- Network Effects

- Posts

- Conquest: System of Record to System of Intelligence

Conquest: System of Record to System of Intelligence

How Conquest Integrates AI to Empower Wealth Professionals

Welcome to the 21st Network Effects Newsletter.

In a world increasingly shaped by AI, you're no longer a software tool helping business owners run their business; you’re helping them do the work itself.

This week, we're diving deep into Conquest, a groundbreaking vertical SaaS company that's reshaping financial planning with intelligent AI workflows. They're evolving from a system of record for client data into a system of intelligence and action

Let’s dive in.

📝 Conquest Company Overview

Founded in 2018, Conquest set out to make sophisticated financial planning accessible to everyone, from retail investors to ultra-high-net-worth families.

However, traditional financial planning is incredibly time-consuming, often taking advisors 10+ hours per client to gather data, analyze scenarios, and deliver a plan. With 10,000 Baby Boomers retiring daily, most advisors can only afford to serve high-net-worth clients (those with over $1 million in assets). This leaves a massive 32 million mass affluent households (with $100K-$1M) largely underserved.

Conquest bridges this gap with a flexible financial planning platform that's:

Digital-first: Self-directed tools expand who can access planning

Collaborative: Tech-enabled advice, guided by data and advisor input

Advisor-led: An interface for complex scenarios and high-value clients

This multi-modal approach drastically deflates the cost-to-serve, broadens market access, and positions Conquest as a core engagement system for wealth managers. It centralizes all client financial data (income, goals, pensions, debts, life transitions), enabling advisors to craft precise plans and budgets seamlessly.

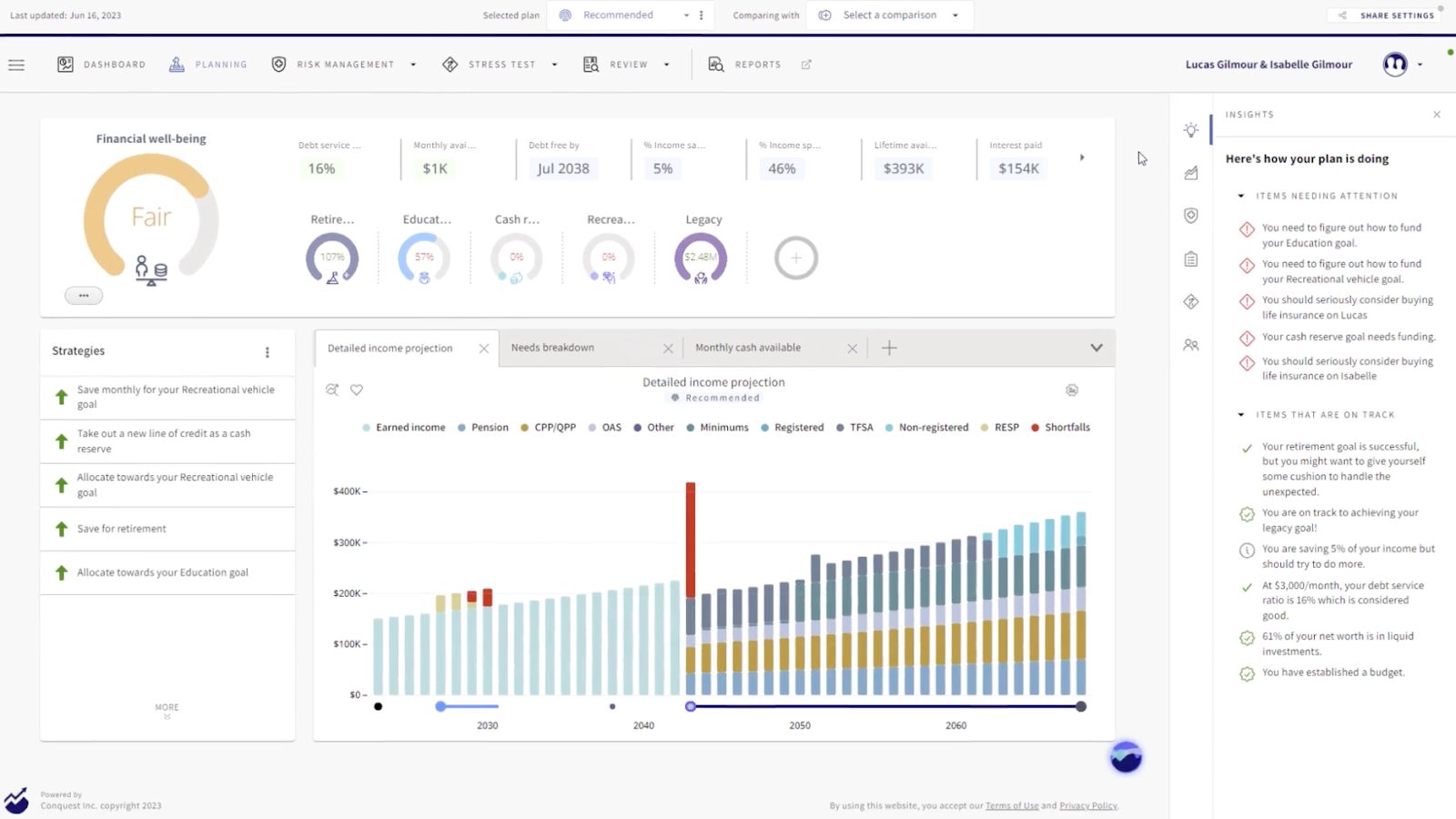

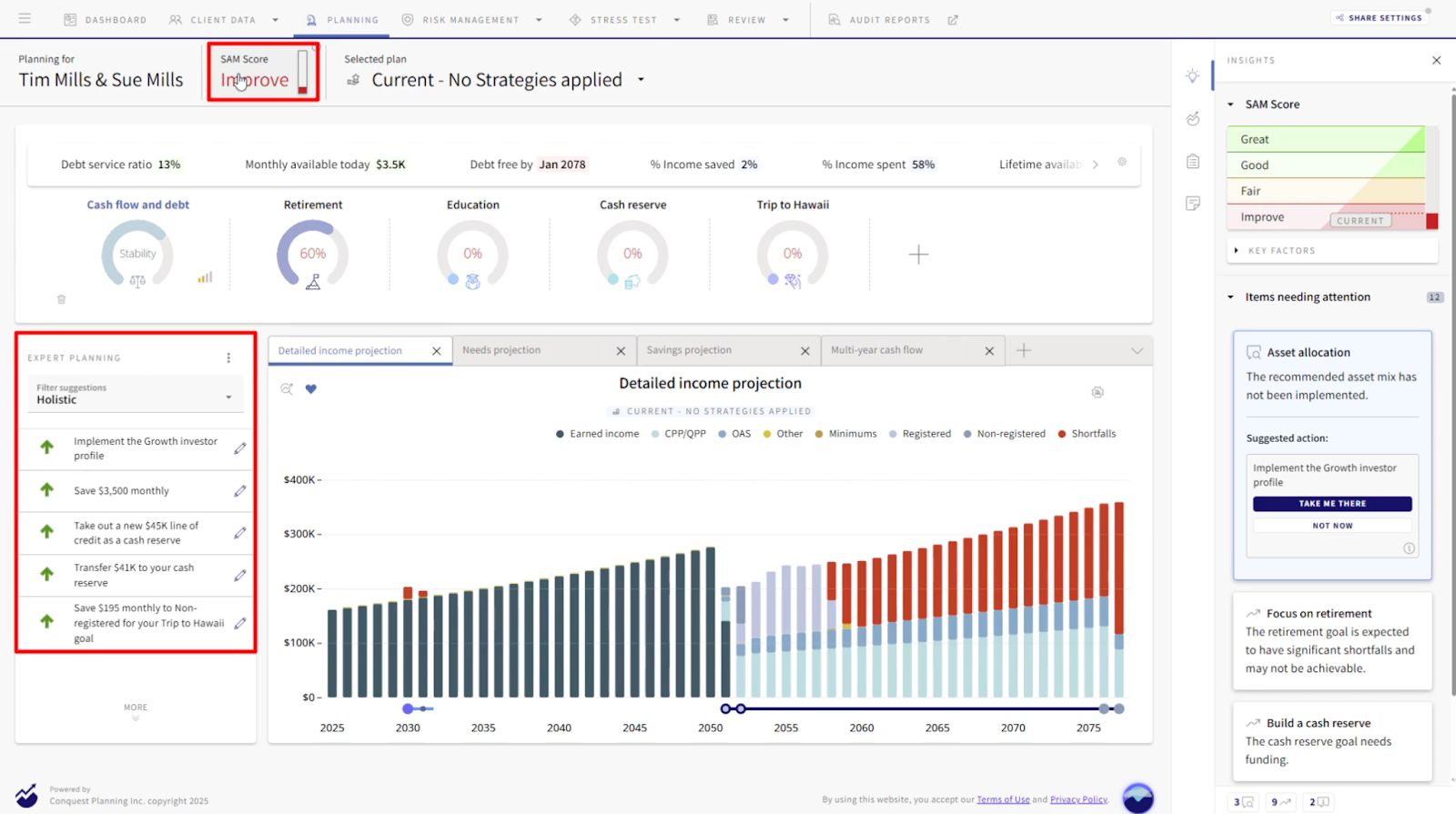

🖥️ Introduction of Strategic Advice Manager “SAM”

In June 2024, Conquest announced the launch of SAM (Strategic Advice Manager). SAM is an advisor's ultimate co-pilot, guiding the planning process, identifying goals, recommending personalized strategies, and continuously updating based on new information

Users can engage with SAM in three ways:

Auto Plan (Autonomous): One-click planning for high-efficiency scenarios.

Guided (Human-In-The-Loop): Intuitive support for junior advisors and clients, perfect for building literacy.

Expert (Advisor-Led): Full control for seasoned professionals tackling the most intricate cases.

SAM operates with deep wealth management domain expertise, understanding complex financial mechanics and contextualizing client visions into actionable budget plans.

The Impact: SAM compresses time-consuming tasks, improves planning quality, and unlocks significant advisor capacity. Conquest reports that advisors utilizing SAM create plans 90% faster and can produce 4x more plans.

Every client can go through roughly 65 life transitions. Exploring scenarios used to take hours. With Conquest, our advisors can model these in real-time.

📌 Evolution of Vertical Software Systems

Conquest exemplifies the new frontier in SaaS: the System of Intelligence.

Historically, the north star for software platforms was to become the definitive System of Record (SoR). This meant monopolizing internal data, creating valuable, defensible positions with high switching costs. However, AI's arrival has fundamentally raised the bar. Simply storing data isn't enough; the real value now lies in what users do with that data.

Consider these examples:

Restaurants: POS data now dynamically informs pricing and promotions.

Healthcare: EHRs actively triage diagnoses and recommend next steps.

HR: Talent data proactively informs retention strategies and identifies skill gaps.

Wealth Management: Client financials now drive real-time, personalized advice and proactive scenario modelling.

The evolution of software demands a new lens for evaluating success. As platforms transition from Systems of Record to Systems of Intelligence and Actions, the key metrics shift dramatically:

♟️ New Rubrics for Success

The evolution of software requires a fundamental shift in how we evaluate success. As platforms evolve from Systems of Record to Systems of Intelligence, the metrics to evaluate also change. Here's a brief scorecard on what the key strength areas are to validate

Note: When evaluating a software platform, the intent is not to classify it into one of the four stages and measure accordingly. The rubric serves as a means to depict what success looks like for each stage of evolution and is not meant to be mutually exclusive.

🖌️ How To Design The Intelligent Layer

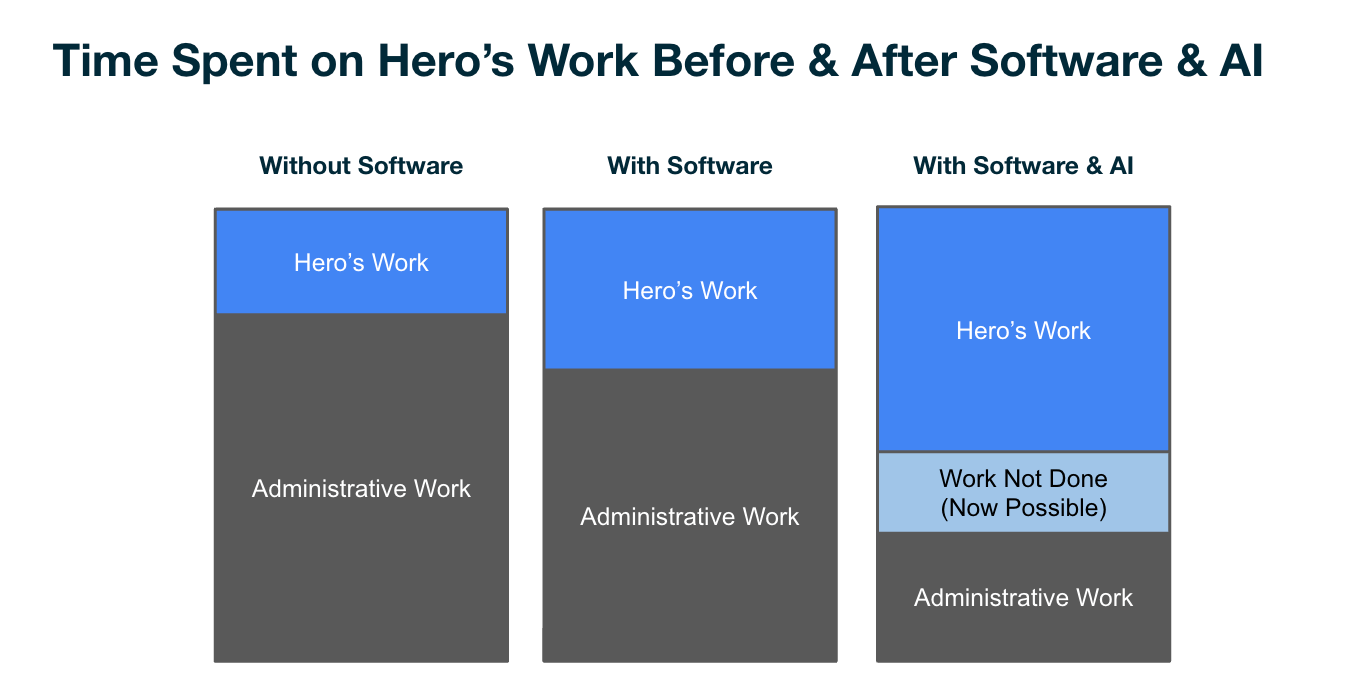

Where does AI deliver the most value across professional workflows? One way to frame it is by categorizing work into three buckets:

Hero’s Work

This is what professionals pride themselves on, their core expertise – what makes them essential. For an accountant, it's advising clients. For a doctor, it's delivering care. This is the work that's celebrated.

Administrative Work

The necessary but often tedious tasks – scheduling, reconciling, and invoicing. We want to get these done as quickly as possible, often leading to them being neglected or done poorly.

Work Not Done

This is valuable work that simply doesn't happen because professionals lack the time, skills, context, or resources. It might be outsourced, ignored, or simply isn't exciting to do, even if it's beneficial. Think about:

Answering phones during lunch.

Filing complex compliance statements.

Running multiple bids for procurement.

Great software empowers the Hero's Work, automates and eliminates Administrative Work, and makes the "Work Not Done" suddenly feasible. The key is to focus on what your users love doing and design AI to enhance it.

📌 Lessons for VMS Operator

1. Empower Heroes, Eliminate Admin

Map out your customers' daily workflows using the three-work framework:

What hero's work could AI enhance rather than replace?

Which administrative tasks could AI eliminate?

What valuable "work not done" could AI suddenly make feasible?

2. Engagement First, Revenue Later

Conquest initially focused on driving usage, not immediate monetization. They understood that winning influential users and proving value come before extracting it.

3. Data as Your Moat, Intelligence as Your Weapon

You already control critical business data. But data alone isn't enough anymore. The companies that win will be those that transform their data into actionable intelligence.

Conquest leveraged its client data (financial goals, life transitions, asset information) to power SAM's recommendations. The more advisors use SAM, the smarter it gets, creating a virtuous cycle that's nearly impossible for competitors to replicate.

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on Wealthsimple, the first and largest Canadian digital-first bank.

Resources