- Network Effects

- Posts

- Instacart: Expansion Through the Supply Value Chain

Instacart: Expansion Through the Supply Value Chain

The Grocery Delivery Marketplace Quietly Building B2B SaaS

Welcome to the 19th Network Effects Newsletter,

While most investors focus on Instacart's consumer-facing grocery delivery business, the company has quietly executed one of the most strategic vertical SaaS transformations

Instacart is an excellent example of how marketplace companies can expand upwards in the value chain to offer products and services to suppliers, in this case, grocers.

Let’s dive in.

🛒 Instacart Company Overview

Founded in 2012, Instacart is recognized as the market-leading on-demand grocery delivery platform in North America. It facilitates 4-sided transactions with grocer merchants, independent contractors, advertisers and consumers to handle and deliver grocery orders from shelves to homes

Instacart's journey was far from a straight line. The company faced several near-death experiences, including in 2015 when it had a negative $14 gross margin on every order, and in 2017 when Amazon's acquisition of Whole Foods threatened its largest partnership. The company’s fortunes changed with the unexpected black swan of COVID-19, which brought it to another dimension. Its GMV grew by 303% from $5.1 billion in 2019 to $20.7 billion in 2020, as a massive influx of consumers and retailers flocked to its platform.

Today, the platform facilitates over $30 billion in gross merchandise value annually. It connects consumers with personal shoppers who fulfill orders from 85,000+ retail locations across 14,000+ cities. This marketplace leadership provides the perfect foundation for what came next: a strategic move into B2B software.

🤝 Acquisition as a Catalyst to Enterprise Solutions

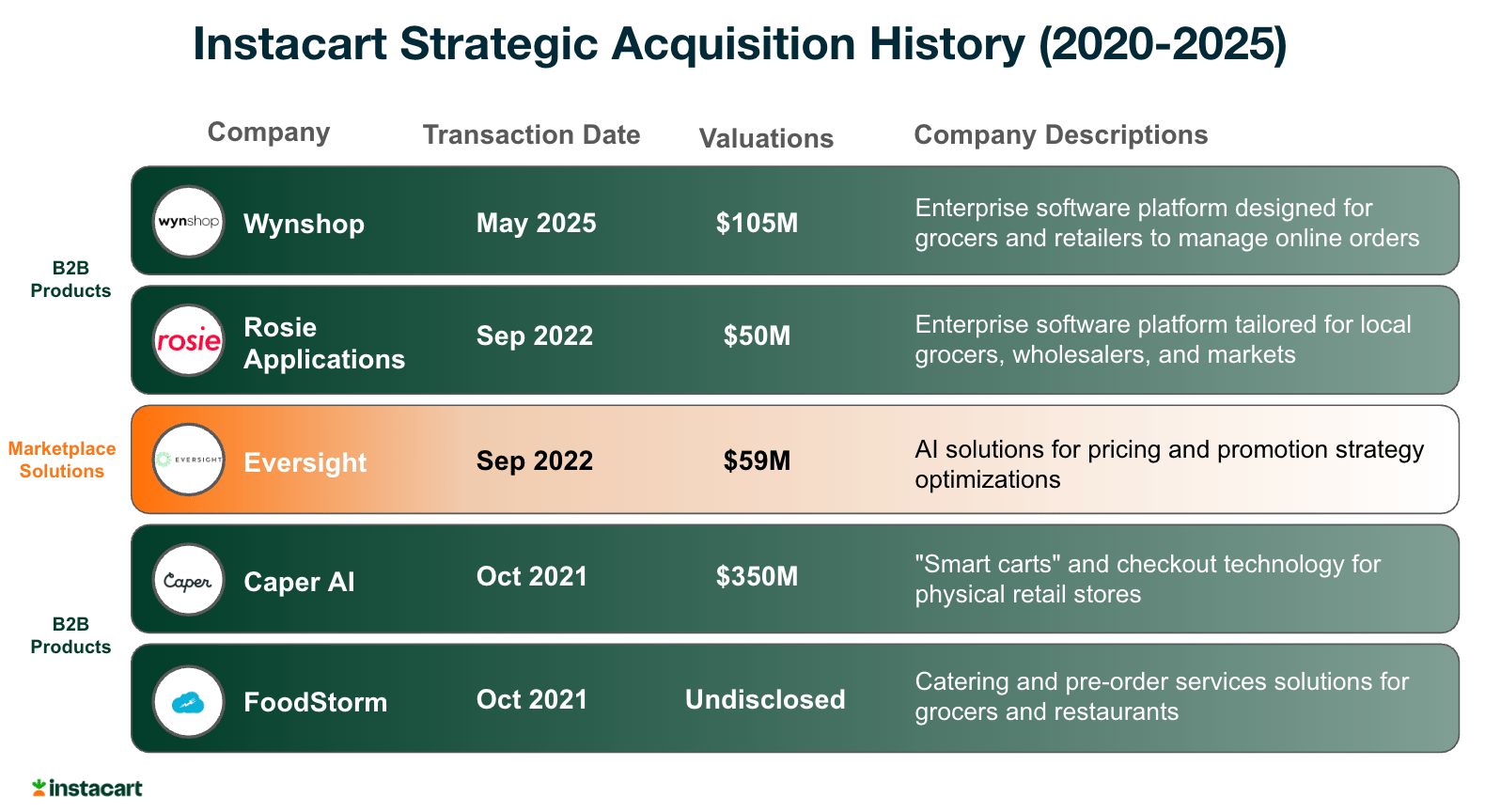

Over the past five years, Instacart has made a series of strategic acquisitions, with four directly related to enterprise solutions for grocers, ranging from in-store fulfillment to checkout and catering solutions.

Instacart's enterprise solutions were formally launched in March 2022, shortly after Fidji Simo became CEO in July 2021. Simo immediately articulated a clear vision: to diversify Instacart’s revenue streams beyond consumer delivery and advertising.

When some things happen in their business, even independent of Instacart, and [the large brands] might pull back advertising dollars, we are still too dependent on that,” Simo said. “Whereas if we had a more diversified business, that would allow us to handle these kinds of changes much better.”

This B2B pivot is most evident in the "Connected Stores" initiative, a suite of technologies that integrate online and in-store shopping for a unified, personalized experience. Key components of this platform include:

Caper Cart: AI-powered smart shopping carts that automatically track items.

Scan & Pay: A mobile self-checkout solution.

In-Store Mode: Loyalty program solutions within the Instacart app.

Carrot Tags: Software connected to electronic shelf labels for pick-to-light capabilities, product information display, and real-time updates.

Out of Stock Insights: Provides real-time data on out-of-stock items to improve in-store sales and operations.

By 2024, about half of Instacart’s top 50 partners have launched a new “big” service or integration, such as SNAP online payments, virtual convenience stores, pickup or enterprise business solutions. The company is actively building its position as the "Amazon for Grocery," not just a delivery platform, but a full-stack technology provider for the entire industry.

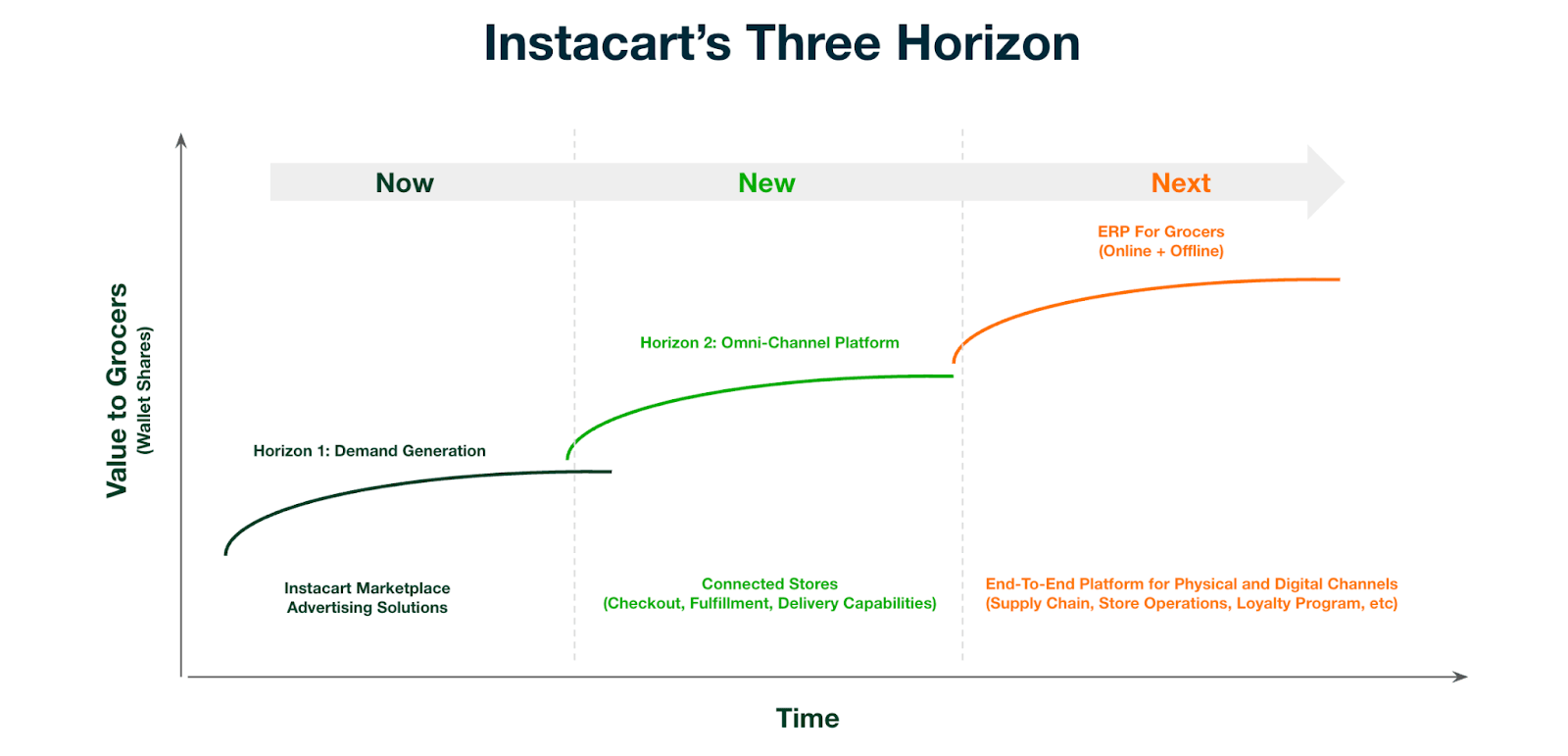

🚀 Instacart’s Three Horizons

While Instacart has been celebrated as a wild success as the leader in the grocery delivery industry, its potential is far beyond on-demand delivery and advertising. By examining its "Connected Stores" expansion through the lens of the VSaaS playbook, we can hypothesize three distinct horizons of value creation

Horizon 1: Marketplace as Initial Wedge (2012-2021)

Instacart’s marketplace became the initial wedge. It provided grocers with a new channel to generate incremental traffic and revenue through a white-glove, on-demand delivery service. Grocers became dependent on Instacart for its access to consumers and its logistics network.

Horizon 2: Omni-Channel Platform Solution (2021-Current)

The introduction of Instacart's enterprise solutions and "Connected Stores" marks the second arc of the company. Building on its existing relationships, Instacart is now selling software that helps grocers create digital shopping experiences for their consumers. This is where products like Scan & Pay, Caper Cart, and Carrot Tags come into play.

Horizon 3: ERP for Grocers (Building on Horizon 2)

The final form of this evolution is to become the system of record for grocers. By embedding itself deeper into operations and replacing legacy software, Instacart will become the central nervous system for store owners and corporate teams. At every step, Instacart is expanding its share of wallet, improving retention, and increasing its pricing power.

Since becoming CEO, Simo has lifted Instacart’s margins from 2.6% in 2022 when Instacart IPO’ed to 14.5% in December 2024. With the focus on B2B offerings such as last-mile delivery, building white-label websites, and selling advertising slots on the company app. Instacart has also expanded into brick-and-mortar offerings such as electronic shelf tags and smart shopping carts. Simo’s version for Instacart was to become a technology partner for grocers can help the company better compete against Walmart and Amazon, as those giants invest in digital grocery tech

🌟 Lessons for Vertical SaaS Operators

Distribution as Wedge

Instacart’s strategy highlights a powerful B2B go-to-market playbook: using a high-demand marketplace as a distribution wedge. Instacart already had the attention and trust of tens of thousands of retailers who were using their marketplace for delivery.

This pre-existing relationship eliminated the cold-start problem of acquiring a customer base and dramatically lowered their Customer Acquisition Cost (CAC) for new SaaS products. Instead of cold-calling grocers, Instacart could simply offer its new software to a captive audience of existing partners.

It is a two-way street. Some start with SaaS, and some start with Marketplace

SaaS → Marketplace: While many vertical SaaS companies start by building a single-player software tool for a specific industry, and then, once they have enough distribution, they build a marketplace on top of it. An example is Mindbody, a vertical SaaS platform for wellness and fitness studios, which is now building a marketplace to connect merchants with students.

Marketplace → SaaS: Instacart is one of the few examples of this evolution. It started by aggregating consumer demand and has now moved upstream to build software that helps its suppliers (grocers) manage their business more effectively.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources