- Network Effects

- Posts

- Moxie: Business In A Box Model 101

Moxie: Business In A Box Model 101

How Moxie Builds a Software Franchise Model for Medspas

Welcome to the 26th Network Effects Newsletter,

The traditional franchise model provides entrepreneurs with a turnkey solution, offering a proven brand, a repeatable business model, and the benefits of scale. But a new, more impactful evolution is underway. A new class of vertical platforms is offering a similar value proposition, but with a technology-first approach.

This is the “Business in a Box” (BIAB) model. It’s a tech-enabled franchise that provides the essential software, shared resources, and supply chain infrastructure needed to launch and grow a business in a specific vertical. In this deep dive, we’ll uncover how Moxie has executed this model for the medical aesthetics industry.

Let’s dive in.

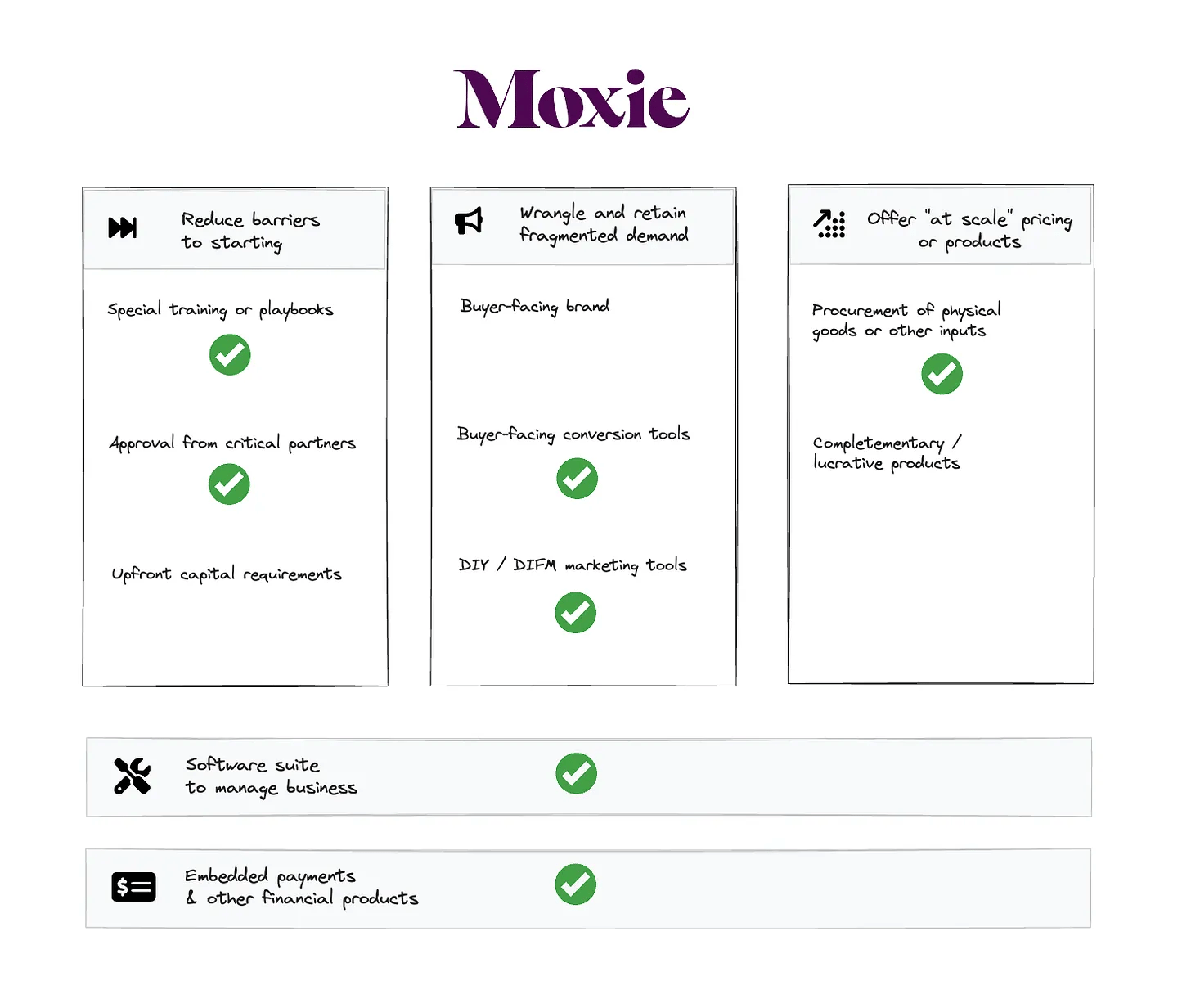

Source: Matthew Brown’s Notes

Moxie’s Origin Story

Moxie was founded on a simple observation: launching a medspa is complex, expensive, and a barrier to entry for talented clinicians. Founder Sam Gerstenzang, after leaving his role as a product manager at Stripe, found that a friend’s attempt to launch a medspa was met with overwhelming red tape and exorbitant costs. After interviewing over 50 medspa owners, he identified a clear opportunity: empower independent medspas by providing a full-stack software solution and access to wholesale inventory.

Moxie's mission became clear: unlock entrepreneurial opportunity for medspa operators by delivering the full-stack tools required to compete with national chains.

Since its launch in April 2022, Moxie has:

Developed medspa-specific EMR and CRM software.

Introduced Moxie Supplies to provide discounted wholesale inventory.

Launched an accelerator program to partner with new entrepreneurs.

Today, Moxie serves more than 500 medspas, with over 90% of its customers being first-time business owners. Moxie equips them with the tools and resources needed to compete effectively against the largest aesthetic chains.

Features Moxie offers

Moxie Products & Services

Moxie has positioned itself not as a point solution, but as the full operating system for launching and scaling a medspa. Its product and service suite spans every major function of the business, blending SaaS workflows with embedded services and operational infrastructure.

Core Software (EMR/CRM): At the core is Moxie’s cloud-based practice management system, designed specifically for medspas. This streamlines patient intake, documentation, and scheduling.

Centralized Marketing: Moxie centralizes customer acquisition for its network, running paid ad campaigns and providing SEO-optimized website templates.

Compliance & Risk Management: The platform embeds HIPAA compliance, recordkeeping, and state-specific documentation standards directly into its workflows.

Business Coaching & Training: Moxie provides structured coaching to guide operators on pricing strategy, staff management, and unit economics.

Financial Infrastructure: The platform integrates payroll management and patient membership programs to improve retention.

Launch Accelerator: Moxie acts as an incubator, providing playbooks, templates, and hands-on support to help entrepreneurs launch quickly.

Medical Director Matching: Moxie runs a marketplace that matches clinicians with the licensed medical directors required by regulation.

Preferred Pricing: Through Moxie Supplies, operators gain access to massively discounted injectables, devices, and consumables by leveraging the collective buying power of the network.

Individually, each of these products and services reduces friction. Collectively, they transform Moxie into a true "business in a box": a platform that bundles software, operations, and procurement into a single, repeatable model for entrepreneurship. This structure also creates powerful network effects, where each customer benefits more as the platform's ecosystem grows.

Moxie’s Unique “BIAB” Proposition

Not all verticals are suited for the BIAB model. Its success hinges on three critical conditions. Moxie, operating in the complex and regulated medspa industry, is a perfect case study for how to fulfill each of them.

A Steady Supply of New Market Entrants: The medspa industry has a consistent flow of new entrants—experienced medical professionals like nurses and nurse practitioners. They have the clinical expertise but often lack the business knowledge. By reducing the friction of starting a medspa, Moxie not only captures an existing market but actively expands the total addressable market (TAM) of independent practices.

The Ability to Significantly Reduce a Major Shared COGS: The traditional cost of launching a medspa often exceeds $160,000, with a significant portion from specialized medical devices and injectables. Moxie leverages the collective buying power of its network to negotiate massive discounts from major suppliers, providing its members with discounts of up to 55% on critical supplies.

The Capacity to Shape Customer Demand: Independent medspa owners are clinical experts, not marketing gurus. They struggle with acquiring and retaining clients. Moxie solves this by acting as a central marketing engine, offering services like high-converting ad campaigns and social media templates.

Software vs BIAB vs Franchise

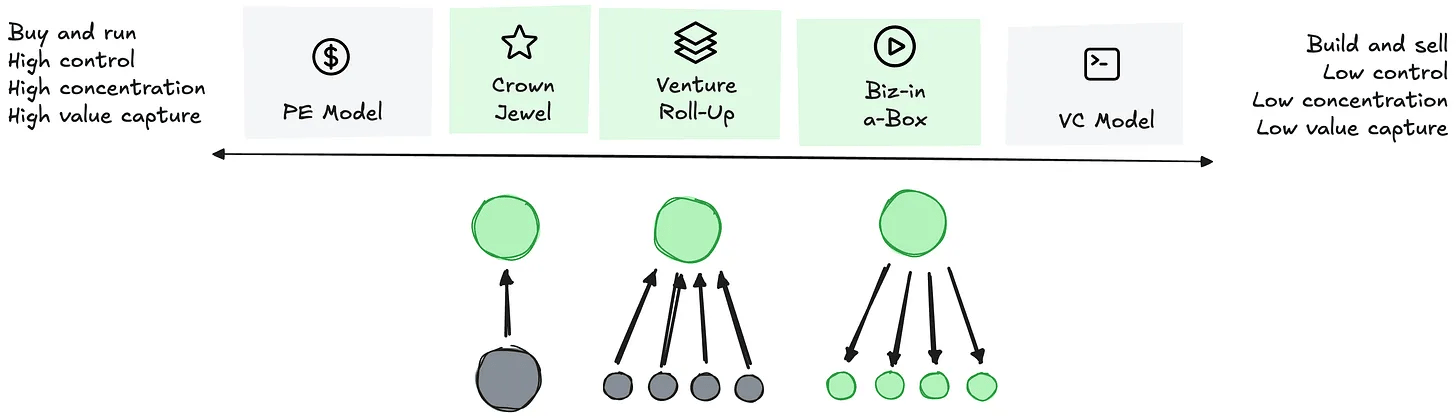

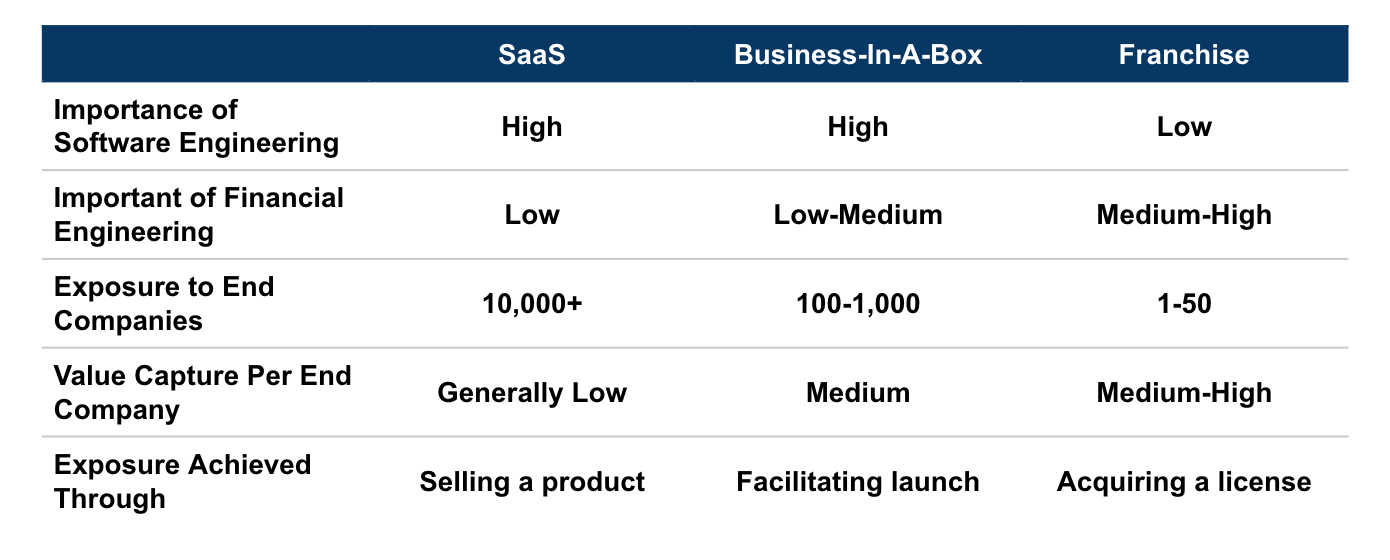

Traditional SaaS businesses are built on scale. They prioritize software engineering above all else, selling a product to tens of thousands of customers with generally low value capture per account. The economic engine depends on volume — broad adoption across fragmented markets — rather than deep monetization of each end user.

Business-in-a-Box (BIAB) models, like Moxie, represent a middle ground. They maintain a high reliance on software engineering, but combine it with services that facilitate the launch of entirely new businesses. Instead of selling to 10,000 customers, BIAB platforms typically support 100–1,000 entrepreneurs in a vertical, but capture more value per business because they are embedded in the core operations — from supply chains to revenue share. Financial engineering matters somewhat more than SaaS, given the importance of negotiating supply contracts and structuring revenue-sharing agreements, but the primary moat remains operational and software-driven.

Franchises sit at the other end of the spectrum. They rely far less on software, instead leaning on financial engineering and brand equity to grow. By acquiring or licensing a brand, a franchise can expand to dozens of local operators, with higher value capture per business than SaaS or BIAB. However, exposure is limited: franchises usually scale to dozens, not thousands, of locations. Their power lies in unit economics and centralized control, rather than innovation in software.

Moxie blends traditional SaaS businesses and the franchising model. It uses software and network scale to reshape how entrepreneurs enter and succeed within a vertical

How Moxie Makes Money

Moxie moves beyond the traditional SaaS subscription to build a more powerful and defensible revenue model.

Moxie’s primary monetization comes from a combination of:

Fixed SaaS subscription fees

Embedded services as a percentage take rate of revenue

Optional value-added services (e.g., managed marketing)

Moxie's revenue is primarily tied to the value it provides. By negotiating massive discounts on COGS, Moxie can take a portion of the savings or operate on a revenue-sharing model. This makes the model far more lucrative and defensible than a flat fee, as Moxie’s success is directly aligned with the success of its customers.

By combining these three elements, Moxie doesn't just sell software; it sells the infrastructure for a profitable and successful business. This is the new frontier for vertical SaaS.

Conclusion

The story of Moxie and the "business in a box" model is a powerful reminder of how vertical SaaS is evolving. While the first wave of platforms focused on digitization, the most successful new ventures are becoming more creative and partnership-oriented, pursuing unconventional paths to create more value for their vertical. Their objective is not about user acquisitions but about solving problems users have.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources