- Network Effects

- Posts

- KM Tools: Slow Venture’s First Creator Investment

KM Tools: Slow Venture’s First Creator Investment

Unveiling Slow Venture's Contrarian Bets on Creator CEO

Welcome to the 24th Network Effects Newsletter,

Hearing Slow Venture’s contrary bet with the launch of the $60M back in February 2025, the industry buzzed with anticipation and skepticism.

In August, Slow Ventures made its first investment, a $2M investment into Jonathan’s woodworking holding company, betting that his social platform and tooling manufacturing business can scale into a category-leading durable business.

In this issue, we'll uncover the investment narrative behind the deal, Slow’s creator fund investment criteria, and the rise of creator CEOs.

Let’s dive in.

About Jonathan Katz Moses (@katzmosestools, KM Tools)

In 2010, Jonathan was bartending and doing small construction jobs in California when a life-changing event occurred: he was severely injured while intervening to protect a couple from an attack. During his recovery, he turned to woodworking, eventually opening his own shop.

He began recording and sharing instructional videos on YouTube, quickly attracting a following. His first product launch — a magnetic dovetail jig — sold 27 units immediately, backed by his growing community. From there, he expanded into new product lines, built manufacturing capacity, and steadily grew his online presence.

By 2024, Jonathan’s business had reached $6M in profitable revenue and was on track for $10M in 2025, consistently doubling or tripling annually, except 2022 when a costly shop relocation slowed growth.

Jonathan's approach to his business is defined by three core principles that set him apart in the creator economy:

Authenticity Over Everything: From the beginning, Jonathan has refused to take brand deals. He's built his business on the belief that to be a trusted resource. His primary monetization comes from his products and his Patreon community, ensuring his content is always objective

Community as a Business Foundation: Instead of focusing on traditional advertising, Jonathan invests in his community. By sponsoring events like the Texas Woodworking Festival, he gets to connect directly with his audience

Autonomy is Non-Negotiable: Jonathan values the art of building, from product and content. He has rejected numerous investment offers in the past because they came with strings attached, such as losing operational control or giving up a board seat

very excited to back Jonathan Katz-Moses, the first investment out of our new slow creator fund. Jonathan is an expert woodworker with a deep and loyal community, on which he’s built a dominant platform and fast growing tool brand. More in my newsletter:

— Megan Lightcap (@mmlightcap)

8:20 PM • Aug 11, 2025

Outcome of the Creator Investment

In early 2025, Jonathan applied to the Creator Investment Fund, joining a pool of more than 600 applicants. After several conversations with the team, led by Billy Parks and Megan Lightcap, Slow Ventures moved forward with a $2M investment. The partnership offered Jonathan three key advantages:

Liquidity Unlock: The capital provides financial breathing room, freeing Jonathan from the “hamster wheel” of meeting growing fulfillment needs and cash-flow obligations (e.g., warehousing costs, inventory controls)

Operational Autonomy: Slow does not take board seats or operational control, allowing Jonathan to retain full decision-making authority

Brand & Network Leverage: Slow’s reputation and connections give Jonathan access to talent, partners, and expertise to support expansion

As a result, with the funding, Jonathan can step back and better strategize the business, for example:

Insourcing Marketing: Building a dedicated team to create organic content, moving away from expensive, less-effective paid ad agencies.

Expanding Product Development: Hiring a team to accelerate new product releases, so Jonathan is no longer the sole product developer.

Boosting Operational Capacity: Scaling fulfillment operations to prevent products from going out of stock.

Focusing on Content: Freeing up Jonathan's time to do what he does best—create content and connect with his community.

Slow’s Approach to Creator Investments

Check size & structure: Slow invests $1–3M into a creator’s holding company, covering all ventures, businesses, and media platforms.

Equity stake: Investments typically buy ~10% ownership, with rights to follow on in future financings.

Parent holdco structure: Capital is invested in the creator, not just a single project, ensuring alignment across their full community and ecosystem.

Autonomy preserved: Slow does not take board seats, set deliverables, or dictate operations—the creator retains full control.

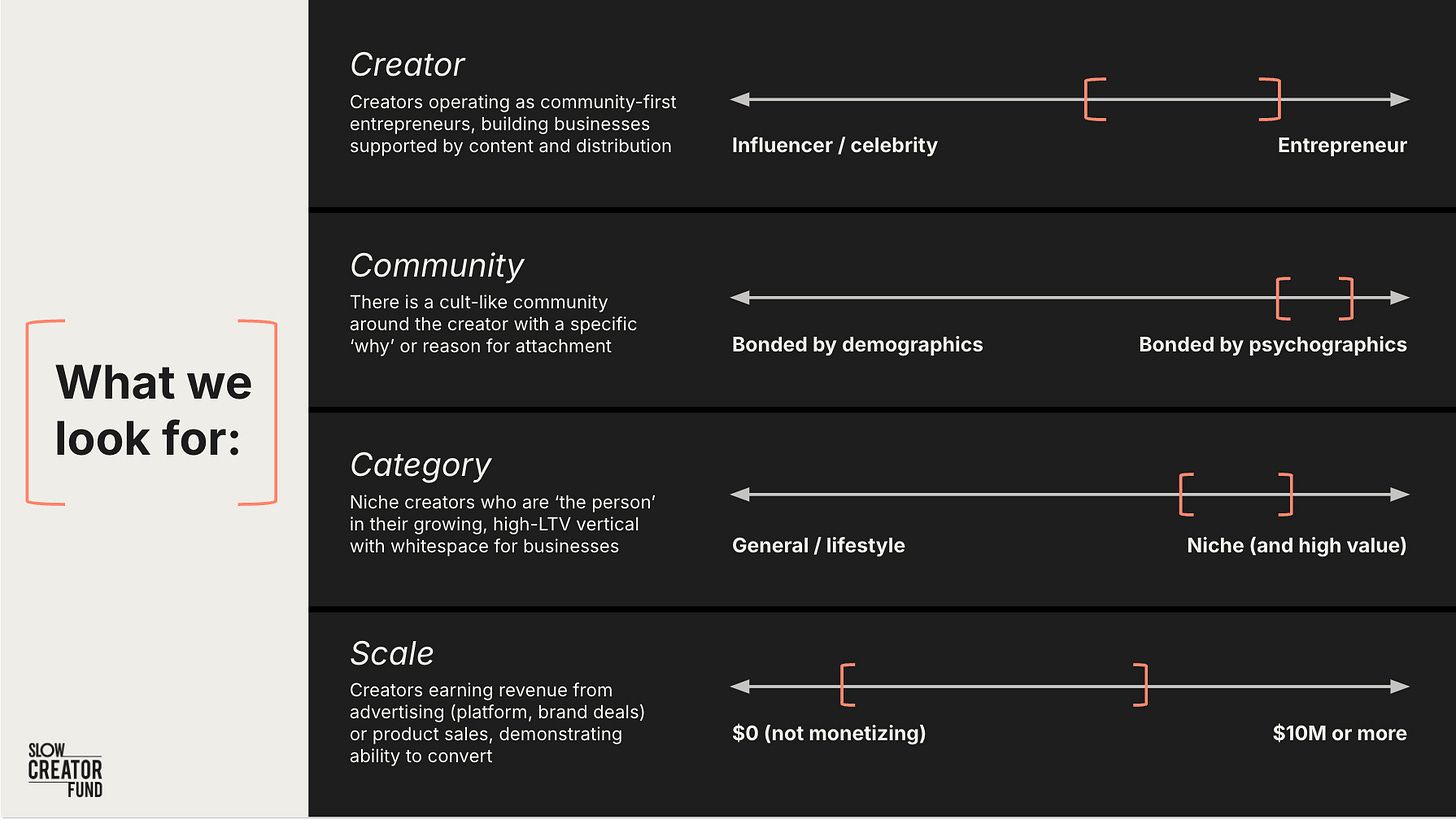

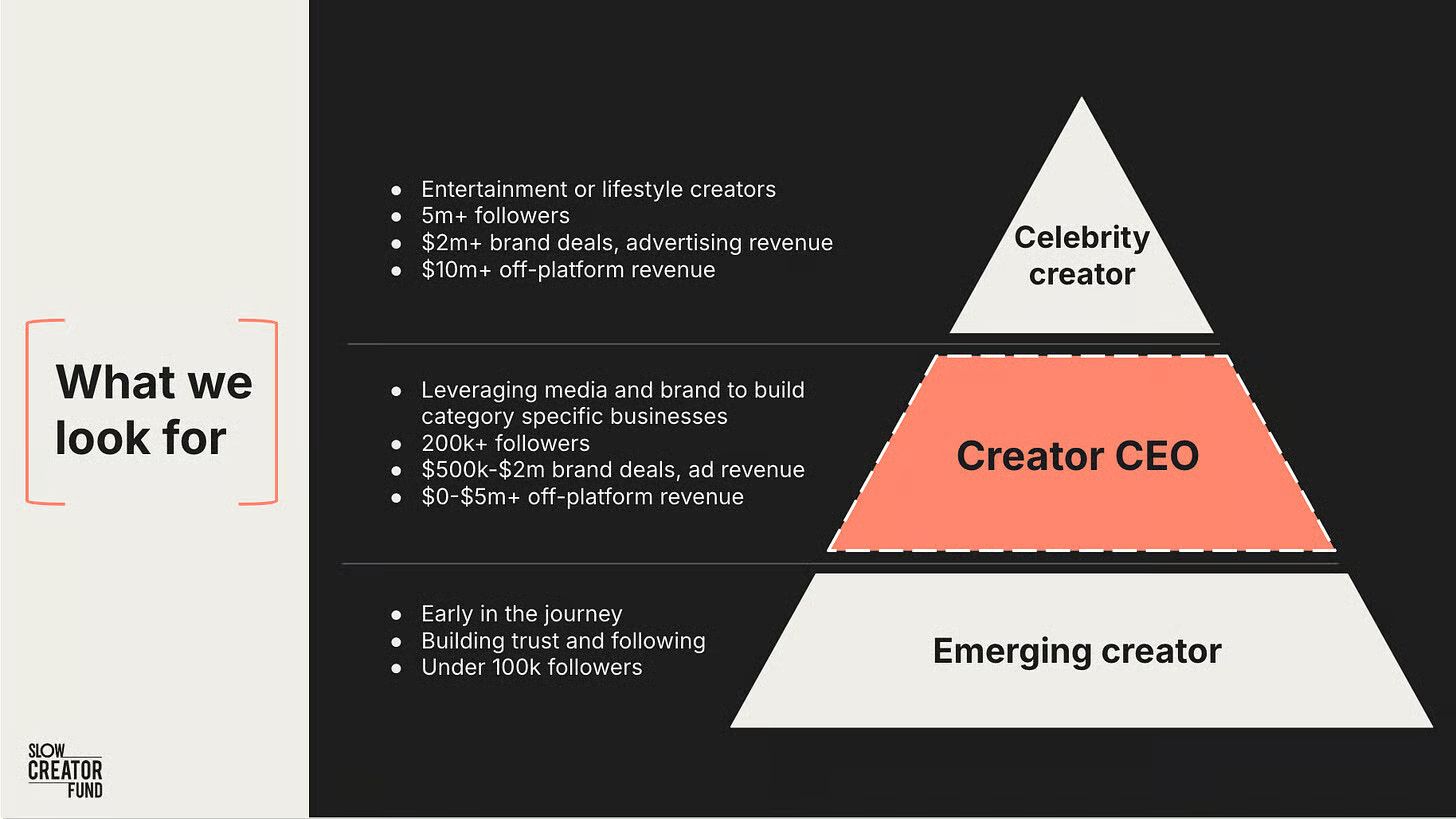

In June 2025, Slow Ventures revealed the four dimensions they used to evaluate creator investments: creator, community, category, and scale.

Creator

Slow gravitates toward creators who act like founders. They are obsessed with their niche, and they are great at both storytelling and execution. They’re magnetic, great at world-building, and can rally audiences, employees, and investors to come along for the ride

The fund will focus on creators who've become authorities on niche areas, such as automotive or gardening, rather than on celebrities or athletes

Community

Slow looks creators with a community of deep connections and shared values, rather than numbers. When the center burns bright, growth on the edges gets easier.

Category

Slow prefers specific or narrow verticals over broad entertainment or lifestyle, where attention can be ephemeral. It’s also (relatively) easier to build lasting enterprise value in a niche.

Narrowly-focused creators have simply identified an entry point into the digital battlefield. Once they have established credibility and grown their initial audience, their cult-like status often offers the license to authentically explore adjacent categories.

Scale / Traction

As a broader guideline, Slow likes to see ~200k–2M+ followers and $500k+ in annual advertising/platform revenue. If the creator is generating revenue off‑platform from product sales, that serves as even stronger proof of conversion.

Content Creators to Full-Stack Studios

In Slow’s article “Every Franchise Needs a Lebron”, it illustrates that top creators, who are deeply embedded in their niches, achieve intense consumer association with their vertical, and it further translates into low CAC, low churn, and a distribution moat.

For top vertical creators, this dynamic introduces a compelling economic opportunity for creators to branch out from the information exchange business to create their own product and service businesses, seeded with their distribution and digital reputation.

Media is a broken business model, but the distribution that comes with media companies can be incredibly lucrative

Some of the most prominent examples include:

In the next phase of the creator economy, creators who layer products and services on established niches will dominate. There are massive opportunities for financial vehicles such as Slow’s Creator Fund to partner with exceptional Creator CEOs and support their businesses into a category-leading franchise.

Learn more about what they do at: https://creatorfund.co/about/

If you found this valuable, consider sharing with a colleague or founder.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources