- Network Effects

- Posts

- Jobber: The Operating System for Local Service Pros

Jobber: The Operating System for Local Service Pros

How Jobber Became the Go-To Platform for Trades

Welcome to the 2nd Network Effects Newsletter.

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world's leading tech companies. Today, we're diving into Jobber, founded by Sam Pillar (CEO), Forrest Zeisler (CTO), and Graham Audenart in 2011.

Let’s Dive in

📝 Overview

Jobber is a vertical SaaS platform designed to digitize and streamline operations for small and medium-sized home service businesses. Jobber offers an end-to-end solution that replaces manual processes and disparate tools, from scheduling and dispatching to invoicing and payments.

With over 250,000 service professionals across over 60 countries using the platform, Jobber has become a trusted partner for businesses aiming to modernize their operations and enhance customer experiences.

📌 Thesis 1 - Expanding Markets Ripe for Digitalization

The global home services market—spanning HVAC, landscaping, plumbing, and residential cleaning—represents a $650B+ opportunity. While software adoption is growing, the market remains highly fragmented and in the early stages of digital transformation, particularly among the millions of micro-SMBs operating with 1–20 employees. Many of these businesses still rely on spreadsheets, paper invoices, or generalist tools, lacking purpose-built platforms that address their unique field operations.

In addition, the aging U.S. housing stock (average home age: 47 years) is going to drive demand for home services in the future, Home service owners are increasingly turning to software to streamline quoting, scheduling, invoicing, and payments.

📌 Thesis 2 - Vertical Focus with Defensible Economic Moat

Jobber’s categorical leadership in the SMBs market stems from its focus on building tailored features (e.g., job routing, quote-to-invoice automation) that generalist platforms and point solutions can't replicate.

Jobber’s moat is reinforced by high switching costs (due to workflow embedding), trust-based brand loyalty, and tailored customer support that speaks directly to first-time software users. Their payment solutions will also grow alongside their customer businesses, which would become a large source of revenue for Jobber. For example, Shopify’s merchant solution, including Shopify payments, monetizes through a revenue-share model according to payments, has outgrown subscriptions, posing substantial economic opportunities for Jobber as well.

🌱 Genesis Story

Before founding Jobber, Sam Pillar and Forrest Zeisler were freelance software developers working out of a local coffee shop, Remedy Café, in Edmonton. They spotted each other across the room—two strangers united by glowing black screens filled with lines of code—and quickly bonded over their shared craft.

Sam had previously worked with home service businesses and saw firsthand the operational headaches they faced—messy scheduling, manual invoicing, and poor customer communication. He also saw a massive, underserved opportunity: helping these businesses run more efficiently through software.

In 2011, Sam and Forrest teamed up with Graham Audenart, who is a close friend of Forrest, a painting business owner who was living those pain points daily. Together, they set out to build a solution. The result was Jobber—a platform built to streamline and simplify the everyday operations of small home service businesses.

I spent a lot of time with the teams [SMBs in Service Industries] there, and saw a lot of inefficient, manual work being done by the crews just to get from one job to another, figure out what they were supposed to be doing on site, and interacting with their clients. This experience gave me the idea to start working on what would ultimately become Jobber

🖥️ Product & Services

Jobber provides a mobile-first software solution that streamlines operations for home service businesses, focusing on (1) job management, (2) customer service, and (3) business operations.

Job Management

At the heart of Jobber’s platform is a robust job management engine that orchestrates end-to-end service delivery. Every step in the process is streamlined and made trackable:

Request – Intake of service requests via phone, website forms, or email

Quote – Generation of scoped estimates, including labour and material costs

Schedule – Coordination of technician availability with client preferences

Dispatch – Real-time job assignment, route planning, and technician tracking

Invoice – Auto-generated invoices reflecting completed service

Payment – Integrated payments with card-on-file and tipping options

This workflow lives inside a centralized dashboard, giving operators complete visibility into job statuses, technician locations, and customer interactions.

What differentiates Jobber is its embedded communication layer. At each step—quote approval, appointment confirmation, reminder, post-service follow-up—customers receive timely, branded messages via SMS or email.

Customer Services

Jobber provides a series of customer-facing tools to help provide better customer experiences. Across the lifecycle of the job, there are a couple of key customer interactions where Jobber has streamlined and digitalized to ensure the best customer experience for the users.

Online Booking Platform

A customizable, embeddable form where customers can request services directly from the business’s website or social media channels. Availability, job types, and location-based filters ensure that leads coming in are qualified and automatically synced to the team’s job calendar. This gives customers the convenience of booking anytime, while reducing administrative load for the business.

Self-Serve Client Hub

A self-serve portal where users can review quotes, past jobs, check job progress, view invoices, and make payments. Instead of calling or emailing for updates, clients get everything they need in one place, creating a more transparent and seamless experience. The portal also allows Jobber users to customize the experience for ther clients, which they can include reviews and photos on similar projects.

Customer Communications

For many small service businesses, Customer service has always been a growing pain as the business gets larger. The growing number of missed calls and delayed replies has led to lost leads, frustrated clients, and missed revenue.

Jobber addresses this pain with multi-channel customer service tools that extend responsiveness across channels. Whether it is about a quote, a status update, a scheduling update, Jobber can diagnose and translate them into summaries and actions. For example, a new lead has called to book a consultation regarding to a driveway paving service, Jobber can respond immediately, gather necessary information about the conditions of the driveway, availabilities and contact information, then share a note with the users around calling them back the next day with the proposed quote.

“For service providers in these industries, customer service is such an important part of the job. You need to be able to get in touch with a plumber when you need one….. For many of them, most of them are answering while their heads are under a sink at somebody’s home.”

Business Operations

Jobber also helps users manage their business, from operational management to marketing to analytics, to effectively oversee the health of the business and identify growth opportunities. For example, the reporting suites allow businesses to see quarter-over-quarter revenue and margin growth across their service types, to inform decisions in future pricing changes and marketing campaigns. Another example includes the use of email campaign templates to run automatic multi-channel campaigns across emails, text to a curated audience (e.g., customers who purchased landscaping services from us in the last 12-16 months).

In the 2025 Spring Jobber Feature Announcement, management says over $190M in additional revenue has been generated through the email campaigns by Jobber. In the future, Jobber will also be shipping new features, including a no-code website editor for users to create a website under Jobber’s platform.

Integrations & AI

Beyond the three core streams of services, Jobber also hosts an ecosystem of 60+ integration partners and third-party applications, allowing users to connect their Jobber platform to other software to meet their bespoke needs. Common partners include QuickBooks for accounting needs, Docusign for contract management, Gusto for payroll services, etc.

Source: Jobber Website

In terms of AI, the company is focusing on applying artificial intelligence to strengthen its existing suites of products, from quote generation to email campaign recommendations to workflow automation. AI has a significant opportunity to further streamline complex workflows for Jobber’s users.

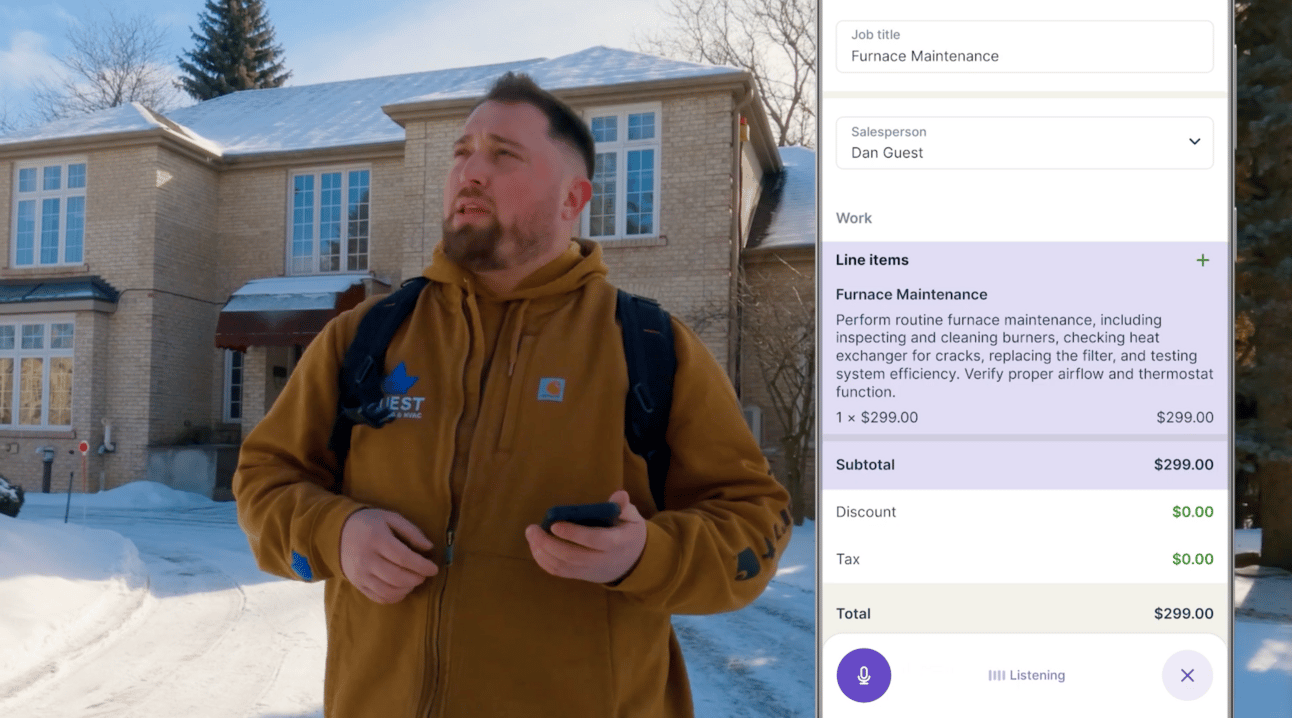

One notable example is the implementation of Voice AI for on-the-ground field service workers. In this 53-second-long video below, Dan illustrates the power of Voice AI in improving operational efficiency for its users. The opportunity to allow users to organize and provide input to the job while they are working and driving between sites, allows for massive productivity gains.

Another example would be the Jobber Copilot, which is a web assistant that allows users to prompt questions and provide insights around different jobs and the health of the business. Users can prompt questions to understand the performance of the business, of the employee, of a certain service offering and receive an immediate response with data evidence.

🏢 Markets

North America is undergoing a major structural shift in how home services are consumed and delivered. With 147 million homes in the U.S. and 16 million in Canada—many of which are over 47 years old—demand for recurring maintenance, upgrades, and repairs is only accelerating. Homeowners are spending more to maintain aging properties, while the shift to hybrid work has driven increased investment in home improvement and comfort. The result is a $650B+ home services market, comprising over 6.2 million local businesses across landscaping, plumbing, HVAC, cleaning, and other trades.

Yet while demand is surging, the supply side of the market is straining. Skilled labor shortages are hitting a critical point, as older tradespeople retire and younger workers increasingly opt for college over vocational paths. For example, between 2022 and 2032, skilled roles like electricians and plumbers will have more than 20x the number of annual job openings than new workers entering the field. This supply-demand imbalance is pushing up wages, increasing customer wait times, and leaving many jobs unfilled altogether.

This growing gap has intensified the need for efficiency, professionalism, and scalability across local service businesses. However, the market remains highly fragmented, where over 90% of local service providers are small businesses with fewer than 20 employees, and many still rely on outdated tools or manual processes. According to Jobber’s 2023 Home Service Trends report, only 19% of small service businesses feel “very confident” in their digital capabilities, yet those who adopt tech grow 3–4x faster than peers

⚔️ Competition

The competitive landscape is shifting from generic tools to verticalized platforms that deeply embed into daily operations. The most relevant players— ServiceTitan, Housecall Pro, and FieldPulse—reflect both the fragmentation of the market and the emerging pressure to innovate through AI, UX, and workflow depth.

ServiceTitan is the category-defining platform for enterprise-grade contractors. With a valuation nearing $9B and an expansive suite of tools—from CRM to dispatching, payments, and marketing automation, targeting the upper end of the market. However, ServiceTitan’s complexity and cost structure make it poorly suited for the majority of SMBs. Its product is geared toward multi-location franchises and mature businesses with in-house tech resources, creating white space for lightweight, affordable alternatives

Housecall Pro targets mid-market service pros with a focus on simplicity, mobile access, and a customer-friendly brand. It offers a clean UI, essential automation features, and support for scheduling, payments, and customer messaging, similar to the Jobber platform. Most customers and review sites have identified Housecall Pros as the closest alternative to Jobber.

FieldPulse is a newer entrant focused on small businesses and solopreneurs, with a product that emphasizes flexibility and customization across workflows, team roles, and invoicing. This adaptability appeals to more tech-savvy operators, but often comes at the expense of usability for the average field professional. While FieldPulse offers a modern alternative to legacy systems, it lacks the ecosystem maturity of more established platforms, offering fewer native integrations, limited partner channels, and a smaller community of third-party support compared to Jobber.

⚙️ Business Model

Jobber generates revenue through a tiered SaaS subscription model, complemented by usage-based payments, AI-powered add-ons, and platform monetization.

Source: Jobber Websites

#1 Subscription Plans

Jobber’s primary revenue stream comes from a range of subscription plans, priced based on business size and feature needs. Plans are split between individuals (1 user) and teams (up to 15 users), and billed annually:

Core ($29–$129/mo): Provides scheduling, invoicing, reminders, and reporting—foundational tools for solo operators and small teams.

Connect ($89–$129/mo): Adds workflow automation, QuickBooks integration, and job tracking features.

Grow ($149–$249/mo): Offers deeper customization, job costing, and SMS-based client communications.

Plus ($449/mo): Tailored for larger teams, this tier includes premium support, API access, AI receptionist tools, onboarding specialists, and Jobber’s proprietary Marketing Suite.

This tiered structure allows Jobber to serve a broad customer base—from solopreneurs to multi-person field teams—with upsells built into usage, team size, and sophistication of operations.

#2 Payment Processing Fees

Through Jobber Payments, customers can invoice clients and collect payments online. While not explicitly priced in plan descriptions, Jobber earns a percentage fee per transaction. This model adds a recurring usage-based revenue stream and strengthens platform lock-in, as users route their cash flow through Jobber.

#3 Add-on Tools & AI Services

The AI Receptionist and Marketing Suite (valued at $99 and $79, respectively) are bundled in the Plus plan, but may be monetized independently for lower-tier customers. These features suggest Jobber is building modular, high-margin add-ons—unlocking incremental ARPU through advanced automations, client communications, and lead capture.

💰 Valuations & Fundraising

Jobber has raised over $191 million across multiple funding rounds, with notable investments from General Atlantic, Summit Partners, and Version One Ventures. The company's latest Series D round in January 2023 raised $100M led by General Atlantic with participation from existing Jobber backers Summit Partners, Version One Ventures, and Tech Pioneers Fund

The lead investors for the previous round include Version One Venture & Point Nine Capital (Seed), OMERS Venture (Series A + Series B), and Summit Partners (Series C)

♟️ Key Opportunities

Embedded Fintech Expansion through Jobber Payments

Jobber is uniquely positioned to deepen monetization through its growing payments platform. By offering Jobber Payments as a fully integrated solution—encompassing invoicing, real-time payments, tipping, and automated payouts—Jobber increases platform stickiness and captures a direct share of customer revenue. This scalable monetization model mirrors the success of Shopify Payments, turning Jobber from a software provider into a financial infrastructure partner.

In 2015, Shopify's revenue from Subscription Solutions was $112.0 million, while Merchant Solutions (which includes Shopify Payments) generated $93.3 million. By 2023, this dynamic had shifted significantly: Subscription Solutions revenue grew to $1.8 billion, whereas Merchant Solutions surged to $5.2 billion, making up approximately 73% of total revenue.

This evolution highlights the scalability and economic potential of integrated payments within a SaaS platform. Jobber, by embedding Jobber Payments into its vertical SaaS offering, can follow a similar trajectory—transforming from a subscription-based model to a comprehensive financial infrastructure provider for home service businesses.

Integration of AI Features

AI features like auto-generated quotes, smart scheduling, and Jobber Copilot help reduce the daily administrative burden for operators, freeing up time and improving workflows. Over time, this deepens reliance on Jobber as both a system of record and execution. As AI becomes more embedded in vertical SaaS, Jobber is well-positioned to convert higher engagement into stronger retention and pricing power.

SME to Upmarket Potential

While Jobber has historically served small and medium-sized home service businesses, it is well-positioned to expand upmarket to larger, more established firms with multi-location operations and larger workforces. As these businesses mature, their operational needs become more complex, spanning payroll, job costing, CRM, and analytics—all areas where Jobber can extend its product footprint.

This upmarket move would drive higher average contract values and open the door to multi-seat expansion opportunities. Jobber’s reputation for ease of use and industry focus gives it a competitive edge over horizontal platforms like QuickBooks or generic Enterprise Resource Planning (ERP) software.

⚠️ Key Risks

Execution Risk in Embedded Fintech

While payments and financial services represent a significant growth lever, they also introduce operational and regulatory complexity. Jobber must maintain high-quality fraud prevention, chargeback resolution, and compliance (e.g., KYC, PCI) to scale this line of business. Missteps could result in reputational damage or regulatory scrutiny.

Slow Upmarket Expansion

Jobber’s growth thesis includes moving into larger accounts, but selling into mid-market or enterprise service businesses requires different go-to-market motions, product sophistication, and customer support infrastructure. If not executed well, Jobber could see rising CAC without corresponding LTV.

Economic Sensitivity and Customer Churn

The home service market, especially for small businesses, is vulnerable to economic downturns. Recessionary pressures can lead to reduced budgets for services and, by extension, reduced demand for Jobber’s platform. Additionally, seasonality is another challenge, where demand for home services can fluctuate with the seasons, leaving businesses relying on software for only certain periods of the year. This creates a constant churn risk for Jobber, as seasonal businesses may cancel or pause their subscriptions during off-peak periods.

For example, during an economic slowdown or a shift in tariff policies, many small businesses experience reduced revenue and higher material costs, which can lead to budget cuts. As a result, businesses may prioritize essential spending over software tools, leading to higher churn rates for platforms like Jobber.

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on StackAdapt, the operating system for paid advertising.

Resources