- Network Effects

- Posts

- Mindbody: ClassPass Acquisition Case Study

Mindbody: ClassPass Acquisition Case Study

How ClassPass Forged the Next Frontier of Mindbody’s Growth

Welcome to the 15th Network Effects Newsletter,

Starting this week, we'll be moving away from structured deep dives into case studies of how leading technology companies unlock growth.

Today, we're exploring Mindbody, one of the most prominent Vertical Market Software (VMS) companies. Founded in 2001, Mindbody focuses on the wellness, beauty, and fitness industries. It serves as a prime example of how VMS can grow by building a multi-sided platform, synergistically servicing different customers (wellness studios and wellness consumers).

Let’s dive in.

📝 Mindbody Company Overview

Founded in 2001 and headquartered in California, Mindbody pioneered the digitization of wellness scheduling, payments, and business management, becoming the cloud-based system of record for an entire category. Mindbody powers 40,000 fitness studios, salons, spas, and wellness businesses across 130 countries worldwide.

Mindbody went public on the NASDAQ in June 2015, under the ticker "$MB." During its time as a public company, Mindbody continued to expand its market presence, achieving 40% YoY growth till 2018. In February 2019, Mindbody was acquired by Vista Equity Partners for $1.9 billion, a 68% premium to the prior day’s closing share price.

🖥️ Business Model

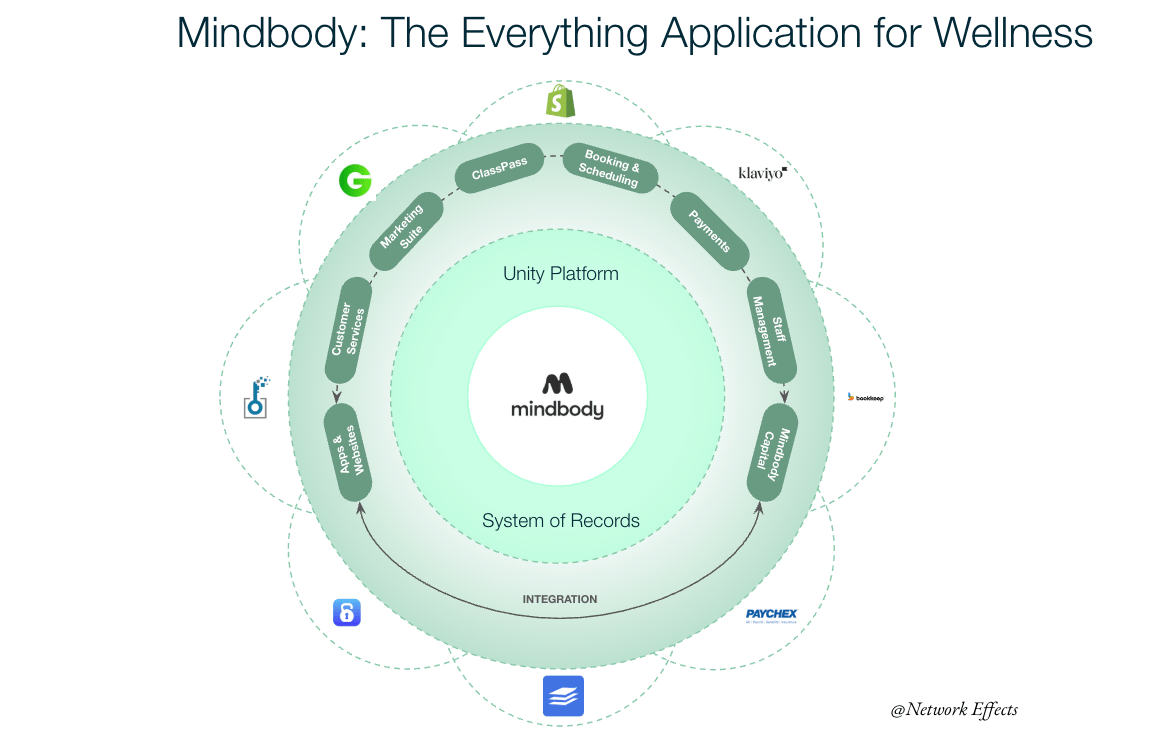

Mindbody exhibits many of the key characteristics of successful VMS companies. Its initial product was an online scheduling and booking application, which served as a wedge to onboard customers to Mindbody's platform

As the business grew, Mindbody evolved into a multi-product company, introducing staff management, account management, and marketing suite features. These additions enabled users to consolidate and unify their workflows and systems of record on Mindbody’s platform.

Mindbody also introduced payment offerings into its platform, diversifying its revenue streams and establishing a scalable monetization method through a revenue-sharing model. This model involves taking a fraction of the gross booking volume merchants generate through their platform. As of 2018, payments constituted ~35% ($88M) of Mindbody's total revenue, with the remaining ~65% derived from subscription and services revenue ($150M).

While all the features mentioned thus far focused on solving operational needs for wellness and fitness studio owners, they did not address their largest problem: customer acquisition. This changed with Mindbody’s acquisition of ClassPass in 2021

📌 Acquisition of ClassPass

In 2021, two years after Mindbody was taken private, Mindbody announced the acquisition of ClassPass for an undisclosed amount (ClassPass’s latest valuation was reported to be $1B). ClassPass is a credit-based membership platform that provides members access to the world’s largest network of fitness and wellness providers. For a subscription price, users receive credits that can be used for reservations across a variety of studios

ClassPass works with businesses through "SmartTools," an adaptive tool that use historical and real-time data to optimize revenue and fill available spots on ClassPass.

“The ClassPass network includes many businesses already working with Mindbody. By combining our respective operations, we will create more seamless integrations and unlock new revenue opportunities for business owners using both services, while continuing to support all fitness, salon and spa businesses who choose to work with Mindbody or ClassPass”

The acquisition of ClassPass unlocked substantial synergies between wellness studio owners and customers. Mindbody customers can seamlessly integrate with ClassPass’s platform, which drives 120+ million bookings from 2.8M active users per year.

Customers to Merchants: ClassPass Brings Distribution to Merchants

ClassPass has become a distribution engine for merchants to attract new customers. Mindbody advertises that 50% of ClassPass members were entirely new to boutique fitness when they joined, and in 2024, ClassPass bookings jumped 44%. Mindbody even guarantees that "introductory offers" on the app only cost studios when a booking occurs, aligning incentives for merchants to sign up for ClassPass.

One concern is that the introduction of an intermediary like ClassPass would cannibalize direct revenue between merchants and users. However, Mindbody’s research shows otherwise:

2 clients switch to book through ClassPass (cannibalization).

4 clients who discover your business via ClassPass switch to booking directly.

29 additional people discover and fill their empty spots. (Out of 100 direct clients)

Merchants to Customers: ClassPass Enjoys a Greater Variety of Class Selection

For ClassPass users, the Mindbody integration means a massive influx of new studios and offerings. This is a network effect flywheel in action: more merchants lead to more choice, more value for consumers, driving more subscriptions, which in turn attract more merchants.

Merchant-to-Merchant: Establishing a New Baseline for Go-To-Market

Mindbody has become the de facto standard for many studios. Founders or managers moving to a new gym often migrate their preferred software with them. Over half of North American fitness studios reportedly use Mindbody or affiliated apps. New merchants that do not make themselves available on ClassPass are poised to be at a disadvantage when most merchants are leveraging ClassPass.

Source: Tidemark Knowledge Project

📌 Benefits for VMS to Expand into Consumer

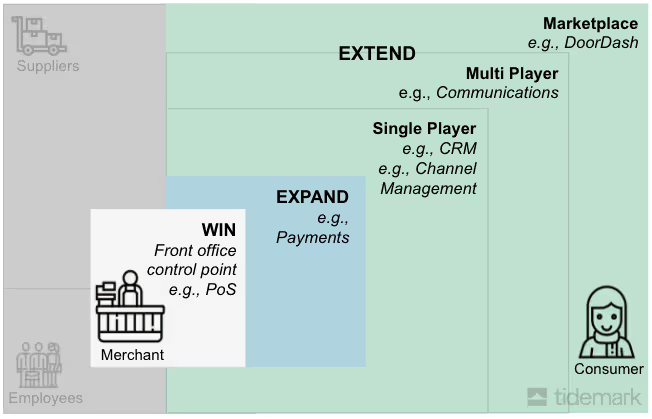

Mindbody’s bold move isn't a coincidence; it is a powerful illustration of a strategic imperative for VMS leaders. For a VMS operator pondering whether their business should enter the consumer market, it is a very difficult and elusive path, yet it unlocks massive Total Addressable Market (TAM) and creates defensible competitive moats.

According to Tidemark, there are four reasons why leading VMS operators should consider the consumer opportunity:

The Ultimate Value Proposition: Finding customers is the most important job for merchants

The Monetization Upside: While traditional VMS subscriptions often capture ~1% of Gross Merchandise Volume (GMV), consumer marketplaces command significantly higher take rates, often 15-30%. This dramatically expands the monetization ceiling.

Defensive Moats: A well-positioned VMS's most existential threat often comes from a consumer marketplace extending vertically into software. Such marketplaces can subsidize software at aggressively low price points by leveraging their higher marketplace take rates. By proactively integrating, or acquiring the consumer layer, a VMS transforms this threat into its greatest defence.

Enhanced Consumer Experience: A unified platform connecting merchants and consumers streamlines interactions, removes friction, and reduces costs. This creates a superior, sticky experience that drives repeat engagement and builds loyalty.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources