- Network Effects

- Posts

- Metropolis: Growth Buyout Strategy

Metropolis: Growth Buyout Strategy

Software, not SaaS, will eat the world

Welcome to the 17th Network Effects Newsletter.

The term ‘Growth Buyout’ refers to when a software company buys a service business to compete directly in the market based on proprietary technology. Rather than becoming the leading SaaS company selling picks and shovels, they own the end-to-end operations and leverage strategic M&A to accelerate growth

Metropolis is a computer vision application that enables parking lot operators to automate payments. In May 2024, Metropolis acquired SP Plus (SP+) for $1.8B, a parking lot facility service provider with contracts to operate in over 4,000 locations. This acquisition made Metropolis the largest parking network in North America, setting a new paradigm for how tech companies scale.

Let’s dive in.

Source: Metropolis Company Website

🅿️ Metropolis Company Overview

Founded in 2017, Metropolis develops the computer vision infrastructure to transform traditional lots into checkout-free experiences. This provides a ‘drive-in, drive-out’ experience for users, replacing legacy ticketing and payment systems with automated license plate-based billing.

In June 2022, when Metropolis raised its Series B for $167M, the platform powered more than 600 parking facilities and served 1.8 million users across commercial and residential areas in over 60 cities. Metropolis is well-positioned to compound its user base as it expands to new cities.

However, their go-to-market momentum was slower than anticipated. Metropolis faced an immovable bottleneck: contract inertia. Parking facilities (especially those at airports, hospitals, and stadiums) are locked into 5- to 10-year agreements with incumbents like SP+ and ABM.

No matter how great your software is, you can't deploy it if you don’t have access to the real estate and its operating rights. The structural friction has limited Metropolis’s pace.

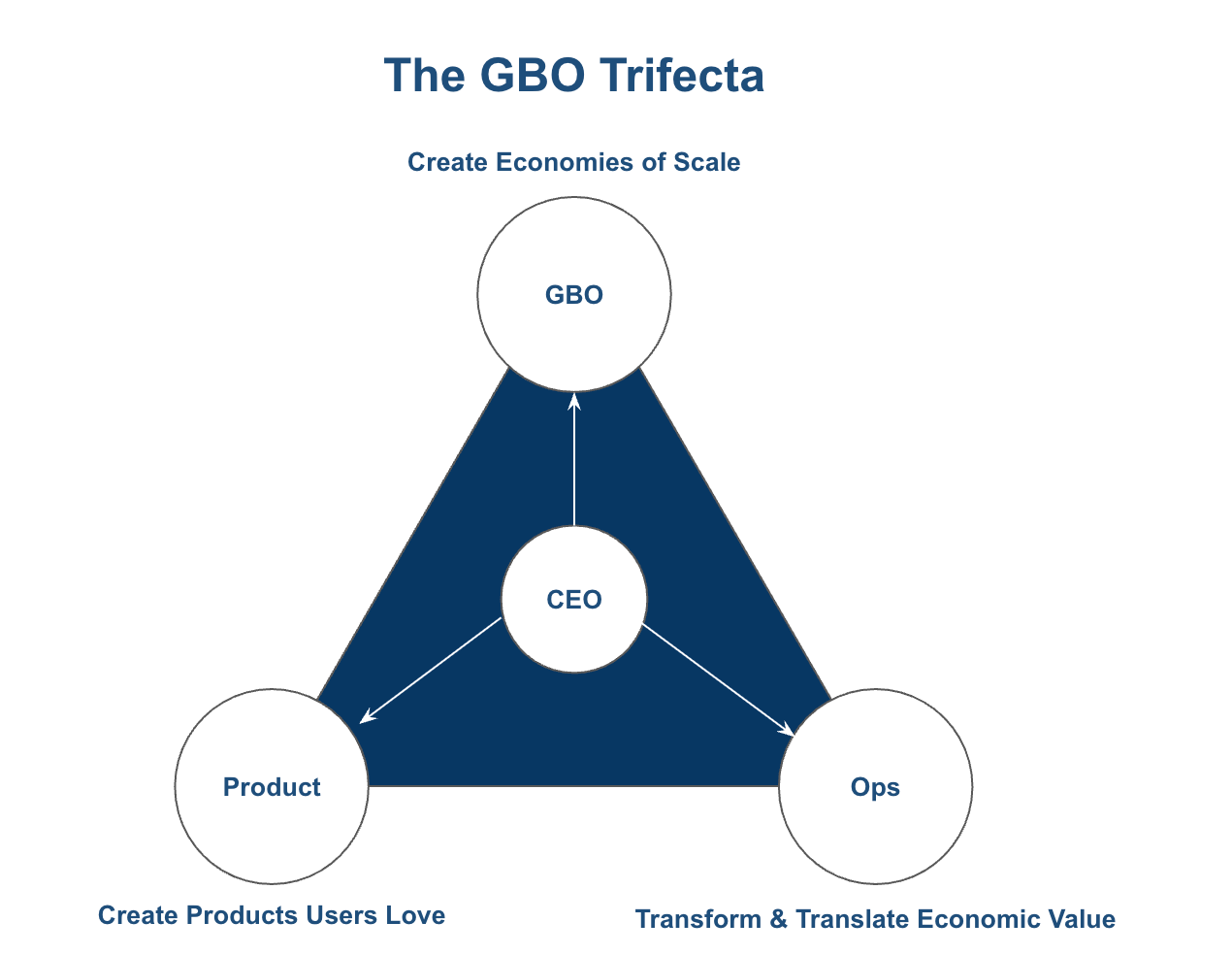

🤝 The Solution? Growth Buyout (GBO)

In March 2022, Metropolis made its first acquisition of Premier Parking, a facility service provider with 2,000 employees operating in 600 locations. This served as a validation for its Growth Buyout (GBO) approach.

After the success with integrating with Premier Parking, in October 2023, Metropolis raised $1.7 billion to acquire SP Plus through a combination of $650 million in loans and $1.05 billion in preferred stock financing. This acquisition granted Metropolis:

Distribution: From Selling Site-by-Site to Owning the Experience

Instead of competing with facility service providers on bidding contracts, Metropolis now directly controls 40,000 parking locations (e.g., parking garages, mobility hubs). This shift unblocks their bottleneck, transforming the protracted sales cycle into a direct operational rollout of their parking technology

Margin Expansion: Layering Software Over a Labour-Heavy Operation

The implementation of Metropolis's platform replaces legacy parking operators, as well as all third-party hardware, technology, labour, and revenue control systems. For example, Metropolis has driven 50% in operating cost savings for a mixed-use office and residential space, Home Plate Center in Seattle. Applying the same operational philosophy at scale will materially increase their Net Operating Income (NOI) margin, translating into profits for Metropolis and real estate owners.

Operational Expertise: Complementary Talents to Provide the Best Experience

The acquisition of SP+ also adds 20,000 employees to Metropolis, many of whom are seasoned facility operators with established connections and expertise in managing parking lot operations. The operational expertise from SP+ talents will complement Metropolis's product technology, enabling a superior execution with customers.

This isn’t just an acquisition; it’s about our shared vision to forge a legacy of innovation and raise the bar for AI in the real world. By deploying our computer vision technology to more than 50 million consumers and our real estate partners globally, we will enable checkout with a speed, ease and convenience that is unparalleled.

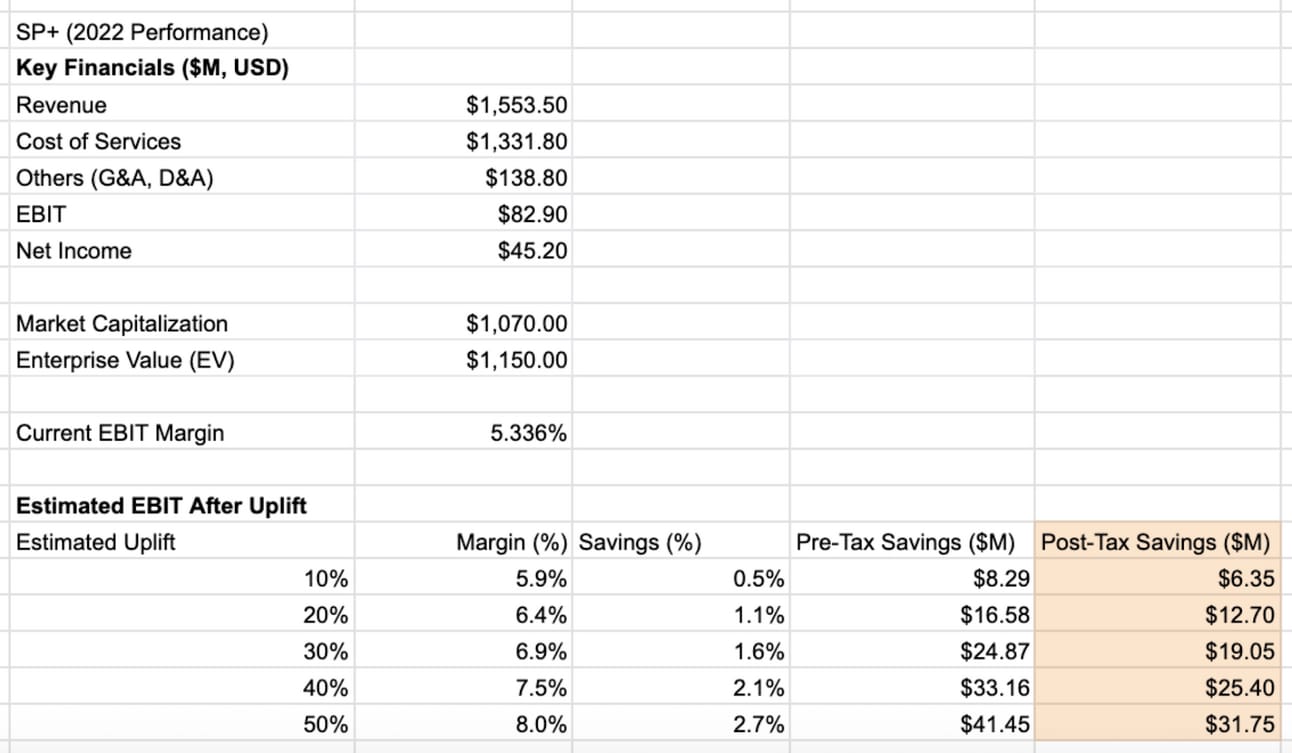

Source: Network Effect’s Analysis, Data from SP+ 10K Filings

📊 The Napkin Test (The Economic Case)

Let’s contextualize the benefits in numbers.

In 2022, SP+ had over $1.55 billion in revenue and only $82.9 million in EBIT, where the cost of services represented 85% of the revenue. According to their 10K filings, the definition of cost of services includes:

“Under a typical management type contract structure, we are responsible for providing and supervising all personnel necessary to facilitate daily operations, which may include porters, baggage handlers, valet attendants, managers, bookkeepers, cashiers and a variety of ground transportation and maintenance staff. In addition, we are responsible for the procurement and maintenance of uniforms, insurance, supplies, and equipment necessary for operations.”

While a detailed breakdown isn’t available, it is intuitive that labour cost is likely the largest cost category for SP+ parking operations.

Now, if we layer in the assumption that Metropolis's technology will generate a 30% uplift through the substitution of ground transportation and maintenance staff, that would imply an additional $19M in cash savings to reinvest in product or pursue more GBO deals.

♟️ What Makes Growth Buyout Viable?

Growth Buyout is a high-risk strategy for software companies due to obvious reasons:

High Capital-Intensity

High Transformation Risk

Valuation Risk (Multiple Compression)

So, what are the characteristics that would make a vertical suitable for GBO?

Market Homogeneity: The market needs consistent customer needs and operating models for repeatable growth

Verifiable Value Proposition: The software's economic benefits must be measurable across customers

Inefficient GTMs due to Market Structures: Structural difficulties such as contract inertia, bias for incumbents, and resistance to change.

Low-To-Moderate Concentration: The concentration of markets has to be sufficiently broad to allow for a range of acquisition targets beyond only whales

High Revenue, Low Margins: Opportunity for achieve margin expansion through implementation of technology (e.g., labour, vendor services)

⚠️ Challenge to Pursuing a GBO Strategy

For most software companies, product managers, designers, and engineers are the lifeblood of the company. However, when you pursue GBO and acquire an operating business, it becomes a whole different story.

The culture changes.

Mark Fields, former President at Ford, famously said,

“Culture Eats Strategy for Breakfast.”

Culture is deeply embedded in every organization, representing what the company stands for. Culture is more powerful than strategy because it dictates how well that strategy can be executed. If culture is misaligned with company strategy, it will "eat" (devour) that strategy before it even has a chance to materialize.

Culture misalignment happens in every M&A; in fact, 30% of transactions fail to ever meet financial targets due to cultural issues. This is particularly important to highlight because in the case of roll-ups (where one industry company purchases another) and strategic M&A (where one software company purchases another), they are likely operating with a similar culture and share a similar talent pool.

However, in the case of a Growth Buyout, where a software platform purchases an industry player, the situation is vastly different due to inherent cultural differences. Software companies attract a very different type of talent compared to other industries. The organizational structure, skill sets, mission, and motivations of people working in each are vastly different.

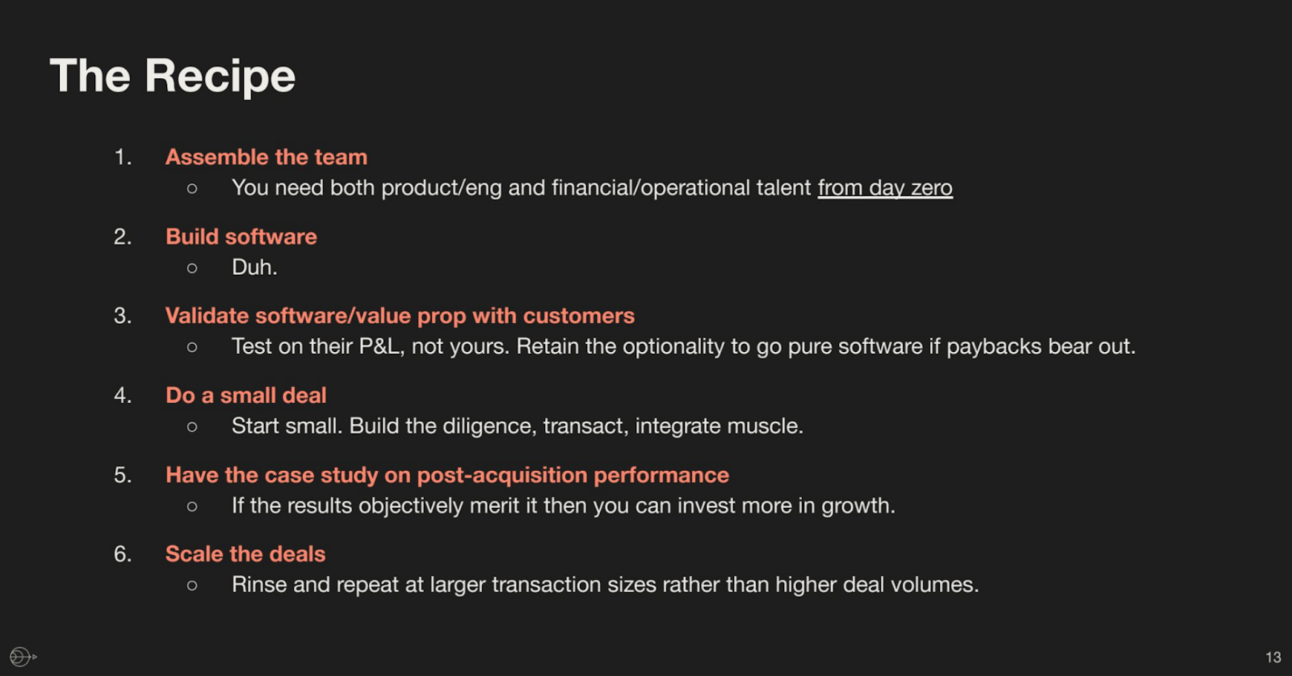

🎯 What Does It Take To Build A GBO Company?

In the case of GBO, at the simplest level, the company will require three types of capabilities:

Product: Lead product, design and engineering to create a delightful experience

Corp Dev: Sources, evaluates, negotiates and closes GBO M&A deals

Transformation & Ops: Leads end-to-end product & service delivery*

*It is not about onboarding customers to your product, but delivering the whole experience

This emerging trifecta of needs will naturally complicate the business. Each capability requires leaders with distinct skill sets, often with conflicting incentives and goals.

GBO leaders must make coherent and effective capital allocation decisions across these three groups and invest in building the talent pool for each, particularly on the transformation and operations side, an constantly overlooked area they may not have been exposed to previously.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources