- Network Effects

- Posts

- Life House: Unbundling Tech & Services Case Study

Life House: Unbundling Tech & Services Case Study

The Growth Buyout Reversal

Welcome to the 18th Network Effects Newsletter,

In September 2024, Life House executed one of the most strategic spin-offs in recent vertical SaaS history. After 7 years of operating as a vertically integrated hotel management platform, the company made the bold decision to spin out its software division into an independent entity called Diamo.

This move represents a fascinating counterpoint to the prevailing "Growth Buyout" trend (covered in the Metropolis case study), where software companies acquire service operations to accelerate growth.

Let’s dive in.

🏬 Lifehouse/Diamo Company Overview

In 2017, Rami Zeidan saw a clear gap in the hotel industry. While major chains operated on advanced systems, independent hotels were left with fragmented, outdated tools. He founded Life House to solve this with a full-stack platform that automates operations and improves profitability

Since inception, Life House was vertically integrated by design. They developed hotel management software and also managed hotel operations on behalf of owners (e.g., revenue management, guest services, operations). This approach offered several critical advantages:

Market Validation: By using their software to manage real properties, Life House could validate product-market fit in real-time.

Deep Customer Understanding: Operating hotels provides intimate knowledge of customer pain points that pure software companies often miss.

“Eat Your Own Dog Food” Culture: Direct operations of the proprietary software created an incredibly tight feedback loop between software development and application

↔️ Divergence of Tech & Service

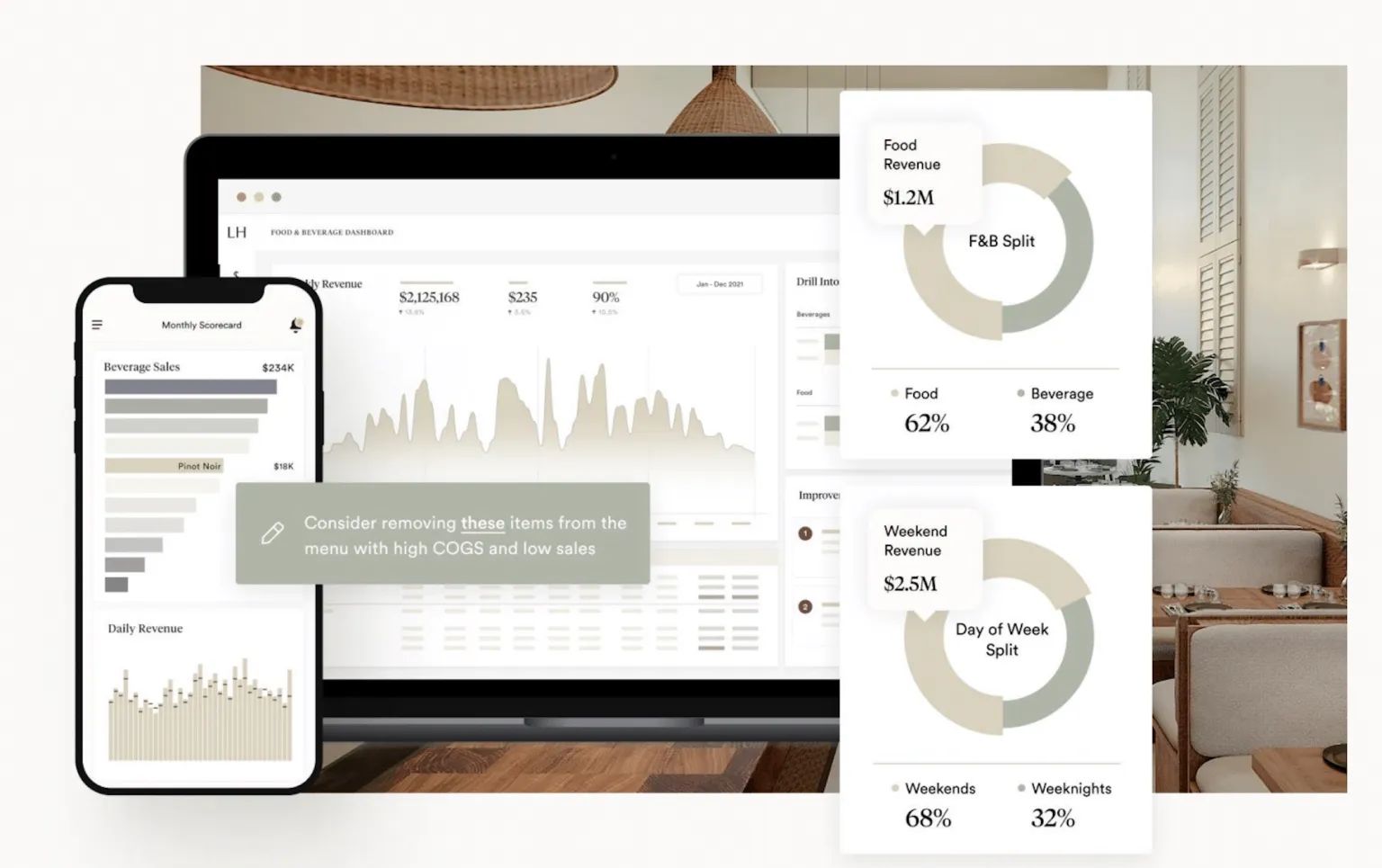

By late 2021, Life House had built an impressive portfolio of 50 boutique hotels. Their management-fee-based revenue model was generating steady, predictable cash flows while their proprietary technology stack was delivering measurable improvements in:

Revenue optimization through dynamic pricing

Guest satisfaction through seamless service delivery

Cost management through integrated systems

The company had successfully proven that technology could transform hotel operations when applied correctly. However, this success came with two unexpected constraints.

Problem 1: Ability to Scale

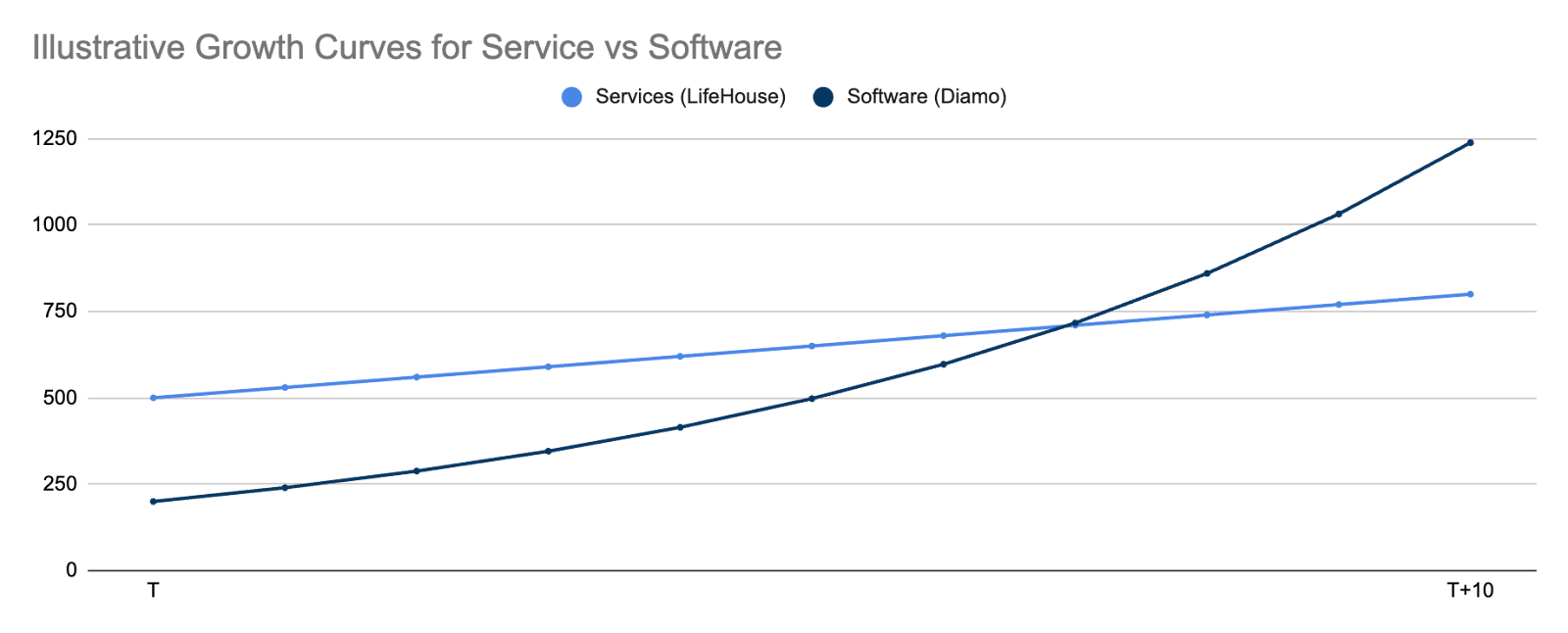

The company's growth momentum, tied to direct property management, was inherently linear. Life House faced an operational bottleneck: the direct acquisition and onboarding of individual hotel management contracts.

No matter how powerful their internal software was, its scalability was limited by the need to secure new management agreements and deploy operational teams. This "structural intensity" prevented Life House from achieving the exponential scaling that most software platforms can achieve

Problem 2: Deviation in ICPs

While the software side of Life House focused on acquiring hotel operators, the management side focused on acquiring hotel owners. They inherently have different needs, which necessitate different go-to-market (GTM) approaches:

Hotel Owners | Hotel Operators | |

|---|---|---|

Pain Points | “Is this management company going to maximize my property's value?" | "Will this software help me optimize pricing and increase bookings today?" |

Buying Processes | Management contracts are relationship-heavy, long sales cycles, often involving lawyers and contracts | Software sales are more transactional, shorter cycles, focused on ROI and ease of use |

Success Metrics | occupancy rates, RevPAR, property value appreciation | daily revenue optimization, operational efficiency, and guest satisfaction scores |

“We have different customers between the management business and our software business, with different go-to market strategies and different groups of investors. We have different exit opportunities. So the agreement we ultimately came to with our board is to allow Life House to be the best hotel operator for independent properties and allow Diamo to be focused on really solving the holistic revenue problem that a smaller property faces.”

✍️ Solution? Spin-Offs

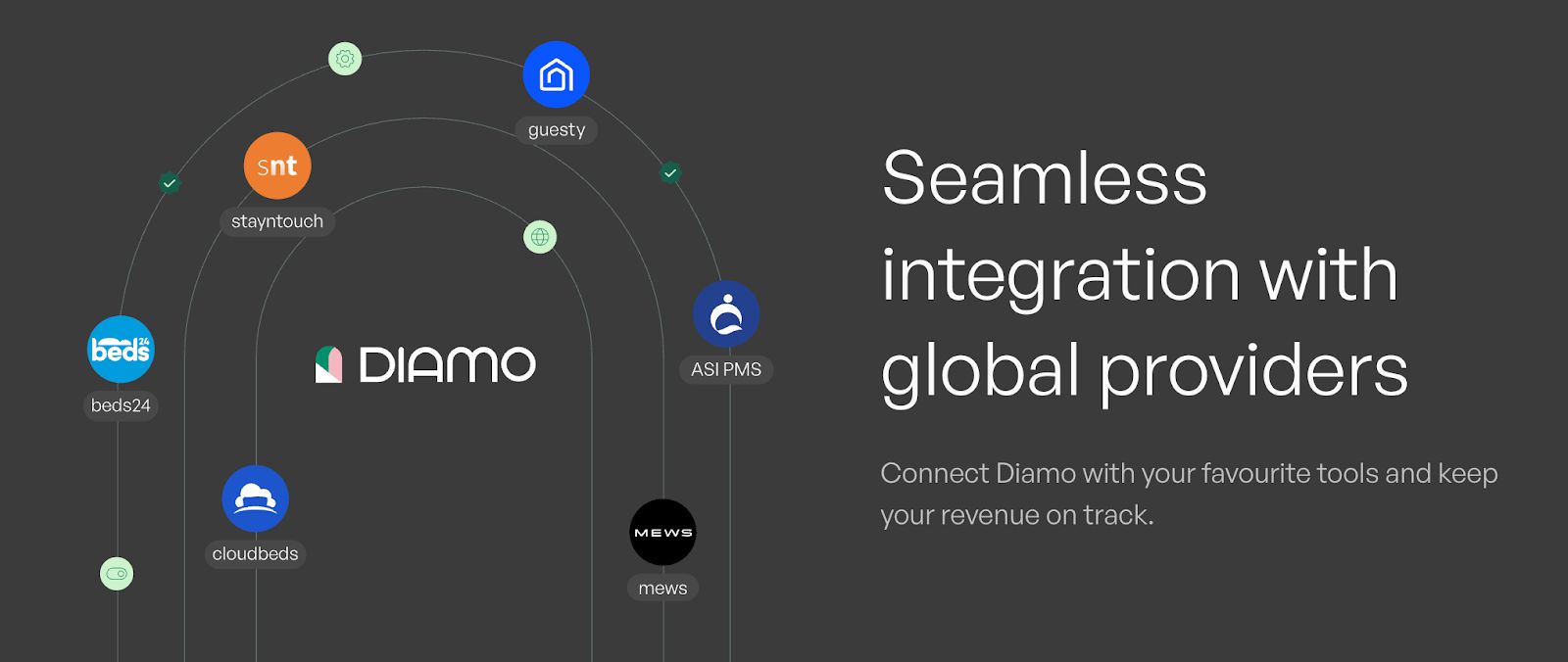

In September 2024, Life House officially spun out its software business unit into a new, independent company called Diamo, led by Life House's former SVP of Product & Revenue, James Kay. Diamo is now a pure-play B2B SaaS company focused on providing revenue management technology to independent hotels. Life House itself remains committed to its core hotel management and operations.

In April 2025, Diamo then raised $4M in seed funding led by Thayer Ventures and Inovia Capital, with a clear mandate to build the Diamo platform and acquire small and medium hoteliers as customers. The key segments include:

Hotels & Motels

Bed & Breakfast Inns

Hostels

Aparthotels

Independent Hotel Management Companies

On the other hand, in December 2024, Life House announced the formation of a joint venture with Lark Hospitality to combine expertise on managing large-scale hospitality services. The new entity will have nearly $1 billion in assets under management, and represent accommodations in 27 states, more than 3,000 total keys, nearly 1,500 employees in peak season, and total annual revenue of more than $150 million under management.

The spin-off has enabled both entities to pursue strategic initiatives with clear propositions and direction, creating alignment for internal teams and external stakeholders (e.g., investors of Diamo, partners of Life House)

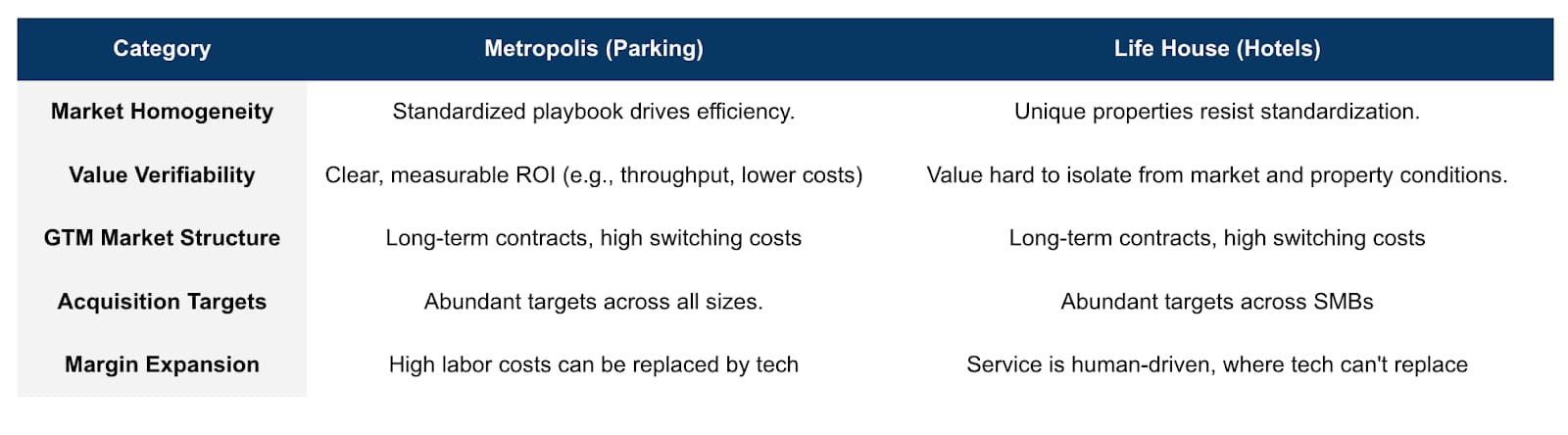

♟️ How Is This Different From Metropolis?

Life House, conversely, started as the service operator, built amazing software internally, and then chose to "unbundle" that software into a standalone entity. It's the "Growth Buyout Reversal", service spinning out software for accelerated, independent growth.

Metropolis: Software-led, buys operations to enable GTM, becomes more asset-heavy.

Life House: Operations-led, builds software internally, spins out software for GTM, becomes (in Diamo's case) pure SaaS.

This reversal is driven by fundamental differences between the markets:

Heterogeneous Markets: The hospitality market is highly heterogeneous, with a strong emphasis on marketing and occupancy performance rather than purely on cost and operational management. The value of hotel software is harder to verify and attribute than a parking solution

Scaling Friction: Life House couldn’t scale its hotel base like Metropolis did with parking locations. Hotel operations are far more labour-intensive and relationship-driven, creating a supply bottleneck that an operational service model could not solve efficiently.

🌟 Lessons for Vertical SaaS Operators

Service is a Double-Edged Sword

The "Do It For You" (DIFY) approach of offering a full service (like hotel management) can be an incredibly effective GTM accelerator early on. It allows you to prove your value, build deep trust, and get immediate feedback.

It's also the best way to "eat your own dog food." Building software for your own operational needs ensures true product-market fit, practical features, and a battle-tested solution that resonates deeply with others in your vertical.

However, service delivery can become a drag on growth and valuations. The linear nature of scaling operations, higher fixed costs, and lower SaaS multiples can constrain your long-term potential compared to a pure software play. This is precisely the "structural intensity" Life House faced.

Growth Buyout (GBO) Solves Demand Bottlenecks, Not Supply Bottlenecks

Metropolis faced a demand bottleneck due to long-term contracts with incumbents. Their solution was to acquire the incumbents to gain market access. They effectively "bought" their way into the market by absorbing the structural friction.

However, Life House faced a supply bottleneck, the linear scaling of their operational capacity. Their solution was to spin out the software, allowing it to scale independently and capture a broader market that their service model couldn't easily reach. In addition to the deviation in ICPs and GTM strategies.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources