- Network Effects

- Posts

- RoseRocket: The Modern Transportation Management System

RoseRocket: The Modern Transportation Management System

How RoseRockets Leverage Network Effects to Scal a Modern Enterprise SaaS

Welcome to the 10th Network Effects Newsletter.

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world’s leading tech companies.

Today, we’re exploring RoseRocket, which was founded in 2015 by Justin Sky (CEO), Justin Bailie (CSO), and Alexander Luksidadi (CTO).

Let’s dive in.

📝 Overview

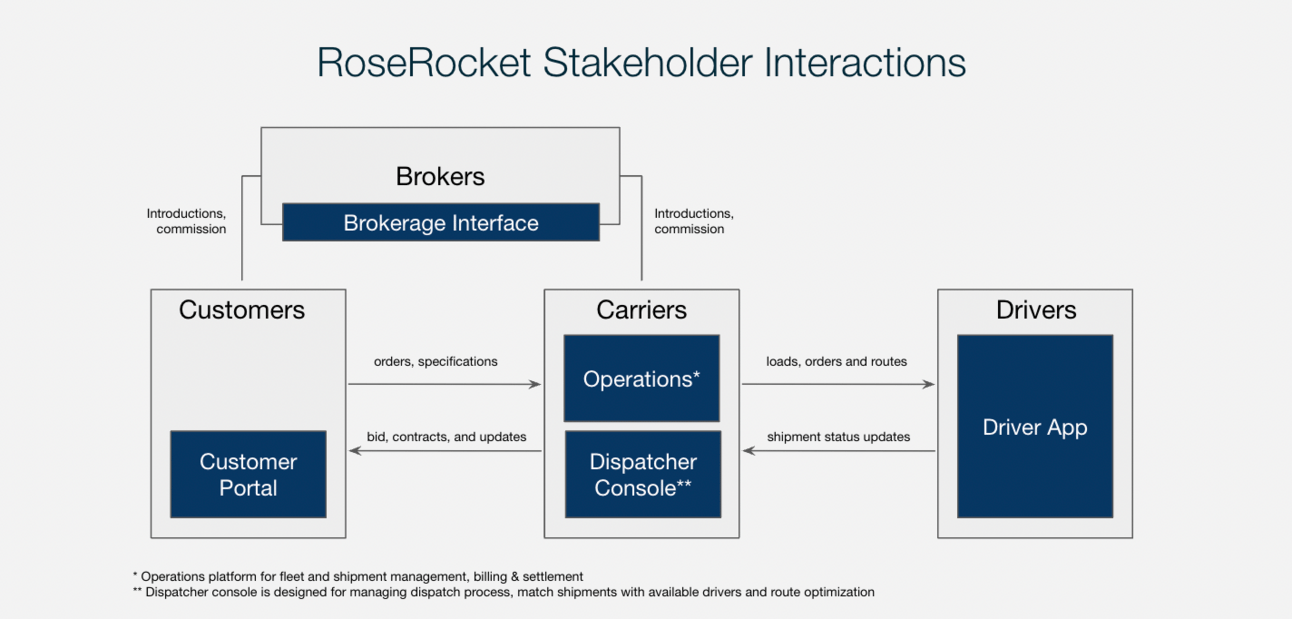

Rose Rocket is a next-generation Transportation Management System (TMS) that serves as the operational backbone for freight brokers, carriers, and shippers. The platform centralizes mission-critical workflows from dispatching and document management to invoicing and partner collaboration, while integrating with dozens of systems such as Samsara, QuickBooks, and Gmail.

In 2025, Rose Rocket launched TMS.ai, its AI-native suite designed to eliminate the rule-based and manual processes of legacy TMS platforms. By embedding natural language interfaces (chat and voice) and intelligent workflow automations such as data entry, document syncing with drivers, and live track-and-trace updates for customers. Rose Rocket is turning TMS software from a rigid tool into an adaptive operating system.

As of 2024, RoseRocket has processed over $2.7Bn in freight and served over 100,000 users from over 1,200 enterprise clients, with customers including Unigroup, United Van Lines, Gulf Relay, Canada Cartage and Mayflower. Customers have achieved 75% Fewer phone calls with online customer track and trace and 4x faster invoicing by syncing documents with drivers.

📌 Thesis 1 - TMS Network-Effects-Driven Growth

Rose Rocket’s foundational insight is that every freight shipment is inherently a multi-party collaboration. By enabling shippers to share track-and-trace links, document upload portals, and real-time status updates with carriers and brokers. Rose Rocket transforms routine logistics interactions into powerful guest invitations

Since introducing guest access, Rose Rocket’s active network has grown 47×, expanding from early adopters in niche LTL corridors to thousands of shippers, carriers, and brokers across North America. The scale of the network drives organic engagement and conversions, in complement to TMS’s referral partner program, can create brand lift in customer awareness and drive customer acquisition cost (CAC) down at scale.

Many Rose Rocket customers first experience the product not as a customer, but through a vendor or partner, much like you signed on DocuSign long before you purchased the product, or received a shared file on Box

📌 Thesis 2 – TMS.ai AI Workflow Entrenchment

Traditional TMS relies on rule-based mechanisms to manage operations and workflows, and the usage of the platform does not necessarily enhance its capabilities. However, with the implementation of AI, the platform can learn and understand organizational context by ingesting historical records (e.g., routing histories, SLA performance logs, exception patterns) and user interactions (e.g., chat dialogues, interactions with Rosie).

As part of the launch in February 2025, some of the key features from TMS.ai include

DataBot: Automated data entry using OCR technology to capture and process information from documents to emails. This solves the industry's manual data problem, reducing input time on average by 75%.

Rosie: A co-pilot embedded in every order, Rosie streamlines workflows by assisting with updates, completing actions, and connecting data. Whether it’s identifying backhaul opportunities, matching loads to carriers, to cut load-matching time by 90%

Freight Audit and Pay: AI-powered invoice matching, eliminating 80% of manual inputs and audits of the freight reconciliation process while reducing costly errors.

The longer the users have used TMS.ai, the greater the switching cost will become, because of the memory it builds within the systems of record and uses interaction history. Future AI application opportunity areas are going to include:

Route Optimization

Fleet Management Optimization

Voice AI in Job Entries & Updates

From DataBot eliminating manual data entry to Rosie instantly matching loads to carriers, one thing is clear – AI in transportation is here, and it will completely change how every team member works, for the better

🌱 Genesis Story

In 2012, Justin Bailie, who grew up with a background in the freight industry, launched a freight brokerage to connect carriers and sellers. He had an early version of building an application that allows customers to track orders. At the time, B2B logistics lacked the visibility and user experience that had slowly become the standard in consumer-facing industries. While the brokerage itself was successful, Justin became increasingly drawn to the idea of solving deeper infrastructure problems with technology. He eventually sold the business to pursue building software solutions for trucking companies.

Justin’s first venture is FR8nex, an online tool to book, source, and track freight. The business failed due to the lack of online connectivity in the trucking industry. However, the experience validated Justin’s convictions to build technology for the legacy trucking industry.

In 2015, while standing in line at a UPS Store in Barrie, Justin overheard a conversation about someone building a mobile tech widget. Intrigued, he struck up a conversation and asked to be introduced to the developer, who happened to be based in San Francisco. He connected with the person and learned about the world of technology and venture-backed startups.

That casual encounter led him to Mike Betts, who was working at ventureLAB, an incubator at York University. Through Betts, Justin was introduced to Justin Sky. The two quickly connected over a shared vision for modernizing freight and would go on to co-found Rose Rocket together

In 2016, RoseRocket had gone through the Y-Combinator program, which had seeded their ambition to transform the operations of the legacy trucking industry.

The key issues facing the industry are capacity, visibility, supply chain disruptions and labor shortages — and the antiquated systems and applications that enable these problems to only get worse

🖥️ Products & Services

Rose Rocket is a modern, modular Transportation Management System (TMS) purpose-built for freight brokers, carriers, and shippers. The platform acts as the system of record and command center for end-to-end logistics operations, handling everything from dispatching and order creation to invoicing and partner collaboration.

Core Transportation Management

At its core, Rose Rocket provides a flexible, cloud-native operating system that helps logistics teams run the end-to-end process for transportation shipments. It’s built to accommodate the unique workflows and needs of different stakeholders, including carriers, brokers, third-party logistics providers (3PLs), and shippers

Key Capabilities:

Order Management: Create, manage, and track inbound and outbound freight orders in one centralized system. Orders are enriched with custom fields, service types, and billing logic, allowing for flexibility across use cases

Dispatch & Load Planning: Assign loads to drivers or carrier partners via a drag-and-drop interface, optimize routing, and manage real-time ETAs. Integrates directly with telematics for live truck visibility.

Carrier & Partner Collaboration: Invite external stakeholders into the workflow with shared tracking links, document uploads, and digital signatures. Turns every shipment into an acquisition loop.

Transit Management: Monitor freight as it moves through each stage from pickup to delivery. The system automatically captures key events such as arrival, detention, delay, and proof-of-delivery (POD) submission

Invoicing & Reconciliation: Integrated freight audit tools and AR/AP workflows allow users to automatically match documents, audit invoices, and reduce manual back-office work.

Reporting & Analytics: Users can analyze on-time delivery rates, carrier scorecards, lane performance, exception frequency, invoice aging, and margin by customer or mode. Dashboards are configurable and exportable, enabling teams to share insights

The level of sophistication has also grown as there is an expanding need to support

Different modes of transportation (intermodal, parcel, rail, air and dedicated fleets)

Different locations outside of the home region (i.e., multiple fleet stations)

Enhancement in freight procurement, analytics, and real-time reporting

ESG data reporting disclosure

Customer Portal

Rose Rocket’s platform enables trucking companies to create a web-based portal for each customer. In the portal, the customer can place and track orders on a self-service basis, which reduces manual work for logistics teams. Rose Rocket’s platform also automates the task of generating a quote after an order has been placed.

Once a shipment is underway, Rose Rocket’s customer portal displays a map that tracks the current location of the merchandise and provides related information such as ETA, order status, and billing status. Logistics companies also use the portal to manually share shipping updates. A company could, for example, alert a retailer if a truck is expected to arrive at its warehouse sooner than expected.

Different roles (e.g., driver, dispatcher, shipper) have tailored interfaces and permissions, improving usability and security across the network.

Driver and Fleet Management Tools

On the other side, Rose Rocket provides an integrated suite of tools to help carriers manage drivers, assets, and fleet operations more efficiently. These capabilities are designed to support both company-owned fleets and outsourced capacity.

Driver Profiles & Compliance: Each driver has a digital profile that stores certifications, licenses, insurance records, and training documentation. Alerts are triggered for upcoming renewals or violations, helping ensure regulatory compliance and minimizing risk

Mobile Driver App: The Rose Rocket mobile app acts as a digital command center for drivers on the road. Drivers can receive dispatches, view order details, update load statuses (e.g., arrived, loaded, delivered), upload documents (like PODs and BOLs), and communicate with dispatch from a phone application

Asset Tracking & Maintenance: Fleet managers can track trailers, tractors, and equipment in real time through GPS and ELD integrations. Assets are linked to maintenance schedules, repair logs, and inspection records, making it easy to ensure vehicle uptime and reduce unexpected breakdowns

Flexible Workforce Support: Whether managing a full-time company fleet or a dynamic network of owner-operators and leased drivers, Rose Rocket’s tools offer the flexibility to onboard, assign, and support different types of drivers. Each role has access to only what they need, streamlining workflows and protecting sensitive information

Ecosystem & Integrations

Rose Rocket connects to dozens of third-party tools, allowing teams to customize workflows to meet without duplicating data entry.

With integrations into leading telematics partners Geotab, Isaac, KeepTruckin, Samsara, Thermo King and Omnitracs, visibility platform project44, and security system SaferWatch, Rose Rocket has created a TMS that allows both carriers and 3PLs to scale at the speed of their choosing while being prepared to accelerate growth within their own walls without technology enhancements obstructing that growth.

In addition to other integrations that are core for business operations, such as accounting, marketing and communications. The integration ecosystem allows customers to integrate between systems to ensure synchronization of data and create a single source of truth

Source: Rose Rocket Youtube Channel

🏢 Markets

The trucking industry continues to dominate the freight transportation industry in terms of both tonnage and revenue, comprising 72.7% of tonnage and 76.9% of revenue in 2024. The industry has earned $906 billion in revenue and employed 3.5 million truck drivers. There are over 100k+ shippers and 1M carriers, of which 95% have less than 10 trucks.

Trucking has undergone significant changes in recent years. According to a recent industry survey, 91% of motor carriers operating 20 trucks or more use a Transportation Management System (TMS), up from 62% in 2005. Additionally, the same survey reported that 68% of freight brokers with fewer than 10 employees use TMS software.

According to McKinsey, industry executives at major carriers have cited cost and productivity as the major pain points for carriers, and are much more willing to invest in technology to improve operating margins.

Source: Activant Capital

⚔️ Competitions

The transportation software market is evolving rapidly. The industry is transitioning from rigid, monolithic systems to intelligent platforms that embed directly into customer workflows. Leading vendors are constructing interconnected ecosystems, enabling multi-party collaboration, and delivering measurable return on investment. We categorize the competitive landscape across three distinct segments:

Transportation Management Software (FreightPop, Turvo)

Modern TMS platforms aim to serve a range of stakeholders, including shippers, carriers, brokers, freight forwarders, and third-party logistics providers. Most vendors begin with a single stakeholder segment before expanding across the supply chain through product-led or relationship-driven cross-selling.

This cross-sell potential enables vendors to create embedded network effects as counterparties adopt the same underlying infrastructure. The principal challenge lies in aligning divergent stakeholder incentives and developing a product architecture capable of serving multiple user personas.

TMS Supply Chain Orchestrators (Logixboard, Optimal Dynamics, and Leaf Logistics)

This category comprises software vendors that operate above core TMS systems. Rather than displacing incumbent platforms, these companies integrate with existing infrastructure to deliver enhanced visibility, analytics, and decision support capabilities.

Their primary value proposition is derived from aggregating and synthesizing data across multiple systems, often providing insights that legacy platforms cannot surface. These solutions offer a low-friction deployment model and allow customers to unlock incremental value without replacing foundational systems.

Legacy Incumbents (McLeod, Descartes, Oracle TMS)

Legacy TMS platforms dominate the enterprise, with deeply entrenched contracts, complex customization layers, and heavy implementations.

They are “the mainframe of freight”—reliable, secure, and often outdated. Most offer little collaboration, poor APIs, and expensive upgrade paths. Their advantage lies in scale and long-standing customer relationships, but their products were not built for today’s networked supply chains. The switching cost is their moat, but it's also a bottleneck for innovation.

⚙️ Business Model

Rose Rocket generates revenue through a SaaS subscription model layered with seat-based pricing, volume-linked upsells, and workflow integrations that expand ARPU over time. Rose Rocket offers a free version of the TMS platform with limited features and a free trial for the premium version.

Subscription Licensing

Rose Rocket’s core business model is seat-based SaaS, with pricing aligned to the number of users (dispatchers, operations staff, drivers) and the scope of features used. The detailed pricing structure is customized to the company’s specific needs, and is not publicly disclosed

Integration & Ecosystem Monetization

Rose Rocket positions itself as an operating system for freight workflows. Integrations with ELDs, accounting tools, telematics platforms, and warehouse management systems not only improve platform capabilities, Rose Rocket could also charge integration fees or a revenue-sharing mechanism to the third-party apps to monetize usage of their apps on Rose Rocket’s platforms.

Financial Products & Services

While not directly monetized today, these integrations create long-term pricing power and open pathways for value-added services (e.g., embedded insurance, financing, or load board access). Future monetization could mirror vertical SaaS peers that generate incremental revenue through ecosystem transactions.

Source: TechCrunch, Ripple Ventures

💰Valuations & Fundraising

Rose Rocket has raised $69 million to date across multiple funding rounds, with backing from leading venture firms including Scale Venture Partners, Addition Capital, and Y Combinator.

The company’s most recent $38 million Series B round, announced in 2024, was led by Scale Venture Partners, with participation from Addition Capital, Shine Capital, ScaleUP Ventures, FundersClub, and Y Combinator. Proceeds from the round are being used to expand into larger fleets and deepen investment in product development and network collaboration capabilities.

The lead investors for the previous round include Addition Capital (Series A) & Shine Capital (Series A), and Ripple Ventures (Seed)

♟️ Key Opportunities

TMS-as-a-Network: Carrier Bidding Marketplace

As coordination costs rise across fragmented supply chains, Rose Rocket is well-positioned to become the connective tissue of modern logistics. An opportunity is present where Rose Rocket expands its network to build a marketplace product for carriers to directly bid and capture deals from sellers.

This networked approach creates a defensible flywheel and further accelerates the growth of the network as the marketplace participant benefits as the scale of the network grows, improving carrier matching accuracy, response time, and pricing efficiency. Each new stakeholder onboarded increases the utility of the system for everyone else, mirroring the network dynamics that powered Slack and Zoom.

Embedded Fintech

With freight workflows centralized through Rose Rocket’s TMS platform, there is a direct path to expand into embedded financial services. The company already handles sensitive shipment data, cash flow timing, and carrier onboarding—all core elements required to underwrite and monetize transactions.

Rose Rocket can follow the blueprint laid by platforms like Shopify and Jobber by embedding payments, factoring, and fleet insurance into its platform. Each feature can be introduced contextually, for example:

Payments during invoicing

Factoring at Proof-of-Delivery (POD)

Insurance during dispatch

Lending for business operations

As an example, Shopify's pivot to Merchant Solutions led to a revenue mix shift where embedded fintech now represents more than 70% of total revenue. Rose Rocket’s fintech stack, built on top of its TMS network, has similar potential: transforming the platform from a logistics software vendor into the financial backbone of the freight industry.

Case Study: Shopify’s Integration of Embed Finance

In 2015, Shopify's revenue from Subscription Solutions was $112.0 million, while Merchant Solutions (which includes Shopify Payments) generated $93.3 million. By 2023, this dynamic had shifted significantly: Subscription Solutions revenue grew to $1.8 billion, whereas Merchant Solutions surged to $5.2 billion, making up approximately 73% of total revenue.

Adoption of Autonomous Vehicles

As transportation executives confront persistent margin pressure, labour shortages, and rising expectations for delivery speed, autonomous vehicles (AVs) are emerging as a viable lever to unlock cost efficiency and reliability. While full-scale adoption remains a few years out, early commercial pilots from players like Aurora, Kodiak, and Gatik are already reshaping operational assumptions for fleet operators, and consumer applications are slowly rolling out, for example, Waymo and Tesla. The shift to autonomy will not just impact the vehicle layer, it will fundamentally change the systems that orchestrate movement.

The rise of autonomy shifts the role of TMS from a back-office planning tool to a fleet-wide orchestration layer, embedded in real-time decision-making. Their modular architecture, API-first design, and expanding role across dispatch and network collaboration make them well-suited to support the operational bifurcation that AVs will require.

⚠️ Key Risks

Highly Competitive Industry with High Customer Switching Costs

The transportation software ecosystem is experiencing accelerated innovation driven by venture-backed startups, horizontal platforms expanding into logistics, and entrenched legacy incumbents defending market share. Dozens of vendors are pursuing overlapping customer segments, ranging from SMB brokers to large asset carriers, leading to buyer fatigue, pricing compression, and increased switching incentives.

In addition, over 90% of large fleet owners already have a TMS platform in place, which it cumbersome to switch from one vendor to the other, despite RoseRocket having marginal improvements for the users.

AI Features Development & Adoption

The execution of AI features is going to heavily impact the customer experience, and managing the variety of use cases and exceptions is going to be key to shaping the customer experience positively. In the short term, it may cause disruptions to workflows, given the learning curves and hallucinations/inaccuracies that may occur. There is a risk that AI tools are either underutilized due to poor UX or overbuilt for customers with limited operational maturity.

Misaligned AI investments could dilute engineering focus and extend time-to-value for customers. Moreover, models trained on noisy or sparse data from fragmented fleets may yield low-confidence outputs, undermining customer trust in automation features.

Exposure to Fraud in the Logistics Industry

The freight industry is facing a surge in sophisticated fraud schemes, including VoIP abuse, identity theft, and impersonation attacks leveraging “clean” MC numbers. Despite rising awareness and adoption of risk management tools like Highway or Carrier411, brokers remain reliant on ad-hoc defences like gut checks and manual verification.

Rose Rocket’s growing role as a system of record for load execution makes it a logical enforcement layer, but also a potential attack surface. Failure to integrate robust, proactive fraud detection mechanisms could lead to customer attrition, reputational damage, or legal liability in the event of downstream loss.

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on OpenEvidence, one of the fastest-growing AI-native medical information platforms.

Resources