- Network Effects

- Posts

- CCC: VMS Value Chain Expansion Case Study

CCC: VMS Value Chain Expansion Case Study

How CCC Became the Connective Tissue of the Auto Insurance Economy

Welcome to the 16th Network Effects Newsletter.

What if your software didn’t just digitize one company, but connected an entire industry?

In today’s issue, we explore how CCC Intelligent Solutions expanded from a narrow insurance tool into connective tissue for the entire auto claims economy(insurers, repair facilities, automakers, parts suppliers, and ultimately, policyholders). CCC serves as a prime example of how value chain expansion looks in vertical SaaS.

Let’s dive in.

🚗 CCC Intelligent Solutions (CCC) Company Overview

Founded in 1980, CCC started as an estimating tool for auto insurers. Over four decades, it has evolved into a mission-critical software infrastructure at the center of the collision repair ecosystem, from claims handling to repair processes to parts ordering and fulfillment.

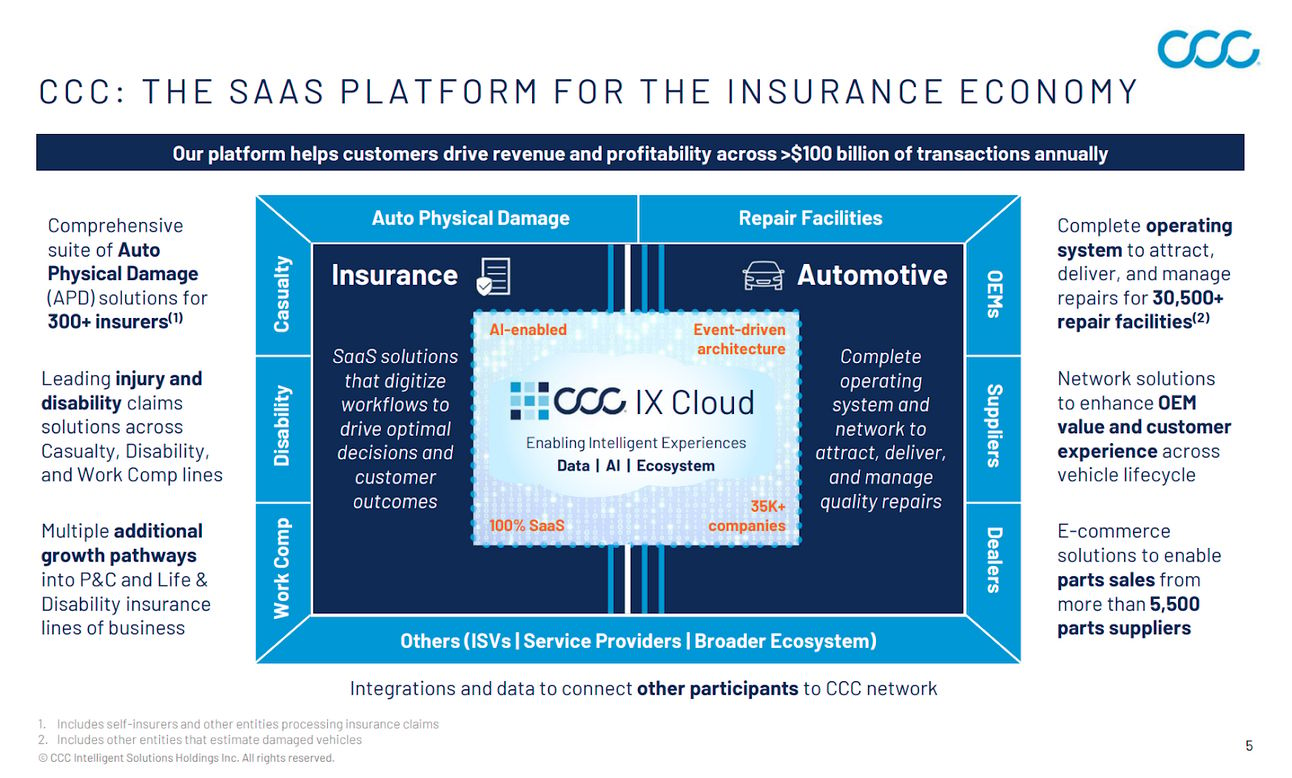

Today, CCC has evolved from a niche estimating tool into a mission-critical software infrastructure, enabling over $100B in transaction value and driving a $6B market cap. CCC supports 35,000+ businesses across the property & casualty insurance economy, including:

300+ insurers (26 of the top 30 auto carriers)

26,000+ repair facilities

Parts suppliers, OEMs, lenders, and other stakeholders

Its business spans three pillars:

Insurance solutions (48% of revenue)

Repair solutions (44%)

Parts solutions (8%)

In 2025, CCCS announced the acquisition of EvolutionIQ, a venture-backed AI platform for claims handling, specifically disability and workers’ compensation. This acquisition further reveals its ambition to further leverage AI and its proprietary transaction and collision data to underwrite more effective policies for auto insurers

🌐 “Come for the Tool, Stay for the Network”

CCC has pioneered the Direct Repair Programs (“DRP”) in 1992. Direct Repair Programs connect auto insurers and collision repair shops to create business value for both parties and require digital tools to facilitate interactions and manage partner programs.

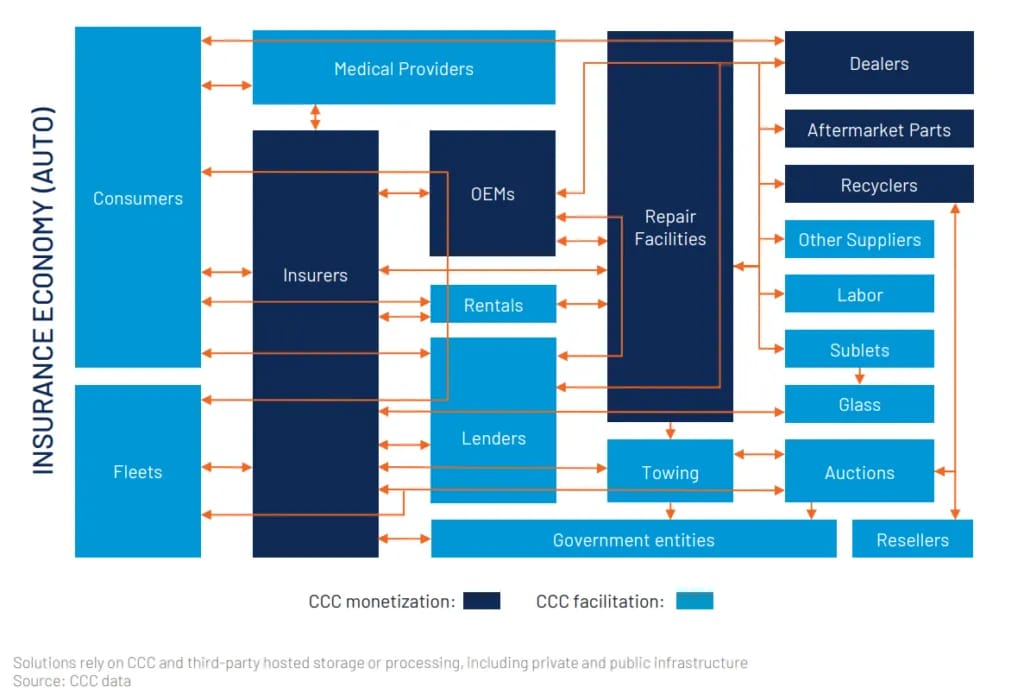

CCC’s DRP infrastructure created a network effect: the more insurers onboarded, the more valuable the platform became to repair shops, and vice versa. This two-sided scale reinforced CCC’s role as a connective infrastructure, beyond a workflow tool.

As the business grew, CCC evolved into a multi-product company with the introduction of solutions for shop management, parts ordering, payments, and consumer engagement. These additions enabled users to consolidate and unify their systems of record and workflows.

Source: CCC Investor Presentation

♟️ Extending Through the Value Chain

The vast network helps solve the "many-to-many" problem in the P&C insurance ecosystem, streamlining interactions and reducing costs. While these features focused on solving operational and workflow needs for insurers and repairers, CCC recognized an opportunity to expand its services across the value chain

From Estimator to Repair Shop OS: Starting with claims estimation for insurers, CCC quickly became the system of record for auto body repair shops.

From Repair Shop OS to Parts Marketplace: CCC connected the supplier’s suppliers, building a two-sided marketplace for OEM and recycled parts.

From Workflow to Industry Platform: Today, CCC unites insurers, repairers, lenders, OEMs, and more, facilitating $100B+ transactions on one shared digital fabric.

For an insurance company, a claim is not just the payment. We describe it as a domino that kicks off potentially hundreds of microtransactions, all of which require dozens of different companies to come together… What we try to do is digitize that economy. Today, we have more than 30,000 companies on the CCC cloud – and our job is to power the decisions and experiences in a digital way so the consumer experience can be great, and all those different industry participants can be efficient and profitable and have growing businesses.

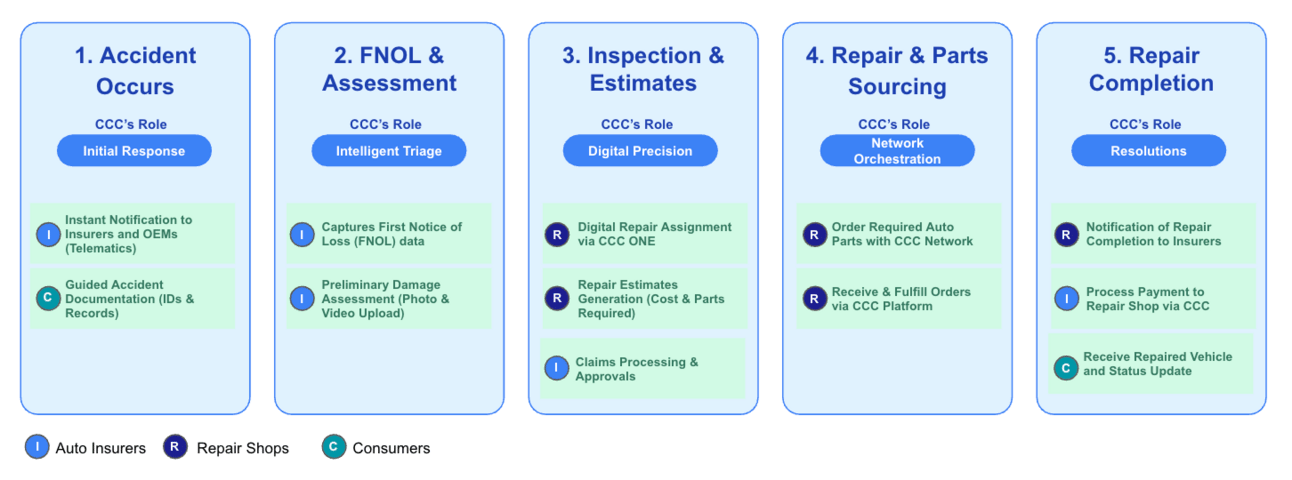

Illustrative Example: CCC’s Role in a Car Crash Scenario

When a car crash occurs, CCC's platform orchestrates a digitized process by managing critical hand-offs and ensuring continuous connectivity among all stakeholders.

1. Accident Occurs: CCC receives crash data via telematics and facilitates instant reporting with OEMs and Insurers

2. FNOL & Assessment: The insurer receives this First Notice of Loss (FNOL) data directly through CCC. CCC then determine if the vehicle is a total loss or repairable, then hands off the recommendation to the claims team.

3. Vehicle Inspection: The insurer digitally assigns the claim to an in-network repair shop via CCC ONE. The repair shop then conducts the vehicle inspection, utilizing CCC ONE's estimating tools to generate estimates. This estimate is handed back to the insurer through the CCC platform for approval.

4. Repair & Parts Outsourcing: The repair shop leverages CCC's integrated Parts Marketplace to order parts (OEM, aftermarket, recycled) from vendors. This handling of parts requests and subsequent order fulfillment is managed within the CCC ecosystem.

5. Repair Completion: Once the repair work is completed and the vehicle is ready for pickup, CCC automates status updates for the consumer, ensuring they are continuously informed. Simultaneously, CCC streamlines the payment processing from the insurer to the repair shop

⚠️ Mitigating Zero-Sum Situations

When VMS expands across the value chain, you have multiple participants in a transaction, sometimes the incentives are misaligned, or there are inherent conflicts because each side is trying to optimize something slightly different.

In CCC’s case, the collision repair ecosystem is riddled with zero-sum dynamics, where auto insurers and repair shops have conflicting objectives:

Repair Cost Estimations: Insurers aim to minimize payouts, while shops seek to maximize revenue for labour and materials

Parts Sourcing: Insurers prefer cheaper aftermarket or recycled parts, while repair shops push for OEM parts to ensure quality and reduce liability

Total Loss Decisions: Insurers may prefer to write off a vehicle, while shops advocate for repairs to retain the job

In an interview with Githesh Ramamurthy, the CEO of CCC, he described this conflict as “one of the most fundamental problems” for the company. CCC has to be understood as the neutral third-party arbiter of information, and they have to justify their estimates with a shared source of truth.

Therefore, they have partnered up with industry data organization Motor Information, a division of the Hearst Corporation, which organizes and discloses data such as parts prices, labour prices, overlap logic, steps to repair each vehicle, etc. The more people that used the product, the more people that used the solution, the more feedback they got, and the more accurate CCC could be with their decisions.

🌟 Lessons for VMS Expanding Across the Value Chain

1. Extend from Core to Ecosystem

CCC started with a wedge by helping auto body repair shops estimate total loss values. From there, they expanded to insurers, then to parts suppliers, and eventually became connective infrastructure across the entire auto insurance economy.

The integration of each additional stakeholder group across the value chain has created deeper workflow depths for all stakeholders

2. Solve Coordination Before Monetization

CCC’s parts marketplace didn’t come first. It came after they owned the repair-insurer handoff. By first solving workflow orchestration (DRP, claims, approvals), CCC created a foundation where transactions could occur without friction.

3. Strive to Be the Neutral Arbiter of Information

Value chain expansion almost always brings you into conflict zones, where incentives between stakeholders don’t align. CCC’s masterstroke was building trust and a shared source of truth through transparent, third-party-anchored data (via Motor). It allowed them to be a neutral arbiter of information

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources