookie tracking)

StackAdapt demonstrated product excellence with the development of the Demand-Side-Platform (DSP), where they have been ranked #1 DSP by G2. In February 2025, it announced a new investment round led by Teachers Venture Growth to further bolster its market position amongst the independent programmatic DSP competitions, including market leader The Trade Desk.

📌 Thesis 1 - The Contextual Advertising Imperative

The digital advertising landscape is undergoing a seismic shift. Privacy regulations (GDPR, CCPA) and the impending death of third-party cookies are forcing brands to abandon reliance on increasingly ineffective and privacy-invasive behavioural targeting. Contextual advertising, targeting users based on the content they actively consume, is not just a viable alternative—it's becoming the superior strategy. Projections indicate this market will surge from $227B in 2024 to $468B by 2029 (~13% CAGR).

StackAdapt is strategically positioned to capture this burgeoning demand. Their proprietary Page Context AI has demonstrably outperformed legacy targeting models, achieving a 50% reduction in CPA and outperforming behavioural retargeting in 76% of healthcare campaigns. This early leadership in a rapidly expanding market provides a significant first-mover advantage.

📌 Thesis 2 – Compounding Data Network Effects

StackAdapt benefits from a strong data network effect: each campaign run on the platform generates real-time performance data that improves bidding algorithms, targeting precision, and creative recommendations across the user base. This feedback loop creates a compounding data advantage where algorithms can train on outcomes of historical bids to enhance the performance of future bids.

The rollout of AI-native features like Page Context AI further widens the performance gap with other DSPs, which helps Stackadapt deliver differentiated services and drive higher ROAS compared to other peers.

The integration of AI into their platform services, such as Ivy, would enhance customer experience and decrease dependence on StackAdapt’s interface, further improving StackAdapt’s differentiation

🌱 Genesis Story

StackAdapt was born out of frustration with the clunky, overly complex processes involved in buying media advertisements. In 2013, Vitaly Pecherskiy, Yang Han, and Ildar Shar were working at ad agencies and saw firsthand the inefficiencies of programmatic buying. While the industry promised automation and precision, they encountered a mess of fragmented interfaces, hidden fees, and inconsistent campaign performance.

They believed there was a better way, a platform that gave media buyers transparency, control, and performance without needing a PhD in ad tech. So they started StackAdapt, with three core principles:

Solve customer challenges with purpose-driven solutions

Harness the power of AI and automation to deliver advanced and powerful software capabilities

Provide a seamless, self-serve user experience with unmatched speed and accessibility

Essentially five months into us working there, we realised there was a clear gap in the market in terms of the software that could exist…So we left to start a new generation of platform solving for the gaps we had observed

🖥️ Products & Services

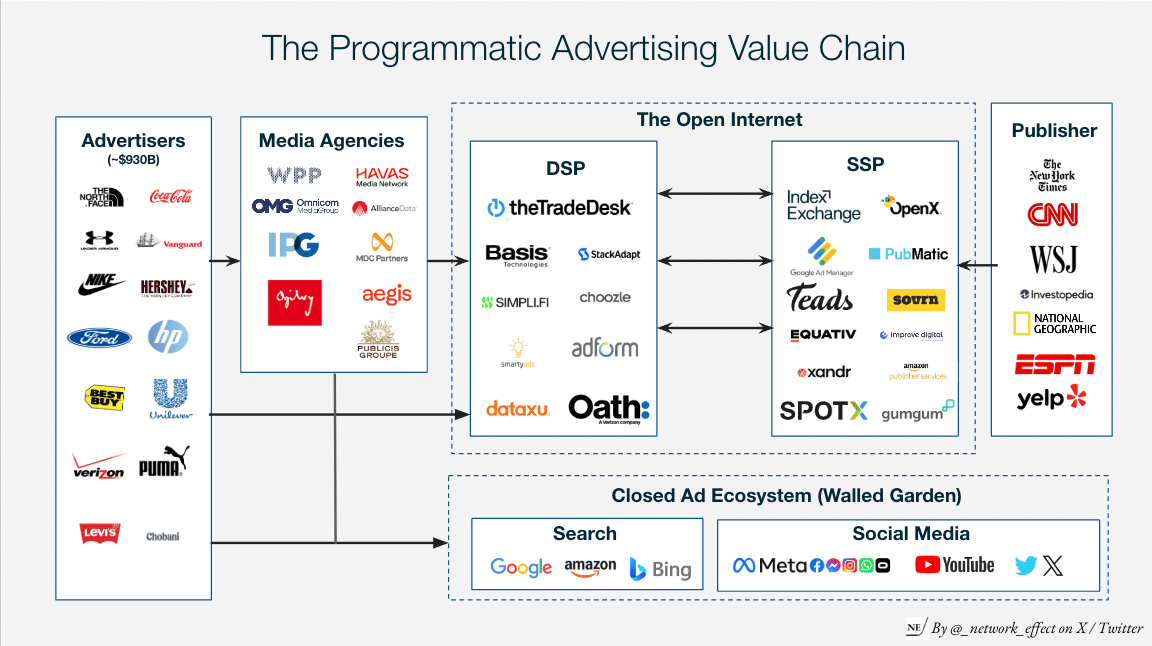

Stackadapt operates as an omnichannel demand-side platform (DSP) in the programmatic advertising industry. Programmatic advertising automates the purchase of digital ad space, replacing traditional manual processes. As a DSP, StackAdapt's core function is to enable marketers to efficiently allocate their budgets across diverse marketing channels through automated real-time bidding. This ensures ads are delivered to the right audience, at the optimal time and price, within a specified campaign duration

The interplay of technology platforms and readily available data facilitates the exchange of ad inventory, allowing advertisers to bid on desired placements through real-time auctions between DSPs (representing demand) and Ad Exchanges (representing supply) whenever users interact with digital platforms.

Source: Stackadapt

StackAdapt's flagship platform provides a centralized interface for managing campaigns across all supported channels. This unified approach streamlines workflows, facilitates cross-channel targeting and retargeting strategies, and offers a holistic view of campaign performance. Marketers can leverage a single platform to reach their target audiences wherever they are engaging online. Key functionalities include

1. Advanced Targeting Capabilities (Core Product)

Contextual Targeting: StackAdapt offers advanced contextual targeting capabilities, including AI-powered Page Context AI for nuanced semantic and sentiment analysis of web pages, and Keyword Rule Targeting for granular control over ad placement based on specific keywords and phrases

First-Party Data Integration: Enabling marketers to seamlessly upload and activate their own customer data for precise targeting and lookalike audience creation, enhancing campaign relevance and ROI in a privacy-conscious manner.

Third-Party Data Partnerships: Providing access to a wide range of vetted third-party data providers for audience segmentation based on interests, behaviours, and demographics, complementing their contextual and first-party data capabilities.

Geographic Targeting: Offering precise targeting based on geographic location, including geo-fencing and geo-radius targeting to help reach local audiences.

Overview of Page Context AI

AI Page Context surpasses traditional methods by fully understanding the webpage’s context, rather than relying on individual keywords. Unlike static keyword-based ads, it adapts in real-time, delivering relevant, personalized ads that align with the content's tone, intent, and themes.

For example, if you’re reading a blog about summer vacations in Europe, AI Page Context recognizes the travel topic and shows ads for flight deals, hotels, or vacation packages in Europe. It ensures that the ad matches the content you're currently engaging with, enhancing relevance and user experience.

2. Creative Management & Optimization

Creative Studio: A built-in suite for designing and customizing native and display ads, simplifying the creative production process.

Dynamic Creative Optimization (DCO): Enabling the automated personalization of ad creatives based on user characteristics or contextual signals, maximizing engagement and conversion rates.

A/B Testing: Facilitating rigorous testing of different creative variations to identify top-performing assets and continuously improve campaign effectiveness.

Source: Stackadapt

3. Reporting & Analytics

Customizable Dashboards: Allowing users to tailor their view of key metrics relevant to their specific campaign goals.

Performance Breakdowns: Providing data on impressions, clicks, conversions, CPA, ROAS, and other KPIS, segmented by channel, targeting parameters, and creative.

Attribution Modelling: Offering various attribution models to understand the impact of different touchpoints in the customer journey and optimize spend accordingly.

Source: AgencyAnalytics

4. Managed Services & Support

Recognizing that some clients require additional expertise, StackAdapt offers managed services and dedicated support teams. This includes campaign strategy development, execution, optimization, and reporting, ensuring clients maximize the value of the platform and achieve their advertising objectives.

Market Landscape for Programmatic Advertising Value Chain

🏢 Markets

Programmatic Advertising Market Overview

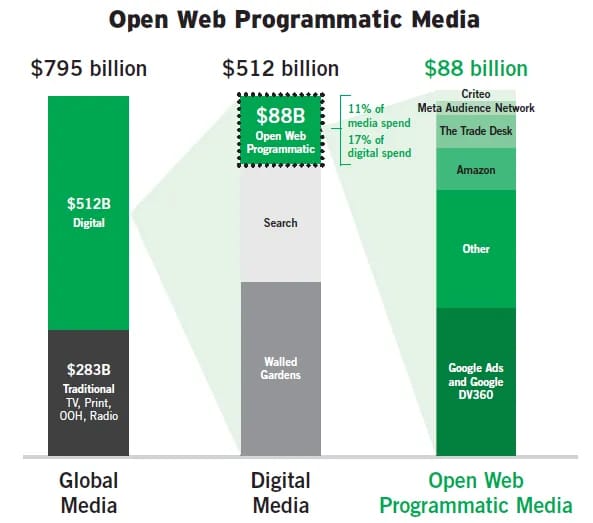

The global programmatic advertising market will reach $725B by 2026. This rapid growth underscores the increasing importance of programmatic advertising and the maturation of its platforms and channels. Marketers leverage various channels and formats within programmatic, including native, display, audio, video, connected TV (CTV), in-game, and digital out-of-home (DOOH).

Walled Garden and The Open Internet

The digital advertising ecosystem can be broadly segmented into two competing environments: walled gardens and the open internet.

Walled gardens are closed, vertically integrated ecosystems controlled by tech giants like Meta, Google, Amazon, and increasingly Apple. These platforms own every layer of the advertising stack—from user data to content distribution to the auction infrastructure—and offer massive reach with deep first-party data. However, they provide advertisers with limited transparency into auction dynamics, pricing mechanisms, and campaign-level performance data. They function as black boxes, forcing marketers to operate within siloed environments with minimal interoperability.

In contrast, the open internet refers to the broader web, excluding search and social. It includes independent publishers, streaming platforms, mobile apps, and digital out-of-home inventory, ranging from the New York Times and Wall Street Journal to programmatic audio and CTV providers.

The Open web programmatic advertising market is estimated to reach ~$88 billion in 2023, which was led by Google DV360 and Amazon, with the largest independent DSP platform, TTD, representing just under 10% share of the market.

However, there has been an increasing shift towards the open internet over the past few years, driven by digital channels such as Connected TV (CTV) and digital audio (Spotify). These platforms have always been underserved from an advertising spend perspective. For example, while consumers spend more time consuming digital audio channels than social media, social media ad spend commanded over $65 billion in campaign spend in 2023 in the US, compared to $7 billion for digital audio.

TTD: Sellers & Publishers Report

Contextual Advertising vs Behavioural Advertising

Within the dynamic world of programmatic advertising, marketers primarily leverage two core strategies to connect with their target audiences: behavioural and contextual advertising.

Behavioural advertising focuses on reaching users based on their past online activities, such as websites visited, products viewed, and purchases made. In contrast, contextual advertising targets users based on the content they are currently consuming. By analyzing the keywords, topics, and themes of a webpage, video, or audio content, advertisers can place ads that are directly relevant to the user's immediate interest.

The industry has shifted towards contextual advertising as privacy concerns, regulations, and consumer preferences around data collection evolve. Traditional behavioural advertising relies heavily on third-party data, which is increasingly being restricted by regulations like GDPR and CCPA and the eventual deprecation of third-party cookies by major browsers.

⚔️ Competitions

The programmatic advertising ecosystem is moving from broad, one-size-fits-all platforms to more performant, data-rich DSPs that focus on targeting precision, transparency, and workflow simplicity. StackAdapt sits at the intersection of this shift—offering a nimble, user-friendly DSP with deep contextual targeting and native ad formats. Most relevant competitors include The Trade Desk, AdRoll, and Basis Technologies

The Trade Desk is the market leader in independent programmatic DSP, powering $12B+ in media spend with global brands and agencies. It has unmatched scale, extensive partnerships, and premium inventory access across CTV, retail media, and emerging channels. However, the platform is complex and is built for sophisticated in-house teams with media buying expertise and deep analytics resources. Its enterprise orientation creates friction for lower- and mid-market agencies and performance marketers seeking simpler workflows and more automated optimization

AdRoll (by NextRoll) focuses on e-commerce growth, positioning itself as an integrated marketing platform for merchants rather than a pure-play DSP. It combines programmatic display, social, and email into a bundled offering designed for smaller DTC commerce brands. While it’s strong on retargeting and cross-channel attribution, its ad personalization and targeting tools lack depth, compared to more sophisticated DSPs such as StackAdapt.

Basis Technologies (formerly Centro) sits between enterprise and mid-market, with a robust platform that includes planning, buying, and analytics. It’s especially strong among independent agencies that value integrated campaign workflows across digital and traditional channels.

⚙️ Business Model

StackAdapt's business model is strategically designed for scalability and aligns its revenue generation with the success of its clients' advertising campaigns. It primarily operates on a usage-based, margin-driven structure, supplemented by premium feature access and a unique white-labeling offering.

1. Platform Access – Usage-Based Model:

StackAdapt offers open access to its core DSP functionalities without any upfront or recurring subscription costs. Clients only incur expenses based on their actual media spend transacted through the platform. The majority of its revenue is generated by applying a take-rate, estimated to be between 15% and 25%, on the total media spend managed through its platform. This margin represents StackAdapt's service fee for providing access to its technology, inventory, and support.

2. Add-Ons – Upselling and Value-Added Services:

StackAdapt offers a tiered approach where clients with higher levels of media spend gain access to advanced, premium features. These add-ons can include sophisticated tools like predictive audience modelling (leveraging AI to identify high-potential users), their integrated Creative Studio, advanced attribution modelling capabilities, and managed service capabilities.

3. White-Labeling – Unique Agency Monetization:

StackAdapt provides a white-label solution that allows advertising agencies to resell the entire StackAdapt platform under their brand. Agencies handle client relationships and campaigns

Valuations & Fundraising

StackAdapt has raised over $500 million across multiple funding rounds, with notable investments from Teachers’ Venture Growth (TVG), Summit Partners and Intrepid Growth Partners. The company’s latest round in February 2025 raised $235 million, led by TVG with participation from existing investors, including Intrepid and existing StackAdapt leadership.

The lead investors for previous rounds include Sandpiper Ventures and Slaight Communications (Seed), Summit Partners (growth round in 2022), and TVG (latest round in 2025).

♟️ Key Opportunities

Capitalize on the Resurgence of Contextual Advertising

Traditional behavioural advertising faces structural headwinds, ranging from tightening privacy regulations (GDPR, CCPA) to rising consumer resistance, with ad blockers now used by over 30% of global internet users. As a result, contextual advertising is undergoing a renaissance, expected to grow from $227B in 2024 to $468B by 2029, representing a 13% CAGR.

StackAdapt has strategically positioned itself as a leader in this shift. Its proprietary Page Context AI has consistently outperformed legacy targeting models, most notably achieving a 50% reduction in CPA and outperforming behavioural retargeting in 76% of healthcare campaigns. As privacy-first marketing becomes the norm, StackAdapt’s ability to deliver performance without compromising compliance sets it apart from peers.

The First-Party Data Revolution

The deprecation of third-party cookies has catalyzed a new era of data ownership. As leading browsers such as Chrome are phasing out cookies for 100% of users by Q3 2025), followed by other platforms such as Safari and Firefox. It has catalyzed a paradigm shift in digital advertising. is looking to Marketers are looking to unify and activate their own data, stored across CRMs, CDPs, and offline sources, to drive performance.

StackAdapt’s deep integrations across the first-party ecosystem position it as a trusted demand-side platform (DSP) for advertisers who view data as a strategic asset. As more budgets flow toward privacy-compliant, first-party-native solutions, StackAdapt is poised to benefit from its head start in this transition.

Examples of Data Integration

Salesforce CRM Integration: A retail brand can ingest purchase history, loyalty status, and cart abandonment events from Salesforce into StackAdapt, then retarget those users via CTV and mobile ads with personalized creative.

Shopify Integration: A D2 company using Shopify can sync product engagement signals (e.g., demo requested, feature used) into StackAdapt to build audience cohorts for upsell or churn-prevention campaigns

Untapped International Growth

Currently live in 19 markets, StackAdapt has a significant runway for international expansion, particularly across Europe and APAC regions, where contextual and first-party data approaches are already the standard due to heightened privacy regulations and limited access to third-party data. In 2024, Stackadapt’s expansion into Australia and the U.K. has already demonstrated strong traction, with reported 2x year-over-year growth in international revenue, representing a strong tractions of product-market fit abroad.

StackAdapt’s platform is inherently designed for global scale. Its language-agnostic contextual AI, performance-optimized bidding engine, and intuitive self-service interface address core advertiser needs regardless of geography. The major work ahead lies in go-to-market execution, specifically:

Forging regional data and media partnerships

Building localized sales and support teams

Executing on customer acquisition with tailored messaging for mid-market buyers in privacy-forward markets

With proven product readiness and early momentum, StackAdapt is well-positioned to replicate its North American success globally and unlock meaningful incremental growth.

⚠️ Key Risks

Structural Risk in Open Web Dependency

StackAdapt’s success hinges on the open web — a sprawling, fragmented landscape where content is distributed across millions of publisher pages, creating fertile ground for contextual targeting. But that surface area is shrinking.

Two powerful forces are converging:

The rise of AI-native interfaces (e.g., ChatGPT, Perplexity, Google’s SGE) that answer queries inline, disintermediating traditional publisher traffic.

The deepening gravity of walled gardens like TikTok, Instagram, YouTube, and Facebook, platforms that tightly control their ad inventory.

For example, Spotify announced Spotify Audience Network, which enables advertisers to target audiences across Spotify's own content and select third-party podcasts, offering demographic, geographic, and behavioural targeting capabilities. This approach centralizes user data and ad delivery within Spotify's ecosystem, limiting external access and control, which are hallmark features of a walled garden

As more user sessions begin and end within these closed environments — or skip past the open web entirely via AI — StackAdapt faces a fundamental challenge: Less quality inventory, fewer signals, and reduced scale for contextual targeting. If the trend continues, StackAdapt must either find new forms of signal in a more constrained ecosystem or build new demand-side pathways into closed environments. Otherwise, it risks being boxed out of where the next billion minutes of attention are spent.

Economic Sensitivity

Advertising is notoriously cyclical and disproportionately impacted by economic downturns. As shown during the 2008–2009 financial crisis, advertising spend fell by over 10%, compared to a 0.7% drop in nominal GDP, highlighting how marketers cut budgets faster than the broader economy contracts. While ad spend rebounds quickly in recovery periods, platforms like StackAdapt are still vulnerable to abrupt pullbacks when brands look to preserve cash.

With ongoing uncertainty around inflation, interest rates, and global macro volatility, StackAdapt could see similar pressure on advertising budgets, especially in the mid-market segment where StackAdapt has built strength. If advertisers shift spend back toward proven performance channels or walled gardens during a downturn, StackAdapt’s revenue growth could meaningfully decelerate

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on Wealthsimple, the first and largest Canadian digital-first bank.

Resources