- Network Effects

- Posts

- Float: The Modern Finance Operations Platform for Canadian SMBs

Float: The Modern Finance Operations Platform for Canadian SMBs

Empowering SMBs & Startups Finance in Canada

Welcome to the 5th Network Effects Newsletter,

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world’s leading tech companies.

Today, we’re exploring Float, founded in 2019 by Ruslan Nikolaev and Griffin Keglevich, with Rob Khazzam joining as CEO in 2021.

Let’s dive in.

📝 Overview

Float is a financial operations platform that helps enterprises manage their cash flow, budgets, and team expenses in real-time. It offers a comprehensive view of a company’s finances, helping teams stay ahead with real-time visibility and control. Float’s platform integrates with popular tools like Xero, QuickBooks, and Stripe to ensure smooth operations.

Float launched its first product in May 2021, initially focused on corporate cards and expense management. Since then, it has steadily broadened its suite to include bill payments, high-yield business accounts, accounts payable automation, and both virtual and physical cards in CAD and USD. The company now serves over 4,000 businesses, including leading enterprises such as Clutch, Neo, Knix, Cohere, TouchBistro, Ada, etc. Since November of 2021, when they raised their Series A, the company has grown its revenue by 50x and total payment volume by 45x, underscoring strong product-market fit and expanding demand for modern financial operations

📌 Thesis 1 - Defensible Moat with Embedded Workflows

Float's core advantage lies in its ability to move beyond basic financial tools by building an integrated platform that becomes the central nervous system for SMB finances. While initial integrations with Xero, QuickBooks, and Stripe provide essential connectivity, the true strategic imperative is to layer proprietary AI-powered automation and insights across the entire financial stack. This evolution transforms Float from a mere system of record into a strategic platform that not only streamlines routine tasks but also empowers SMBs to make smarter, data-driven financial decisions.

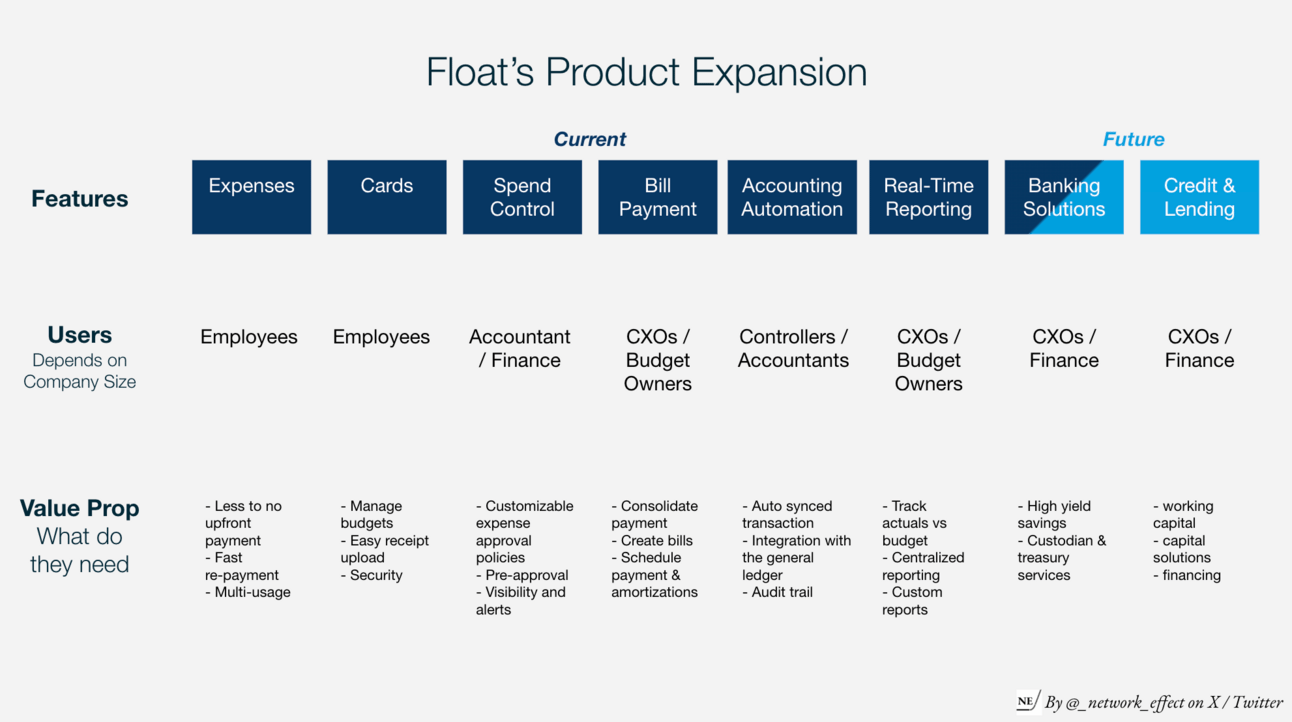

The future roadmap includes expansion into critical CFO functions such as treasury management, credit solutions, and capital management. By deeply integrating these functionalities and embedding AI-driven intelligence, moving beyond operational efficiencies to strategic capital allocation recommendations, Float creates an indispensable solution for SMBs.

📌 Thesis 2 – Product Expansion to Banking & Credit Solutions

Over 25% of Canadian SMBs have faced significant hurdles in accessing capital due to traditional banks' reliance on outdated and often irrelevant metrics. Float is poised to disrupt this status quo by leveraging its real-time data integrations with accounting software, bank accounts, and internal workflows to offer a fundamentally superior approach to underwriting. This granular, up-to-date view of a business's financial health enables faster, more accessible, and smarter credit assessments

This embedded approach mirrors the playbooks of similar fintech players such as Ramp and Brex, as well as payment providers such as Square Capital, which successfully extended financing to merchants by using proprietary data already flowing through their platforms.

🌱 Genesis Story

In September 2019, Ruslan Nikolaev and Griffin Keglevish, both Waterloo computer science grads, launched Float, a fintech platform enabling businesses to issue single-use virtual cards to employees for expenses, eliminating the cumbersome reimbursement process.

Rob Khazzam, who had started his career in private equity and led the country expansion in Eastern Europe and Canada as a General Manager, was exploring entrepreneurial opportunities. In 2021, after learning about the inefficiencies in enterprise payments from Ruslan and Griffin, he joined Float as CEO, with the mission to streamline budget and cash flow management for growing businesses.

“At Float, we understand that addressing the needs of these businesses requires a distinctly Canadian approach…Our financial system needs to match the speed and ambition of Canadian businesses if we want to thrive locally and compete globally.”

🖥️ Products & Services

Float's expanding suite of products is designed to address the fragmented financial tech stack prevalent among Canadian SMBs:

1. Core Spend Products

Corporate Cards

Float provides physical and virtual corporate cards tailored to Canadian businesses. Admins can issue cards instantly, set pre-approved spending limits, and get real-time visibility into team spend, reducing fraud and improving control. Enterprise customers also earn 1% cash back on card spend

Bill Payments

Float offers a centralized platform to manage and automate business payments. From vendor invoices to recurring bills, Float streamlines the accounts payable process with approval workflows and automated reconciliation with ledgers and accounting books of records.

Reimbursements

Float allows employees to submit reimbursements for out-of-pocket expenses directly in the platform. Once approved, funds are pushed back into employee accounts, making reimbursements faster and less error-prone. In complementary to corporate cards, finance teams have full visibility into employee spending in one place.

Financial Services

High-Yield Accounts

Float offers high-interest-earning accounts, enabling businesses to earn returns on their cash deposits. Most big 5 Canadian banks allow companies to earn 1.5, while Float’s high-yield account allows enterprises to earn 4% with zero minimum balance

Foreign Exchange (FX)

With the launch of Float FX, the company now enables low-cost, fast foreign exchange, especially in USD. This includes multi-currency cards, next-day ACH transfers, USD wires, and reimbursements to minimize dead time from international wire transfers and save 90% of fees compared to traditional banks

Platform Infrastructure

Expense Management

Float replaces clunky spreadsheets and manual tracking with automated expense workflows and reporting capabilities, to allow for full transparency and appropriate controls over business expense management.

The platform follows a 3-step process: (1) approval, (2) spend, and (3) close:

Approval: Employees make a spend request, and Float automatically sends it to their managers for approval.

Spend: Once approved, Float issues a card or top-up with funds to make the purchase.

Close: Float notifies cardholders to submit receipts and backup as soon as the purchase is made.

Float also help categorize each transaction and flag specific transactions for potential policy violations, and reconcile spending to receipts in real time. Therefore, finance teams gain instant visibility into spend patterns, budget adherence, and cash flow, turning transactional data into actionable insights.

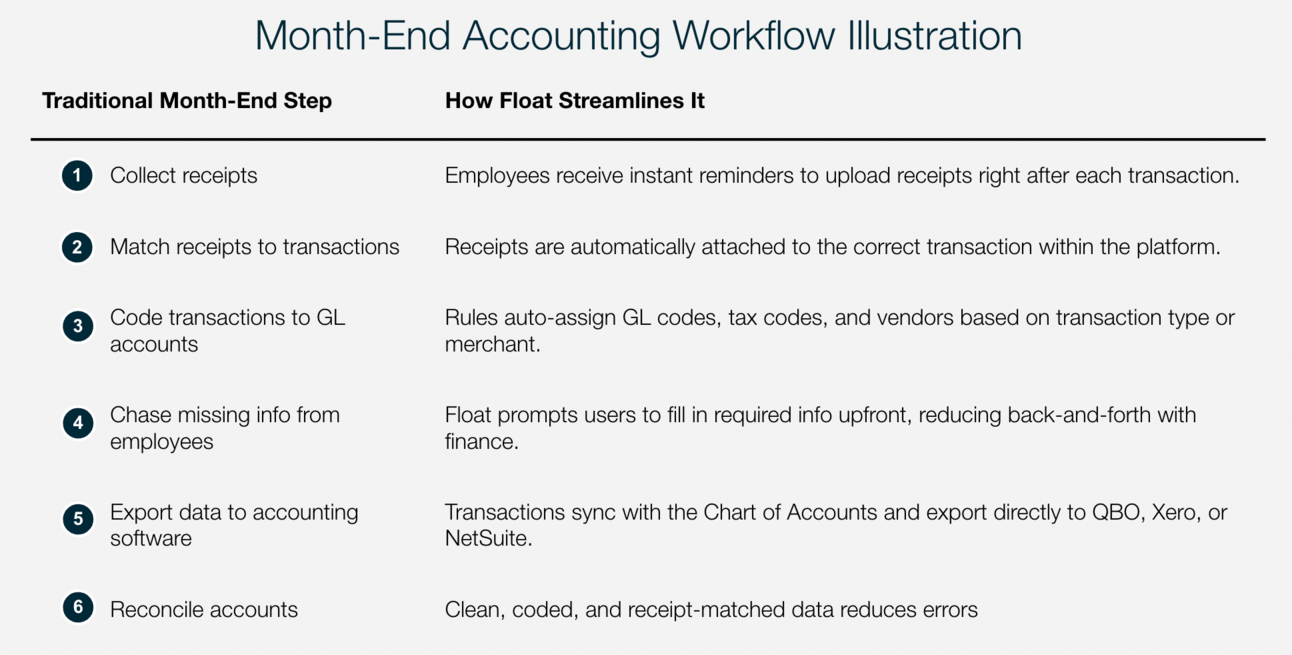

Accounting Automations

Float streamlines month-end accounting by eliminating manual data entry and automating transaction categorization. Finance teams can design and implement workflows to

Automate GL codes, tax codes, merchants and more on similar transactions

Create merchant-specific cards and automate the coding for all card transactions

Save time at month-end and cut down on human error.

Transactions sync directly with the company’s Chart of Accounts and export seamlessly to QuickBooks, Xero, NetSuite, or custom CSV templates. This automation shifts finance teams from reactive reconciliation to proactive financial management.

Source: Float’s Website

🏢 Markets

Finance operations software is undergoing a generational shift in Canada, as businesses move from manual, fragmented workflows to integrated, automated platforms. According to Visa/Moneris, the Canadian B2B payments is estimated at $2.7 trillion annually back in 2017 (which continued to grow since then), the majority of which still flows through outdated systems like paper checks, manual reconciliations, and siloed ERP.

Source: Payments Canada, Visa, Moneries

The Canadian business landscape is largely made up of small and medium-sized enterprises (SMEs) which represent 98 per cent of total businesses operating within Canada.270 However, SMEs only account for 22 per cent of total business expenditure.271 Mid-market businesses represent about two per cent of Canadian businesses, and 44 per cent of total business expenditure.272 Large-market businesses account for less than one per cent of Canadian businesses, but make up 34 per cent of total business expenditure

Small and medium-sized businesses (SMBs) are the backbone of Canada’s economy, making up 98% of employer businesses. However, most of them feel that banks don’t understand their unique needs and aren’t interested in supporting small business owners.

Canadian SMBs face several acute pain points in managing their finances:

Slow access to capital – 70% of new businesses struggle to secure funding due to rigid underwriting and slow bank processes.

Cash flow constraints – Long transaction processing times delay critical payments and inhibit business agility.

Inefficient financial operations – SMBs spend up to 40 hours/month on manual tasks like reconciliation, often riddled with errors.

Poor banking support – Many feel underserved and misunderstood by traditional institutions.

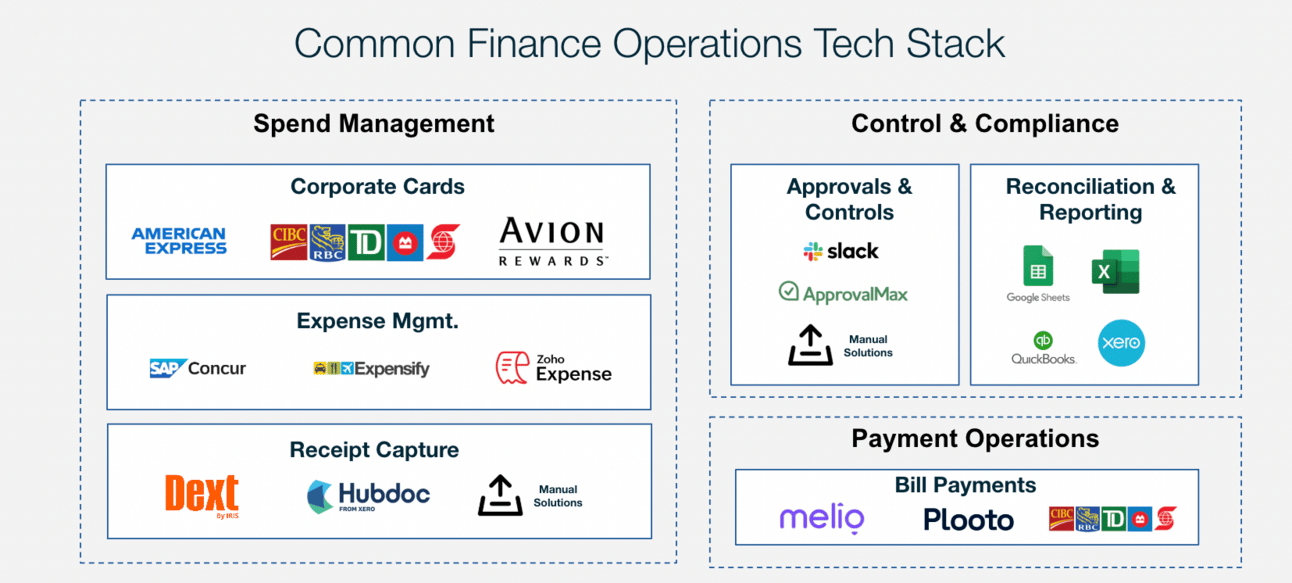

The current finance tech stack for most Canadian SMBs is deeply fragmented. Companies often rely on a patchwork of tools: a card provider for spend, an app for receipt capture, another platform for approvals, email threads for invoice approvals, and spreadsheets for reconciliation. What results is a brittle, error-prone workflow that’s hard to scale and nearly impossible to audit in real time.

Market Landscape for SMB Finance Operations

42% of Canadian SMBs still rely on spreadsheets to manage expenses, while 72% spend up to 520 hours annually on accounts payable tasks—time that could be redirected to growth-driving activities. According to a 2022 Intuit survey, 89% of small businesses use multiple, disconnected finance apps, and over 40% feel their tech stack makes it harder to get a full picture of company finances.

As a result, the finance function becomes reactive instead of strategic. It can’t move at the speed of the business. Errors slip through the cracks, spending gets out of control, and financial visibility becomes blurry.

⚔️ Competitions

Float operates within a rapidly evolving financial technology landscape, where competition spans local Canadian players and potential future entrants from the U.S. While Canadian incumbents are focused on automating discrete financial workflows, U.S. players are increasingly bundling spend management, corporate credit, and broader financial operations into integrated platforms.

Local Competition: Plooto, Moneris

Plooto and Moneries offer a platform that streamlines accounts payable and receivable processes. Their strengths lie in automating existing workflows, such as batch payments and reconciliation, aiming to improve efficiency in core financial operations for SMBs.

Workforce Management Systems: Rippling, Deel

Rippling and Deel are HR and global workforce management platforms that are expanding into adjacent financial workflows, including payroll, reimbursements, and contractor payments. While their core focus remains on global hiring and employee management, not the broader finance stack, their expansion into financial workflows may intersect with Float on select features (e.g., corporate card and expense management)

US-Based Finance Operations Software: Ramp, Brex, Mecury

Ramp, Brex, and Mercury represent the most sophisticated finance platforms for SMBs in the U.S., combining corporate cards, bill pay, spend controls, accounting integrations, and in some cases, cash management. These players benefit from strong capital backing and increasingly comprehensive platforms. However, none are currently active in Canada, giving Float a first-mover advantage to build local financial infrastructure, banking integrations, and credit underwriting models tailored to Canadian businesses.

⚙️ Business Model

Float is building a vertically integrated financial operating system for Canadian SMBs, monetizing across interchange, SaaS subscriptions, credit, and financial infrastructure. While corporate card spend is the wedge, the broader opportunity lies in owning the spend, approval, and reconciliation workflows that sit in finance operations.

1. Interchange Fees from Corporate Card Spending

Float earns interchange revenue (typically ~1.5%) on every CAD and USD transaction processed through its corporate cards. While margins are modest, card usage drives daily engagement, lowers churn, and provides rich spend data that fuels upsell opportunities in budgeting and approvals.

Notably, 1% of the spend is returned to customers as cashback, which limits the net take on card usage. As a result, Float’s interchange economics depend on scaling volume and operational efficiency.

2. Seat-based subscription offerings

Float monetizes through a multi-tiered subscription model aligned to customer needs and scale:

Essentials (Free) – For early-stage teams: up to 20 physical cards, unlimited virtual cards, basic budgeting and accounting tools

Professional ($10/seat/month, min $100/month) – Adds advanced accounting sync (QBO, Xero), cash flow visibility, and multi-level approval workflows

Enterprise (Custom) – Tailored for large organizations with advanced ERP integrations, flexible charge terms, and dedicated success support

This tiered approach enables Float to land and expand, starting with lean startups and growing into mid-market and enterprise accounts as workflows become more complex and stickier.

3. Credit & Lending Solutions

Float’s charge card model allows it to offer short-term working capital to SMBs, with custom underwriting driving limits. While still nascent, this is a high-potential margin lever as the company builds credit data and leans into use cases like working capital solutions, vendor financing or deferred pay

4. Others

Float also generates financial product revenue through FX spread income when customers use USD cards funded from CAD accounts, a stream that becomes increasingly meaningful as cross-border SaaS and vendor spend grows. Additionally, Float can generate interest income on idle balances held for bill payments or pre-funded accounts.

💰 Valuations & Fundraising

Float has raised several rounds of funding to support its growth. Most recently, it has raised a $50M Series B round led by Goldman Sachs Growth Equity with participation from OMERS Ventures, FJ Labs, Teralys, and existing investor Garage Capital. The funding is dedicated to executing the product vision and roadmap.

The lead investors for the previous round include Tiger Global (Series A), Golden Venture (Seed) and Susa Venture (Seed).

♟️ Key Opportunities

Float is at an early inflection point in building the foundational financial infrastructure for Canadian SMBs. Its next phase of growth lies in deepening platform utility, expanding monetization layers, and entrenching itself within critical finance workflows, solving for their customers’ broader finance operations needs

Cash Management & Embedded Treasury

Through the implementation of smart treasury features that allow businesses to create segmented accounts for reserves like taxes, runway, and vendor payments, automatically optimizing funds into high-yield, low-risk accounts based on preset rules. This would streamline operations, maximize returns on idle cash and improve liquidity management.

In the long term, Float could position itself as the go-to platform for cash and liquidity optimization, giving SMBs a strategic, efficient way to manage capital, further enhancing customer retention and differentiation in a competitive market.

Credit & Access to Capital/Spending Power

Around 25% of SMBs face challenges accessing capital, with 40% reporting that their financial difficulties have worsened over the past year. This growing need for accessible financing presents a significant opportunity for Float’s customers. By expanding into capital solutions and credit offerings, Float can address a critical pain point, helping businesses access the liquidity they need to grow.

Float is uniquely positioned to capitalize on this opportunity with its proprietary underwriting advantage, leveraging granular transaction data, team-level spend behaviours, and approval workflows. This data-driven approach allows Float to offer non-dilutive, real-time credit based on operating cash flow and transaction history. Additionally, Float can introduce flexible capital solutions like invoice factoring, revenue-based financing, and charge extensions to further support SMBs.

AI Copilots

As finance teams seek to streamline back-office operations, the demand for automation-first platforms will accelerate. Float’s ability to minimize human involvement across routine tasks is critical to driving operating leverage and increasing adoption among CFOs and controllers.

Automating Routine Tasks: Float’s AI-first approach begins by automating routine, time-consuming finance tasks such as reconciliation, receipt matching, expense categorization, and policy enforcement. These tasks, which traditionally require significant human oversight, can now be handled autonomously by AI, reducing the manual workload for finance and accounting teams

Proactive Insights and Alerts: The platform will move towards offering proactive insights and alerts. AI will send alerts on cash flow anomalies, flagging potential issues and providing recommendations to users.

Co-Pilot Interface: The future roadmap envisions a natural language interface, enabling CFOs and controllers to interact with the platform through voice or text queries. For example, users can ask questions like, "How much did we spend on cloud services last month?" or "What’s our budget variance for the quarter?" The AI would instantly respond with data and analysis. This interface would allow users to quickly query spend data, track budget performance, and analyze financial trends without needing to navigate complex dashboards.

⚠️ Key Risks

US Competition Entrants:

The potential entry of Ramp, Brex, and Mercury isn't just a competitive pressure; it's a significant existential risk. These players have proven their ability to scale rapidly and possess substantial capital. Float must demonstrate a clear and defensible differentiation beyond its Canadian focus – a technological edge, a superior understanding of the Canadian SMB, or a network effect that creates a tangible barrier to entry.

Financial Sustainability in Credit-Heavy Products

As Float builds out its credit and lending solutions, there's inherent risk in managing the balance between offering credit to SMBs and maintaining strong financial discipline. Lending requires sophisticated underwriting models, liquidity management, and the ability to manage defaults. This can put strain on Float’s cash flow and balance sheet, especially if they scale too quickly or mismanage risk.

Limited Addressable Market

While Canada has a sizable SMB market, it’s relatively smaller compared to the U.S. and other large global markets. If Float cannot effectively expand internationally, its total addressable market (TAM) would be capped, limiting its potential to scale and generate significant revenue. The SMB spend management market is large, but to achieve the growth needed to become a dominant player, Float will need to expand into other markets, particularly in the U.S. and Europe, where SMBs face similar challenges in finance operations.

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on Clio, a vertical SaaS focused on legal professionals

Resources