- Network Effects

- Posts

- OpenEvidence: Medical Assistant for Doctors

OpenEvidence: Medical Assistant for Doctors

How OpenEvidence Reinvent GTM for Healthcare Software Companies

Welcome to the 12th Network Effects Newsletter,

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world’s leading tech companies.

Today, we’re exploring OpenEvidence, which was founded in 2021 by Daniel Nadler (CEO) and Zachary Zieglar (CTO)

Let’s dive in.

📝 Overview

OpenEvidence (OE) is an enterprise-grade AI platform for the healthcare industry, enabling physicians and healthcare practitioners to aggregate, synthesize, and visualize clinically relevant evidence in understandable, accessible formats

Today, the U.S. faces a shortage of doctors, with 1.1 million registered physicians serving a population of 350 million. At the same time, the volume of medical knowledge is expanding at an unprecedented rate, doubling approximately every 5 years, compared to every 50 years in 1950. As a result, healthcare providers are under increasing pressure to stay current with evolving clinical practices while delivering high-quality care to patients.

OpenEvidence functions as a knowledge platform for doctors. It allows users to ask natural-language medical questions and receive answers grounded in up-to-date academic publications, including real-time citations to validate treatment paths and clinical choices.

As of June 2025, over 25% of practicing U.S. physicians are now on OpenEvidence, as monthly active users (MaU) and are working with academic medical centers like Stanford Health Care and Mayo Clinic on enterprise deployment for its enterprise software offerings.

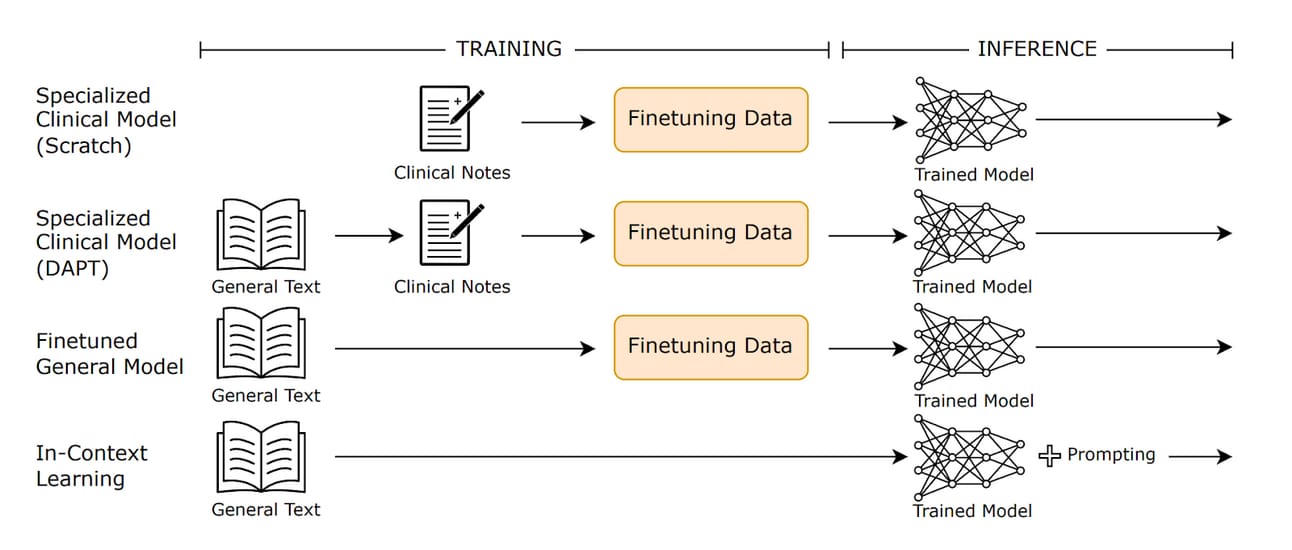

📌 Thesis 1 - Differentiated Model Architecture

OpenEvidence’s core competitive advantage lies in its deliberate use of a specialized clinical model architecture trained exclusively on peer-reviewed medical literature, in contrast to general-purpose models that ingest all kinds of data available on the internet. The scoped-down model training allows for greater reliability, transparency, and clinical trust, which are critical for a high-stakes medical environment where margins for errors are not tolerated

In 2023, a study revealed that OpenEvidence's AI scored over 90% on the United States Medical Licensing Examination (USMLE), making 77% fewer errors than ChatGPT, 24% fewer than GPT-4 and 31% fewer errors than Google's Med-PaLM 2. The gap is likely going to widen as OpenEvidence continues to improve its training and inference of its model.

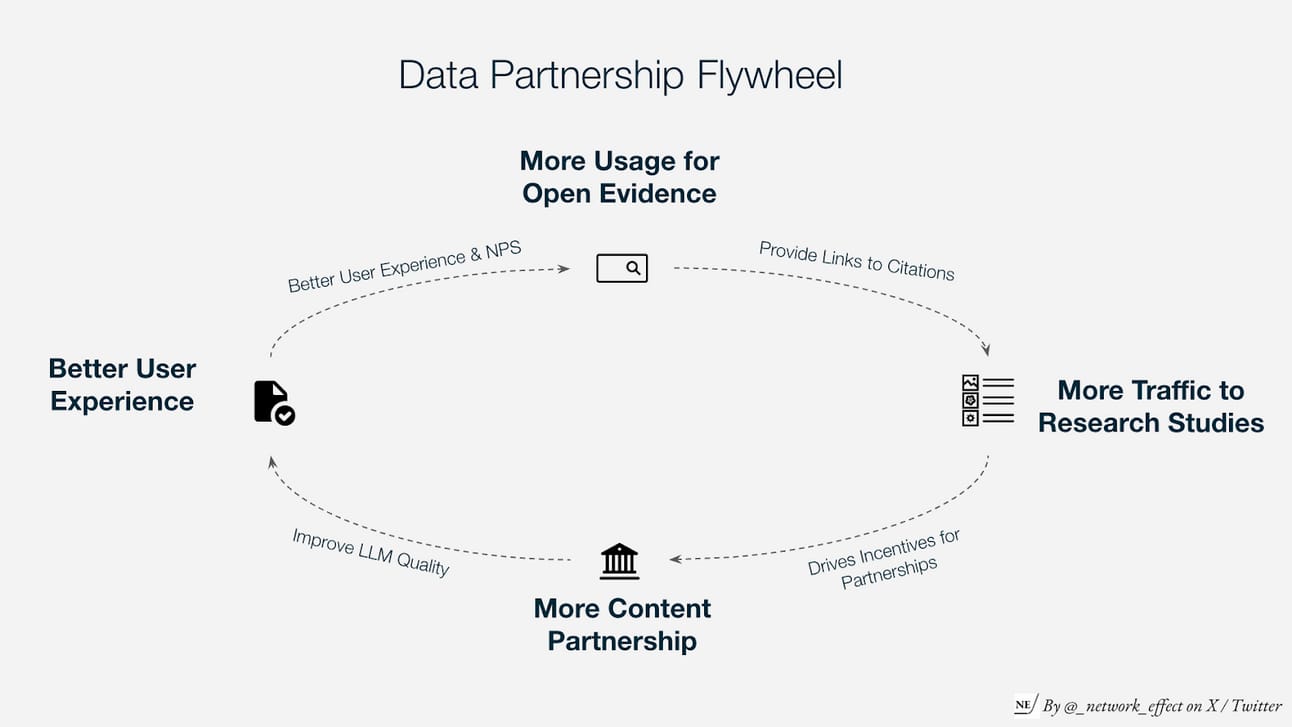

OpenEvidence is able to achieve this through exclusive content partnerships with leading publication providers such as the Mayo Clinic and the New England Journal of Medicine (NEJM). These partnerships grant them proprietary data assets that are both difficult to access and replicate from other competitors. This strategic relationship positions OpenEvidence as a trusted and defensible AI layer within clinical workflows, offering a differentiated path to adoption in a market where credibility and evidence-based validation are paramount.

📌 Thesis 2 – First-Mover Advantage with an Enterprise Moat

OpenEvidence is the first AI platform of its own with a highly differentiated and effective playbook, where they take a consumer-first approach to enterprise software by marketing towards physicians, rather than administrators.

While most healthcare startups drown in procurement cycles and endless IT red tape, OpenEvidence decided to market directly to the physicians by making its software available for free on the internet. This bottom-up wedge didn’t just create usage. It created market pull.

Physicians who have found value in OpenEvidence at the point of care become internal champions, bringing the tool to the attention of their department heads and hospital leadership. What starts as “rogue” adoption becomes formal procurement when enough doctors advocate for it. Instead of dragging through 12-month sales cycles, OpenEvidence sees pathways collapse into weeks, because the value is proven upfront, by the physicians who matter most.

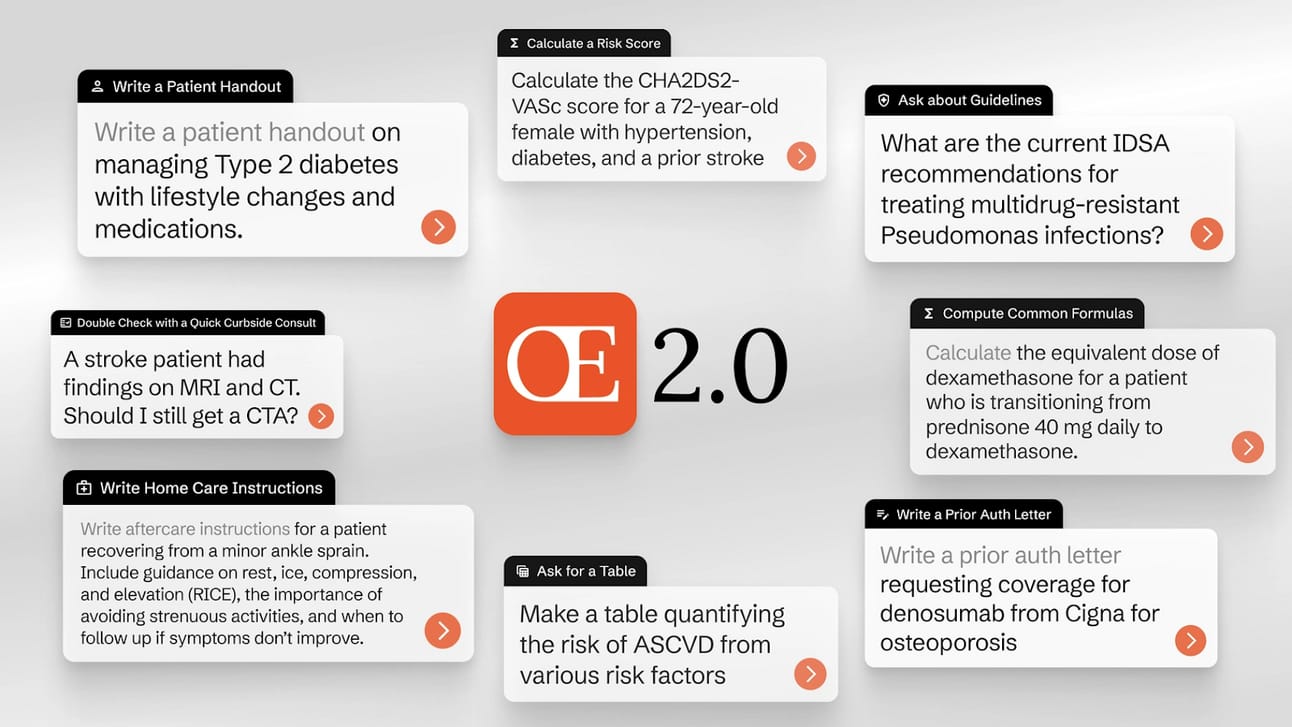

The stickiness of OpenEvidence lies in its ability to embed directly into clinical workflows (OpenEvidence 2.0 capabilities), where surface-level search becomes diagnostic support, authentication letter first drafts, and patient handouts. Doctors integrate it into their daily routines.

🌱 Genesis Story

OpenEvidence was founded in 2021 by Daniel Nadler, a serial entrepreneur with a deep background in AI and enterprise technology. Before founding OpenEvidence, Nadler built Kensho, a machine learning company focused on financial markets, which was acquired by S&P Global for $550 million.

After exiting Kensho, Nadler turned his attention to a growing crisis in clinical practice where physicians are unable to keep up with the growing medical knowledge. Despite the wealth of peer-reviewed research available, frontline doctors remained underserved by tools that could help them access this information in real time.

Nadler saw a clear opportunity to build a foundation model trained exclusively on peer-reviewed medical literature, providing physicians with an AI co-pilot capable of surfacing relevant evidence and citations in seconds. Nadler then had self-funded the company in 2021, and went through the Mayo Accelerator program in 2022.

The MVP was a simple web interface that allowed clinicians to ask open-ended medical questions and receive real-time, citation-backed answers from trusted databases like PubMed Central. Nadler’s team deliberately made it free and publicly accessible, bypassing traditional gatekeepers and empowering individual doctors directly. The response was immediate. Within months, usage grew from a few hundred physicians to over 100,000 medical practitioners

🖥️ Products & Services

Knowledge Search

OpenEvidence’s core product is a medical knowledge search engine It allows healthcare professionals to ask natural language questions and receive answers grounded in peer-reviewed literature, clinical guidelines, and up-to-date medical knowledge.

Clinically accurate, evidence-based responses

Source citations and confidence scores

Designed for physicians, PAs, NPs, and other frontline clinicians

Continuously updated with the latest in medical research and standards of care

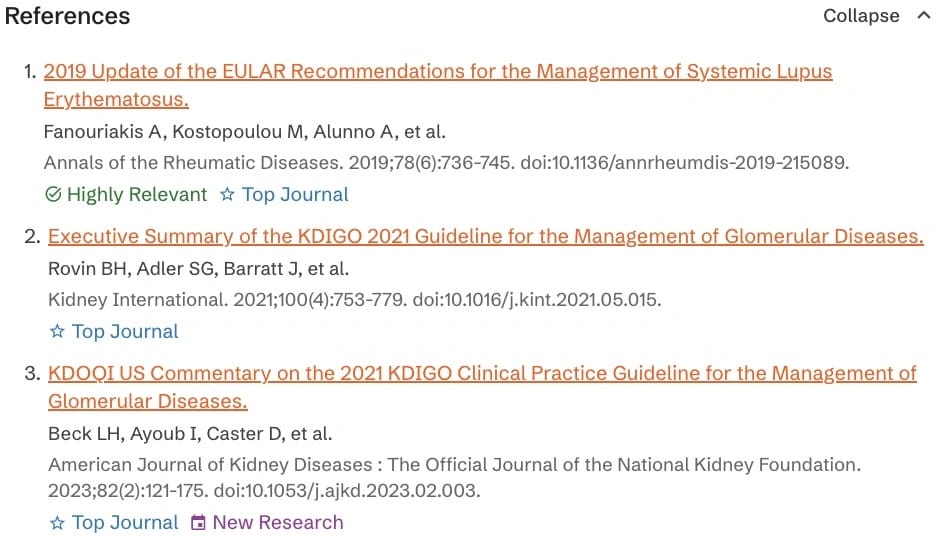

OpenEvidence also added key features such as “Why Cited” labels and “Evidence Updates” to provide a full experience for the users for their prompts

Why Cited: This feature allows users to dive deeper into the primary evidence that was presented to their prompts on several dimensions.

Relevance: Our proprietary evidence retrieval algorithm indicates that he evidence contained in the source can be directly used to answer the question

Publication Creditworthiness: The research is published in a highly regarded journal, such as The Lancet or the New England Journal of Medicine

Timeliness: The evidence comes from research published within the last year, as of the time the question was asked

[Read more about the feature here]

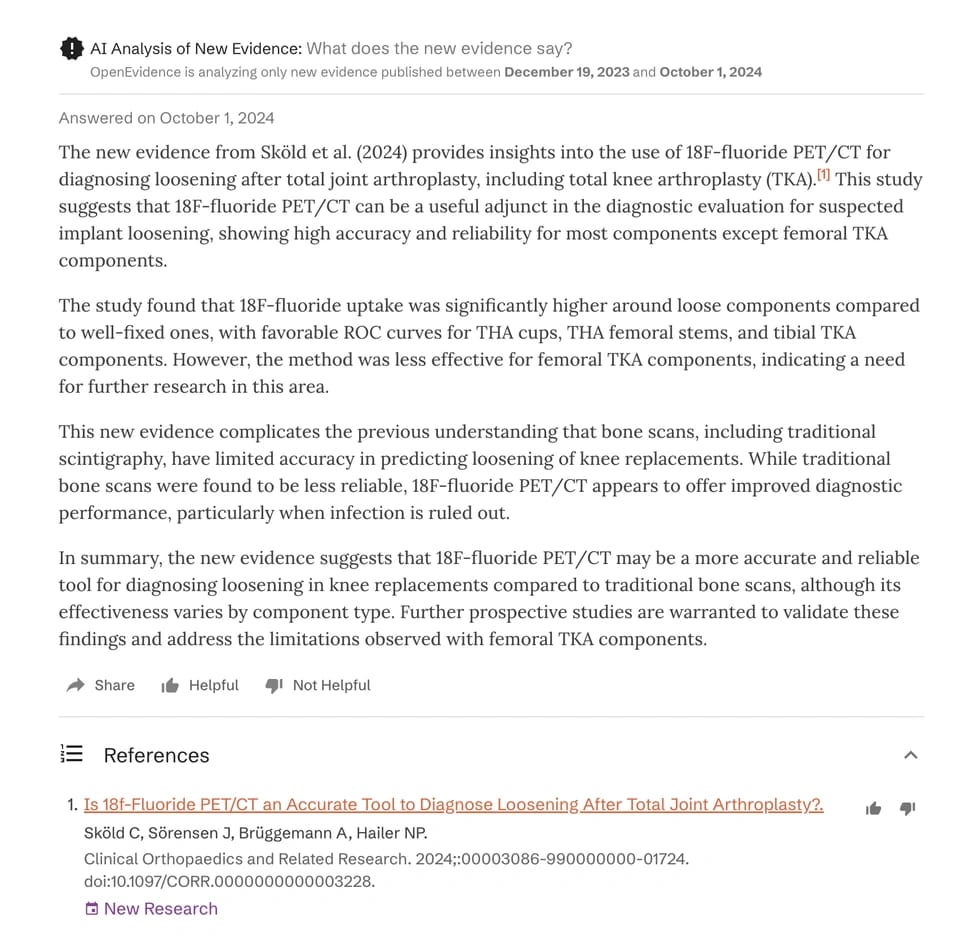

Evidence Updates:

Users can opt in to receive new evidence updates on questions users have previously asked. These updates are email notifications that alert you when new clinical evidence is published, such as significant findings from landmark clinical trials, that relate to your past inquiries.

For example, A family physician uses OpenEvidence to ask, “What’s the latest evidence on GLP-1 agonists for weight loss in patients with Type 2 diabetes?”. Then, two months later, the physician receives an Evidence Update via email:

[Read more about the feature here]

Real Life Example:

The In-Flight Emergency: Chickenpox and Immunocompromised Patient

While on a flight, Dr. Wolver responded to a medical emergency involving a 63-year-old man who developed a severe rash, suspected to be chickenpox.

1. Confirming Chickenpox Incubation Period: Dr. Wolver first used Open Evidence to confirm the incubation period for chickenpox, which is 15 days, referencing trusted sources like the CDC Yellow Book. This helped her determine if the man's symptoms aligned with chickenpox given his recent travel.

2. Assessing Immunocompromise: The situation became more complex when it was revealed the patient had prostate cancer and was on a drug called Extendi. Dr. Wolver needed to know if this made him immunocompromised, as chickenpox can be extremely serious for such patients. Open Evidence searched medical literature and leading journals, providing the answer that the level of immunosuppression was moderate. This meant an emergency landing wasn't immediately necessary

3. Developing a Treatment Plan: Finally, Dr. Wolver asked Open Evidence how to manage chickenpox in this specific case. The platform provided a series of drugs and a reasonable treatment plan, based on recent literature and trusted resources. The guidance indicated that while urgency was needed to get medication, the patient wasn't in immediate life-threatening danger, meaning they didn't need a drug within 30 minutes to survive.

Based on this information, the plane continued its journey. The necessary treatment was made available upon landing, and the patient was okay.

Workflow Augmentation

Beyond search, OpenEvidence supports a wide range of clinical and administrative workflows, reducing cognitive and clerical burdens on healthcare professionals.

Key features include:

Automated documentation tools: Generate prior authorization letters and patient handouts with embedded citations

Diagnostic reasoning support: Augment clinician decision-making with AI-supported differential diagnosis tools

Clinical calculators: Support for 50+ validated medical calculators directly integrated into the platform

Modular guideline support: Drug monographs, dosing modules, and guideline-specific care pathways

Structured output: Tables on demand and flexible formatting for easy interpretation and EHR integration

Expanded question coverage: Supports broader clinical inquiry, including rare or edge-case scenarios

Enterprise Integrations

As hospitals adopt OpenEvidence, the platform must integrate deeply into core hospital systems—including EHRs, billing platforms, and scheduling infrastructure. This connectivity allows OpenEvidence to surface precise, context-aware answers by referencing real-time institutional data directly within a physician’s prompt. For examples

Clinical History Queries

“Over the past 5 years, how many patients over 60 with Type 2 diabetes and chronic kidney disease have been admitted to our hospital, how many of them were readmitted with severe complications, and what were the primary causes and contributing factors behind those outcomes?”

Requires: EHR access (demographics, diagnoses, treatment history, outcomes)Diagnostic Pattern Recognition

“Has this patient had any similar presenting symptoms or diagnostic markers in the last 3 years that might explain today’s elevated troponin levels?”

Requires: EHR access (labs, notes, imaging, historical data)Comparative Outcomes

“Among patients at our hospital who received chemotherapy regimen A vs. B for Stage 3 colon cancer, what was the 1-year survival rate and incidence of adverse effects?”

Requires: EHR + outcome data + possibly billing codes (to identify adverse events)Operational Efficiency

What are the current wait times and availability for CT, MRI, and X-ray services at our hospital across different departments and times of day?

Requires: Scheduling system + radiology system + staff logsFinancial Impact Analysis

“What’s the average cost differential for inpatient vs. outpatient administration of IVIG at our hospital, including readmission rates?”

Requires: Billing system + EHR (treatment setting) + outcomes

🏢 Markets

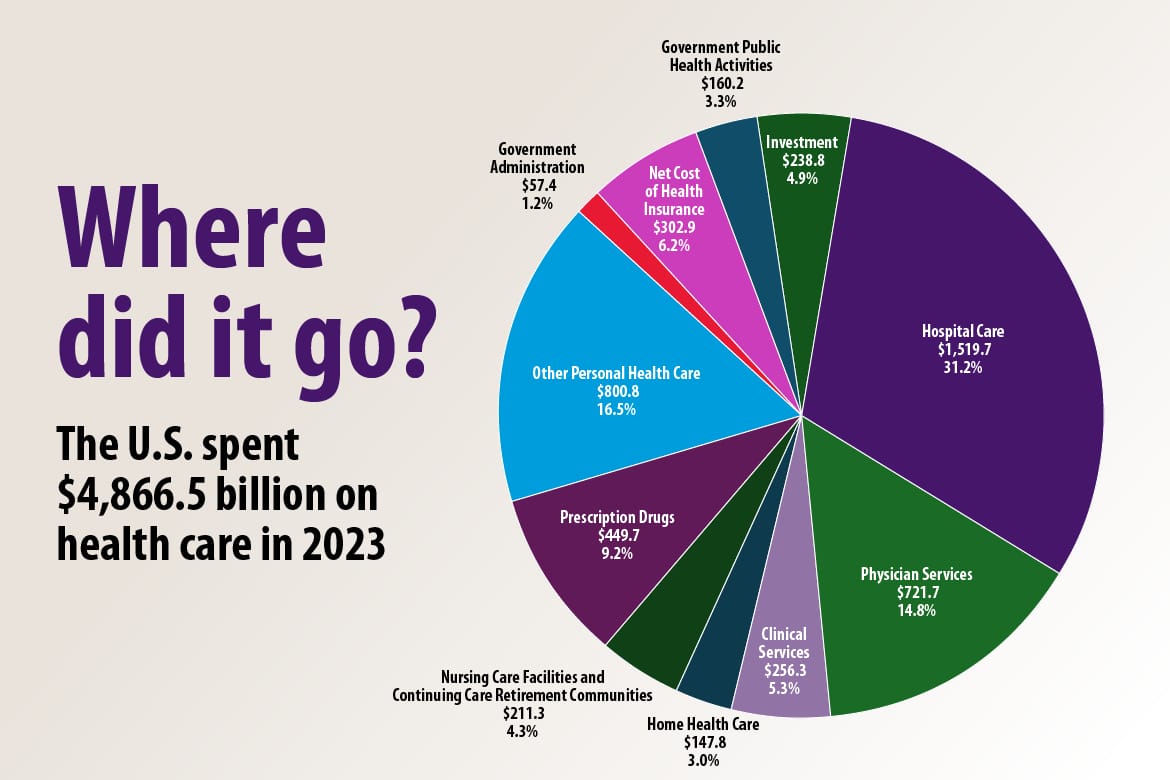

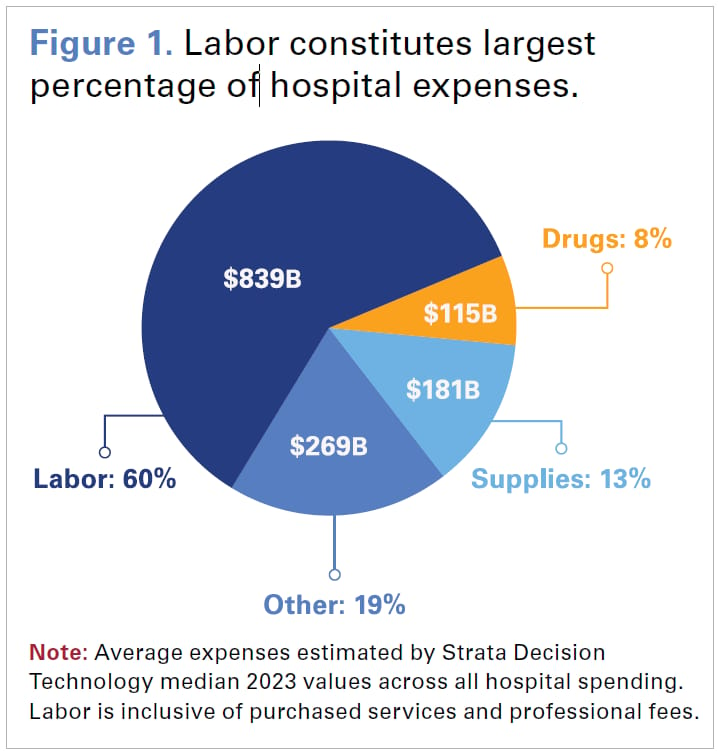

Health spending in the US has reached $4.9 trillion or $14,570 per capita in 2023, an equivalent of 17.6% of GDP in 2023. Hospital Care, Physician Services, and Clinical Services represented over 51% of the total health spending, which amounts to $2.4 trillion. Hospitals are increasingly under pressure to improve operating efficiencies from a few factors:

Firstly, the labour shortage of highly skilled individuals has hurt hospitals' margins. Total compensation and related expenses now account for 56% of total hospital costs. Amid ongoing workforce shortages, hospitals offer competitive wages to retain and recruit staff.

Secondly, despite escalating expenses, Medicare reimbursement continues to lag behind inflation, covering just 83 cents for every dollar spent by hospitals in 2023, resulting in over $100 billion in underpayments, according to the AHA Annual Survey data.

Thirdly, a significant portion of clinical staff time is consumed by administrative tasks, especially medical documentation and navigating insurance workflows. On average, physicians spend nearly two hours on documentation for every hour of direct patient care, leading to burnout and inefficiency.

⚔️ Competitions

OpenEvidence competes in a fast-emerging category of AI-native clinical support tools, where differentiation is driven by trust, data access, EHR integration, and safety.

Clinical Copilots & Decision Support

These startups are building AI-native tools aimed at augmenting clinical decision-making and documentation. Glass Health is focused on generating clinical plans from text prompts; Nabla offers an ambient note-taking copilot used across Europe and the U.S.; and Hippocratic AI is developing a safety-first medical LLM targeting patient-facing use cases. While these tools demonstrate innovation, most are still early in health system adoption, lack deep EHR integration, or have yet to demonstrate reliable performance across specialties and workflows.

EHR-Integrated Platforms

These platforms are incumbents or well-funded challengers deeply embedded in EHR ecosystems. Nuance DAX, owned by Microsoft, is the market leader in ambient scribe tools and is tightly integrated with Epic and Cerner. Notable offers broad automation across scheduling, documentation, and billing. DeepScribe provides an AI-powered scribe targeting smaller practices. While these platforms are heavily adopted, they often rely on legacy voice-recognition models or rule-based logic, making them less adaptable to fast-moving LLM innovation.

General LLMs

Leading model providers are making general-purpose medical models available via APIs (e.g., Google’s MedLM on Vertex AI). These models score highly on medical benchmark tests and are increasingly being evaluated by health systems for clinical deployment. However, using raw general LLMs out-of-the-box poses safety, alignment, and integration risks.

⚙️ Business Model

OpenEvidence provides its AI-powered clinical copilot to healthcare providers, with a focus on physician groups, clinics, and health systems. While the consumer-facing application is free for verified U.S. healthcare professionals (HCPs) to drive bottom-up adoption, enterprise deployments are monetized through a combination of subscription and usage-based pricing.

1. Per-Provider Subscription (Core Model)

The primary revenue model is a monthly subscription charged per active provider. Pricing is typically tiered based on:

Number of specialties supported

Note volume or usage thresholds

Access to advanced features such as medical coding, summarization, or analytics

2. Enterprise Contracts

For larger organizations, OpenEvidence offers annual enterprise licenses with:

Volume-based discounts

Dedicated onboarding, training, and support

Custom implementation and SLAs around uptime, safety, and accuracy

3. Usage-Based Pricing for Add-On Modules

OpenEvidence also offers advanced functionality as modular add-ons, monetized through usage-based pricing. These include:

Automated CPT/ICD medical coding

Clinical decision support and chart summarization tools

API integrations for third-party platforms such as telehealth or RCM systems

Case Study: OpenEvidence’s Decision to go Out-of-EHR

Many healthcare AI startups prioritize deep EHR integration (e.g., with Epic or Cerner) as their initial GTM motion. OpenEvidence has deliberately chosen a non-EHR, physician-facing entry point, instead focusing on lightweight, LLM-powered clinical copilots that can be used independently of hospital IT infrastructure.

There are four key advantages to building outside of EHR

1. Faster Go-to-Market without the need to wait 6–18 months for EHR approvals.

2. Build a direct channel with the end-users, rather than relying on rigid EHR interfaces

3. Control over product velocity, where updates can be shipped without cycles of approvals

4. Interoperability across systems without being locked into a specific EHR environments

EHRs are a battlefield. Our wedge is to win the physician, then expand into the system. We’re not going to spend 18 months chasing Epic integration contracts just to end up as a drop-down feature in someone else’s UI. Our strategy is to build a product doctors love—something they trust, use daily, and actively advocate for. Once we’ve earned that trust, health systems will follow. Physicians are the most influential stakeholders in any clinical software decision, and if we solve their pain first, we can walk into the system with pull, not push

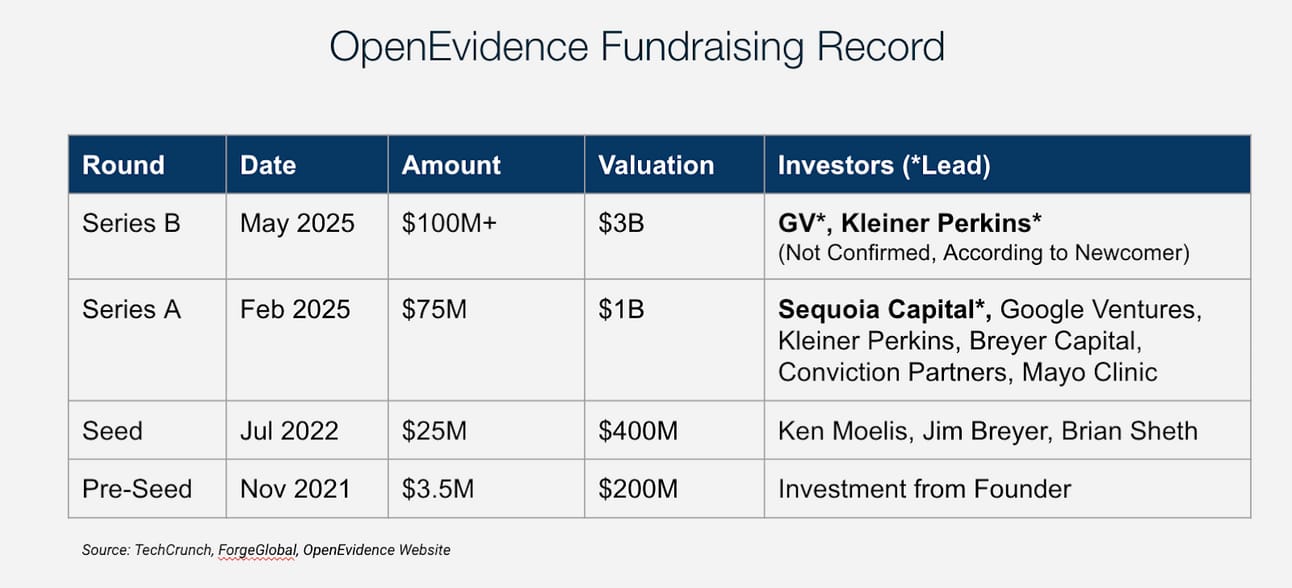

💰Valuations & Fundraising

OpenEvidence has raised over $100 million to date, including a notable investment from Sequoia Capital in February 2025. According to Newcomer, the company is now in discussions to raise a $100M+ Series B with GV and Kleiner Perkins.

♟️ Key Opportunities

Content Partnerships

OpenEvidence can further differentiate its point-of-care diagnostic capabilities by delivering superior model performance, especially as general web-trained LLMs become the industry baseline. Access to proprietary, non-public medical data will be critical for achieving this edge. OpenEvidence can strengthen its data advantage by expanding content partnerships with leading academic publishers worldwide, including

The Lancet

JAMA (Journal of the American Medical Association)

BMJ (British Medical Journal)

The Medical Journal of Australia (MJA)

Annals of Internal Medicine

Integration with EHRs & HCP Applications

As OpenEvidence evolves to 2.0, it to provide clinical workflow capabilities it has an opportunity to become embedded in the clinical workflow used by healthcare providers beyond search. The integrations with existing electronic health records and application will massively increase its switching cost and unlock further productivity for clinical professionals. Example areas include:

1. Electronic Health Records (EHRs)

EHRs are the primary source of structured and unstructured clinical data. They include patient medical histories, lab results, diagnostic imaging, prescriptions, and clinician notes.

2. Care Management Systems

Care management platforms coordinate long-term care plans for high-risk or chronically ill patients. These systems house data on care pathways, intervention history, risk stratification models, and care team notes.

3. Patient Engagement Platforms

These systems include patient portals, remote monitoring apps, and communication tools that capture self-reported data, symptom tracking, and appointment feedback.

4. Operational Software (Scheduling and Staffing)

Scheduling and staffing tools manage provider calendars, shift allocations, and resource availability. This data is critical for optimizing clinical throughput and ensuring that OpenEvidence recommendations are clinically accurate and operationally feasible.

5. Revenue Cycle and Billing Systems

These platforms manage claims, billing codes, reimbursement rates, and insurance verification. Integration here enables OpenEvidence to provide documentation that supports billing compliance, reduces claim denials, and ensures coding accuracy.

⚠️ Key Risks

Regulatory and Liability Exposure in Clinical Environments

Any system that touches clinical decision-making must navigate a complex web of compliance, liability, and uphold itself to 99.999%+ with no margin for error. As OpenEvidence continues to embed itself deeper into physician workflows, especially within diagnosis, treatment recommendations, it edges closer to the boundaries of clinical responsibility.

Regulatory scrutiny from the FDA or equivalent bodies may increase as the product’s scope expands beyond “search” into “decision support”. A single high-profile fatal misdiagnosis from a health provider who uses OpenEvidence could set off reputational or legal consequences that outstrip even the strongest commercial momentum.

Platform Dependence on Exclusive Content Partnerships

One of OpenEvidence’s core defensibilities lies with its proprietary content relationships with institutions like the Mayo Clinic and NEJM could also become a structural risk. These data partnerships are not trivial to secure or maintain. They are governed by licensing agreements that may not be perpetual, exclusive, or immune to renegotiation.

If OpenEvidence’s privileged access to these datasets were reduced, revoked, or replicated by a competitor, the platform could lose a major portion of its accuracy edge. In the case that academic institutions want to reverse their partnership with OpenEvidence or decide to partner with multiple AI companies, OpenEvidence may lose one of its core competitive advantages.

Management Buy-ins

While OpenEvidence has gained strong momentum and traction, with over 20 %+ physicians using the OpenEvidence application. Although bottom-up demand has accelerated visibility with hospital leadership, the healthcare procurement process remains highly complex. Final purchasing decisions still rest with administrators, not practitioners, and institutional stakeholders in IT, compliance, and legal may be resistant to adopting new AI-driven technologies due to perceived risks around data security, model accuracy, and regulatory compliance.

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on Beehiiv, the newsletter platform with a proprietary ad-network exchange.

Resources