- Network Effects

- Posts

- Shopify: Embedded Finance Ecosystem

Shopify: Embedded Finance Ecosystem

The role of embedded finance in Shopify’s success

Welcome to the 23rd Network Effects Newsletter,

For any vertical SaaS platform, a natural evolution is the introduction of financial products like payments, lending, and banking solutions. This strategy, known as embedded finance, fundamentally transforms the unit economics of a vertical SaaS business.

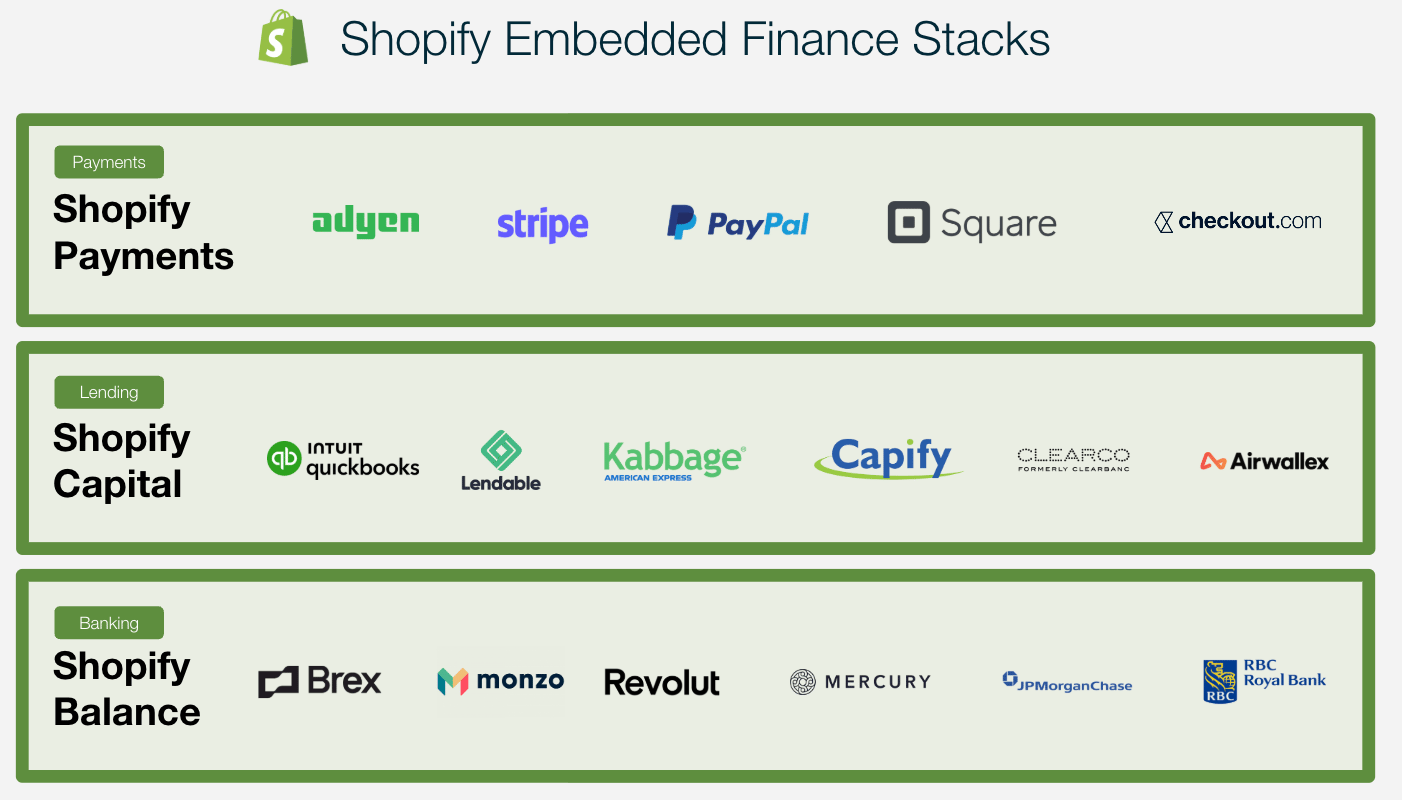

Shopify is the prime example of this model. It has evolved from a pure commerce platform into a vertically integrated fintech ecosystem, including its payment processing stack (Shopify Payments), its working capital arm (Shopify Capital), and its merchant account infrastructure (Shopify Balance).

In this issue, we'll unpack how embedded finance reshaped Shopify’s monetization engine, reduced its customer acquisition cost (CAC) payback periods, and rewrote what lifetime value (LTV) looks like for a vertical SaaS company.

Let’s dive in.

Shopify Company Overview

Founded in 2006 with the goal of simplifying online selling, Shopify has grown into a titan of the vertical software industry. Over nearly two decades, it has processed over $1.1 trillion in e-commerce payments for millions of merchants. The key to this growth wasn't just a great product; it was a strategic expansion into financial services that began in 2013 with the launch of Shopify Payments.

This move allowed merchants to accept credit cards and other payment methods without leaving the Shopify platform. Instead of simply charging a monthly subscription, Shopify began earning a share of every sale its merchants made. This "derivative of customer success" model fundamentally changed the company's economics, making its growth directly tied to the prosperity of its users.

Shopify Capital (2016): loans and cash advances

Shop Pay (2017): A one-click checkout solution

Shopify POS (2017): Branded hardware for in-store transactions

Shopify Balance (2020): Business account and debit card offerings

Shop Pay Installments (2020): A buy-now-pay-later solution in partnership with Affirm

Shopify Finance (2025): Integration of Capital + Finance

Source: Proprietary Analysis, Company Filings

Shopify’s Embedded Finance Products

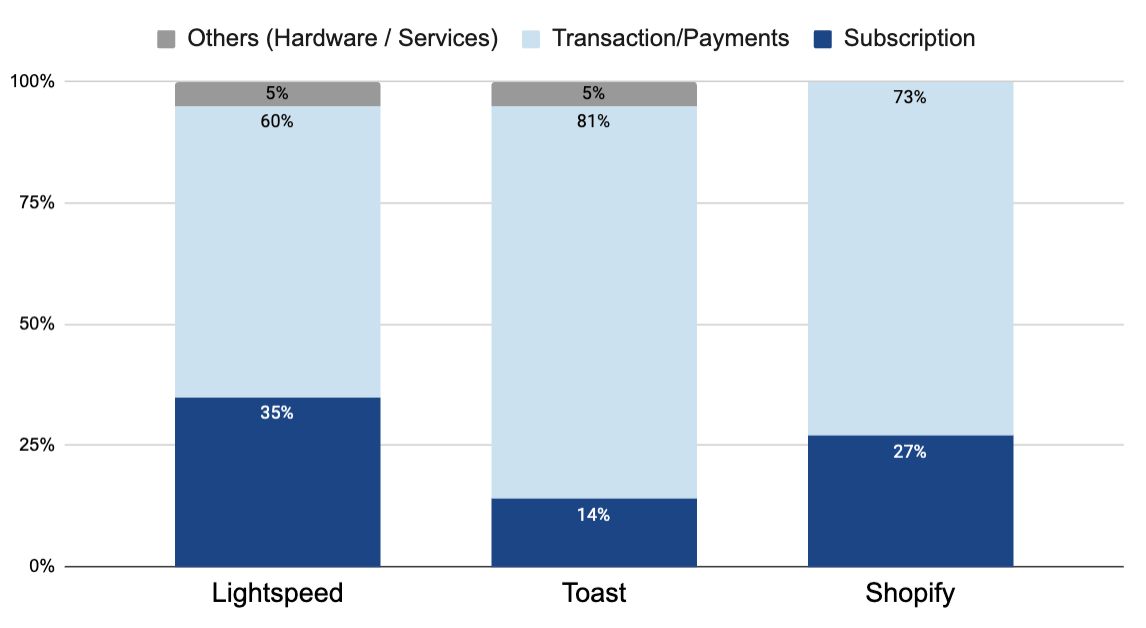

For leading platforms like Lightspeed, Toast, and Shopify, payment and transaction fees often generate over 60–80% of their total revenue. This model is far more scalable than a traditional subscription-only business. Instead of competing directly with banks, these platforms leverage their existing customer relationships and data to offer tailored financial solutions.

For a merchant, this integrated approach provides a huge advantage. Instead of juggling multiple providers for payments, loans, and banking, they get a single, seamless experience. This increases convenience and builds trust, making the platform much more valuable. For Shopify, this strategy is built on three pillars:

1. Shopify Payments

Shopify Payments is the central nervous system of the company's financial ecosystem. By processing payments, Shopify becomes embedded in the merchant's payment flow. This creates invaluable insight into the merchant’s financial performance.

Then: When it launched in 2013, Shopify Payments was a white-label solution in partnership with Stripe. It allowed merchants to bypass third-party gateways and offer a more seamless checkout experience.

Now: Today, payments are a fully in-house solution that powers over 80% of all Shopify merchant transactions and includes advanced features like accelerated checkouts and a wide range of local payment methods.

2. Shopify Capital

Shopify's control over payment data allows it to offer financing in a way that traditional banks cannot. With a full view of a merchant’s sales history, Shopify can pre-approve them for loans or cash advances. Shopify offers two key products:

Merchant Cash Advance: Shopify provides financing upfront in exchange for a fixed percentage of future daily sales until the advance is fully repaid.

Asset-Backed Loans: Shopify lends a specific amount of money that you repay over time with fixed terms. The loan is secured by your business assets, and you have a set repayment schedule regardless of daily sales.

Then: Launched in 2016, Capital started by offering small loans to help merchants with inventory and marketing.

Now: It has evolved into a major financing provider with check sizes ranging from $200 to millions, disbursing over $5 billion to merchants globally. The repayment model, which is tied to a percentage of daily sales, makes it highly flexible and appealing to small businesses, reducing pressure during slower periods.

3. Shopify Balance

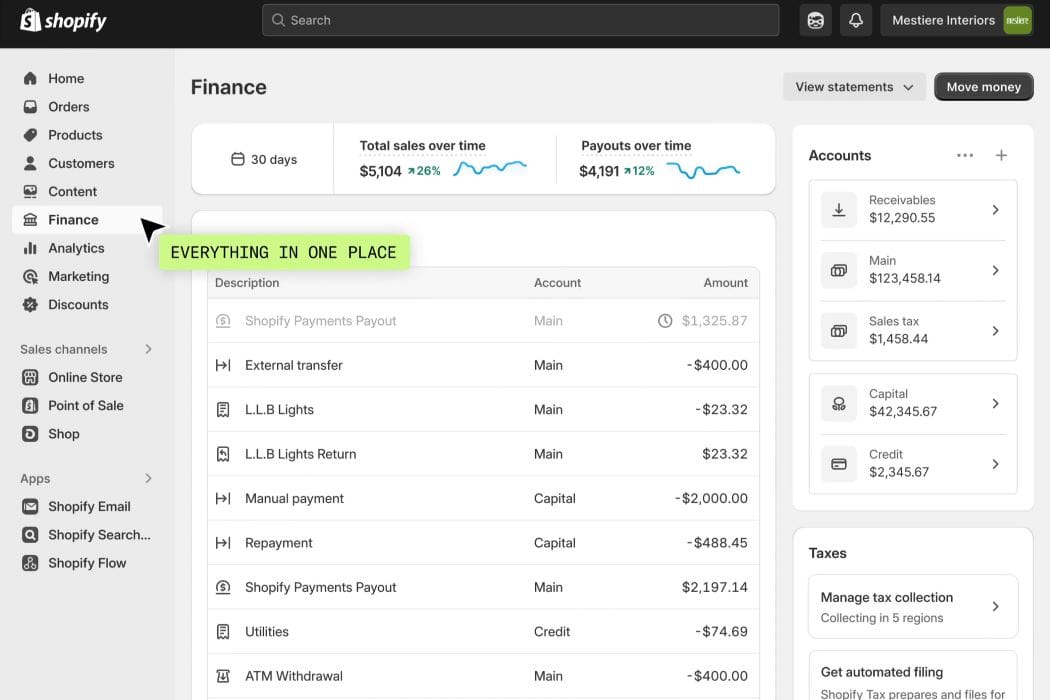

Shopify Balance is the culmination of this integrated strategy. It's a business account that allows merchants to manage their finances directly within their Shopify dashboard, with features that cover business payments, tax obligations, and credit card solutions.

Then: When it launched in 2020, Shopify offered merchants corporate bank accounts, a corporate card, and a spending rewards program.

Now: Today, Shopify Balance extends its offerings to cover bill payments, tax automation, and a competitive interest program to increase APY yields up to 3.96%.

Two in five of the company’s merchants currently use their personal bank accounts and cards for business. They’re combining their personal and business finances, making it difficult to measure the financial health of the business

Note: In 2025, Shopify integrated Shopify Capital and Shopify Balance into Shopify Finance.

Screenshot of Shopify Finance Portal Source: Betakit

Implications on Unit Economics

Before building out payment and other financial services, Shopify’s revenue model relied on subscriptions, driven by the number of merchants and the size of their operations. The introduction of embedded finance allows Shopify to monetize a fraction of the sales generated by its merchants, which was approximately 2-3% as of 2024.

For example, a merchant on the "Grow" subscription plan pays roughly $100 per month ($1,200 annually). Assuming this merchant generates $120,000 in annual sales, Shopify would earn an additional $2,400 per year from payment revenue.

This payment revenue dramatically increases (3x) the lifetime value (LTV) for each merchant while the cost of customer acquisition (CAC) remains the same. The additional value provided to the customer can also accelerate sales. The additional revenue from payments allows companies to reduce subscription prices to improve customer conversion. For example, Shopify offers the first six months for just $1 per month to lower the barrier to entry and compete with other e-commerce platforms.

As a result of the unit economic lift, inside sales go-to-market is possible where it previously wasn’t. At over $5,000 in average revenue per customer, vertical SaaS companies can afford to hire an outbound sales team instead of relying on product-led growth channels like word-of-mouth and paid acquisition.

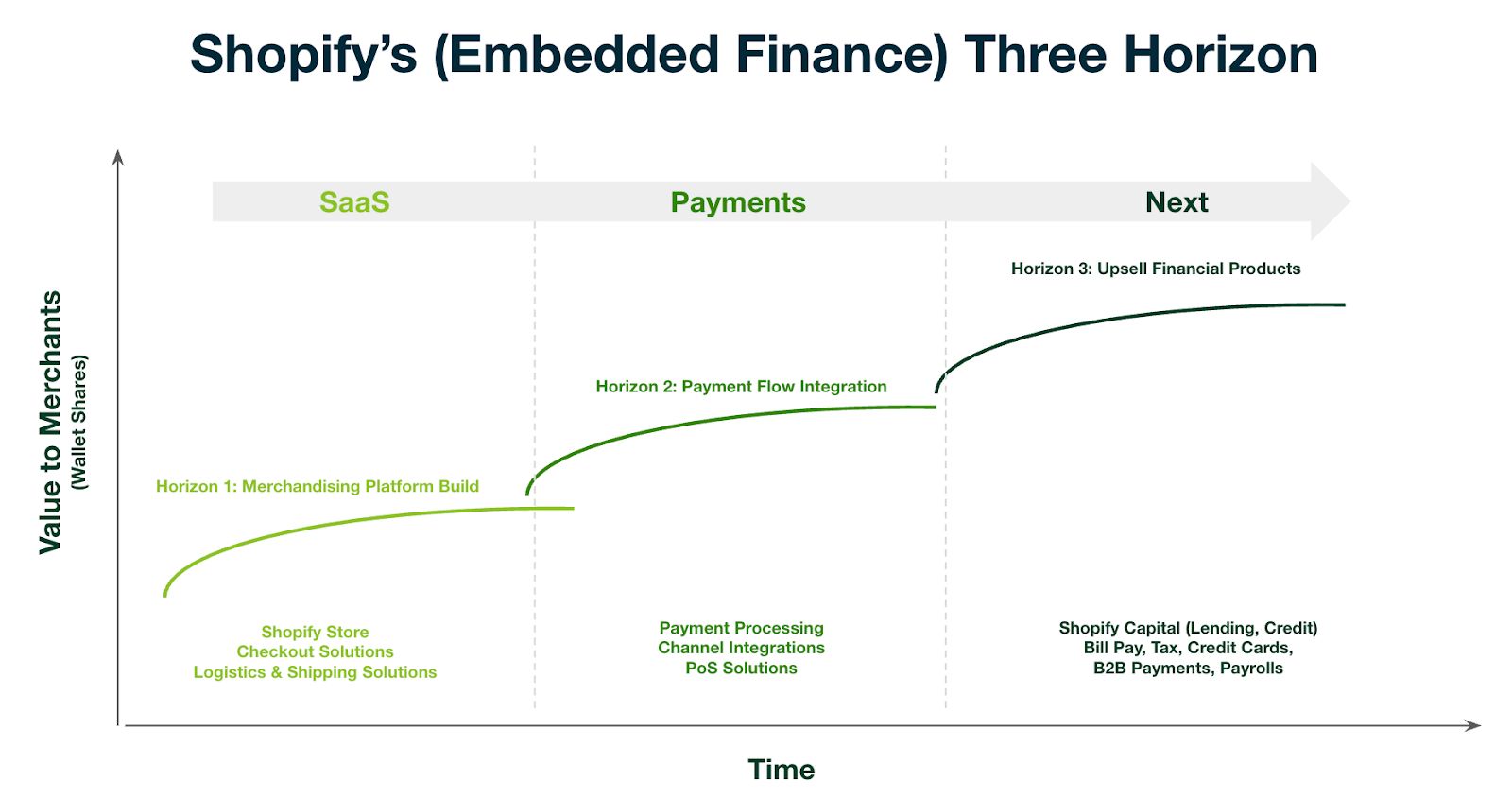

Lessons for VMS — Shopify’s Three Horizons

If you are building vertical SaaS for business owners in various industries. There are many useful lessons to be learned from the Shopify embedded finance approach. At a high level, Shopify can be described in these three horizons

Horizon 1: Build the Platform and Own the Data

Your core SaaS product is the foundation. Your first mission is to become the system of record for your industry. You need to build a platform that captures all the critical workflows and data. If you’re building for restaurants, you need to own the POS data. If you're building for logistics, you need to own the booking data. Without this, the next two horizons are impossible.

Horizon 2: Embed the Payments and Capture the Money Flow

Once you have the data, you must embed payments. This is where you transform your platform from a cost center for your customer into a revenue center for your business. By processing transactions, you capture the most valuable data point of all: a direct feed into your customer's financial health. This gives you unparalleled distribution and a high-margin, scalable revenue stream that fuels everything else.

Horizon 3: Build the Financial Services Add-ons

With the payments infrastructure and data moat in place, you can now build a suite of financial products that are genuinely better than what any legacy bank can offer. This is where you layer on lending (like Shopify Capital) and banking (like Shopify Balance), creating a full-stack financial ecosystem. This adds enormous value to your customers and makes your platform nearly impossible to leave.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources