- Network Effects

- Posts

- Carta: Operational Infrastructure for Private Capital

Carta: Operational Infrastructure for Private Capital

How Carta evolved from a Cap Table software for startups to a multi-product ERP for Institutional Investors and private companies

Welcome to the 14th Network Effects Newsletter,

If you're new here, this newsletter is all about unpacking the vision, strategy, and execution behind the world’s leading tech companies.

Today, we’re exploring Carta, which was founded in 2012 by Henry Ward (CEO)

Let’s dive in.

📝 Overview

Carta is a software platform for equity management for private companies and fund administration for funds. It was founded to digitize capitalization table management, which is a manual and complex process that involves issuing stock options, closing a fundraising round, and managing liquidity events.

Following the success of its equity management offerings, Carta has successfully expanded its capabilities to include 409A valuations, compensation management and tax services, eventually serving funds with their formation and administration needs.

One of Carta’s unique advantages is its multi-sided network effect, as its platform is used by founders, general partners (GPs), limited partners (LPs), and employees. It has slowly evolved into the default cap table management software for startups and venture capital funds, with over 35% of venture-backed companies reportedly choosing Carta for their capital management needs.

As of 2024, Carta administers nearly $100 billion in assets across 30,000 companies and 8,000 funds and SPVs. Carta reported $370 million in ARR at the beginning of 2024, with its cap table business generating the bulk at $250 million, followed by fund administration ($100 million), private equity ($20 million) and secondary trading ($3 million).

As of 2021, Carta was valued at $7.4 billion when it raised a $500M Series G round led by Silver Lake, representing a 46x ARR multiple. However, the valuation has fallen to ~$3.5 billion as of January 2025, bringing its implied revenue multiple down to approximately 9.5x based on its reported 2023 annual revenue.

📌 Thesis 1 - Multi-Sided Network Effects Across the Capital Stack

Carta initially tackled the inefficient, underserved process of paper stock certificates and 409A valuations. This seemingly small market was merely Carta’s "wedge" to become the system of record for private companies on equity ownership. As Carta expands its offerings beyond cap table services with liquidity solutions, tax services, and fund administration, it has created a powerful network effect, as companies, investors, and law firms have converged on its platform

This has organically created interactions at an exponential pace, further spreading and validating Carta’s market leadership. For example:

Employee-to-Founder: Employees from Carta-managed companies, who go on to found or join new ventures, instinctively bring Carta with them, propagating adoption.

Investor-to-Company: VCs and LPs, already accustomed to Carta's transparent reporting for their existing portfolios, increasingly expect or even mandate that new investments utilize the platform. This is reinforced by venture funds directly offering Carta at a discount, creating a "default" for their portfolio.

Inter-Investor: New venture funds and family offices, experiencing Carta's efficiency through their investments in existing Carta-powered companies, are driven to use it for their fund administration.

Peer-to-Peer: Organic referrals amongst founders, investors, and legal professionals further amplify adoption, validating Carta's market leadership.

Complementing its product expansion across the value chain, it has created immense switching costs and established itself as the “default” for equity management systems

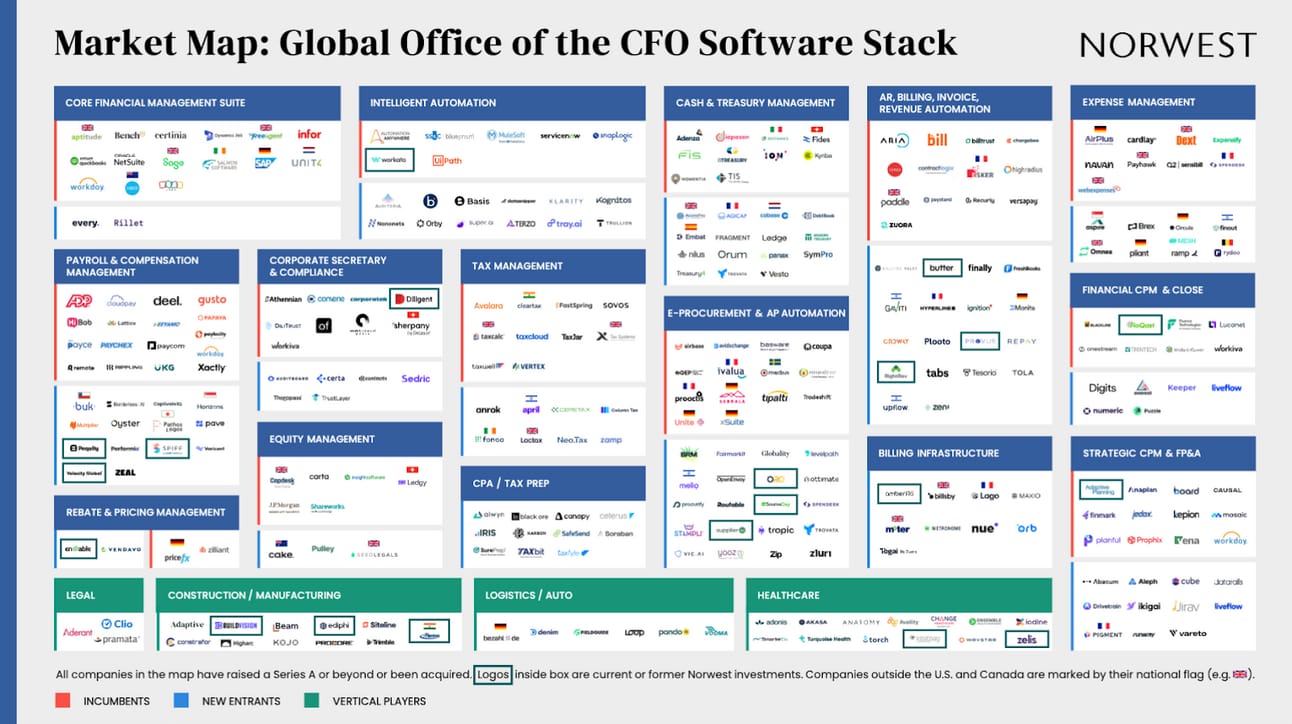

Source: Norwest Venture Partners (Note: For Company CFOs, not Fund CFOs)

📌 Thesis 2 – White-Space Market Opportunity for Fund CFOs

As Carta pivots away from pursuing its exchange solution, CartaX, the company has identified its next growth opportunity in becoming the de facto ERP platform for Fund CFOs, addressing all their operational needs. In February 2025, Carta released the statement “An ERP for Private Capital”, subtitled “Carta’s next evolution—An ERP for Private Capital”, indicating Carta’s intent to expand its fund administration to cover the full stack for fund CFOs.

The competitive landscape for CFO software stack is highly fragmented, with many tools covering many capabilities from billing to procurement to tax to compliance to treasury to pricing to expense to financial planning & analysis (FP&A). However, there is a different story for funds; many of these processes are still being performed manually with spreadsheets, leaving white-space for fund administration providers.

Many existing fund administration providers (e.g., State Street, Northern Trust) are primarily outsourcing service providers, lacking the engineering talent and product-led operating model that Carta possesses. Carta views this as an opportunity to expand its capabilities to cover various funding needs. The acquisition of Tactyc in October 2024 further catalyzed the acceleration of its product vision to become the integrated fund operations platform for capital providers and managers.

🌱 Genesis Story

Henry Ward had studied computer science and mathematics at the University of Michigan and then worked on software for fixed-income traders at Reddworks and Between Markets. After pursuing an MBA in 2010, Henry founded his first venture, Secondsight, which was a robo-advisory platform to modernize wealth management.

Henry Ward and Manu Kumar met during Ward's attempt to raise funding for Secondsight. Kumar, an investor at K9 Ventures, suggested Ward consider addressing the challenges of managing stock certificates and cap tables for private companies, which led to the co-founding of eShares, later renamed Carta.

At its inception, Carta entered a new software category for which companies had neither budgeted nor established trust in software. Consequently, Carta struggled to acquire early customers. However, Henry found alternative ways to acquire customers through its 409A valuation services, which are mandatory for private companies to complete as part of their legal and accounting requirements.

During the same time, Henry tried to raise seed capital from investors and was often faced with rejections due to the perceived lack of market potential with equity management. However, Henry would offer discount codes to venture investors to help their portfolio companies with their 409A valuation processes. This proved successful, as investors were seeking new ways to support their portfolio companies.

As traction grew, law firms also began to adopt Carta as their primary equity management platform for clients. Legal professionals are incentivized to reduce fragmented software usage, and as Carta was the first equity management software introduced to them, they embraced it, creating defensibility and distribution for Carta.

"I would just run my finger across the keyboard, it didn't matter... I just make something up and say, 'Here's the discount code, give it to your portfolio companies and they'll get a free first year 409A'... they would forward it to their CEOs... and they CEOs that all forward it to me going, 'Hey, my investor recommended you.'"

Case Study: The Evolution and Retreat of the CartaX

Carta's founder, Henry Ward, envisioned creating a liquid exchange for private company ownership long before he fully recognized the market size for cap table management. This ambitious vision culminated in the launch of CartaX in 2020, shortly after Carta had solidified its position as a market leader in equity management following a $300 million Series E raise

While Carta has all the conditions to succeed in building the exchange platform for private company equity shares:

1) Extensive Distribution: Access to equity holders (i.e., founders, employees, investors) across 35% of venture-backed companies and venture funds

2) Centralized Records: Serving as the system of record for venture funds, family offices, and other institutional investors

3) Strong Market Demand: A clear need for liquidity as private companies increasingly stay private for longer periods

However, the reality of CartaX didn't align with these expectations, leading to its shutdown in January 2024. While adoption hasn’t been strong, Carta has recognized that CartaX often created misalignment problems for the issuers of the shares, not just the buyers or sellers. These challenges included:

1) Incentive Misalignment: Early sales could potentially de-incentivize employees and dilute their long-term alignment with the company's success.

2) Unwanted Investors: Attracting short-term, speculative investors who might not be strategically aligned with the company's long-term vision.

3) Activism Risk: Exposure to risks of shareholder activism or unwanted takeovers from firms not vetted by the company.

4) Over-solicitation: Reports of investors feeling "bombarded" to invest in new share issuances on the platform, which could lead to a negative perception.

“It's more that we don't want Carta to be the same icky broker that everyone else is out there, where you’re just emailing random people all the time. I've been getting those emails for the last 15 years of my life from random people…. it's more about how you make sure you can be in alignment with your customers and continue to unlock what's best on behalf of the company. A big part of that is trust

Arjun Sethi, Co-Founder of Tribe Capital, Carta Board Member

“Because we have the data, if we are trading secondaries, people will always worry that we are using the data, even if we are not….. So we have decided to prioritize trust, and exit the secondary trading business”

🖥️ Products & Services

Source: Carta

Equity Management (Ventures)

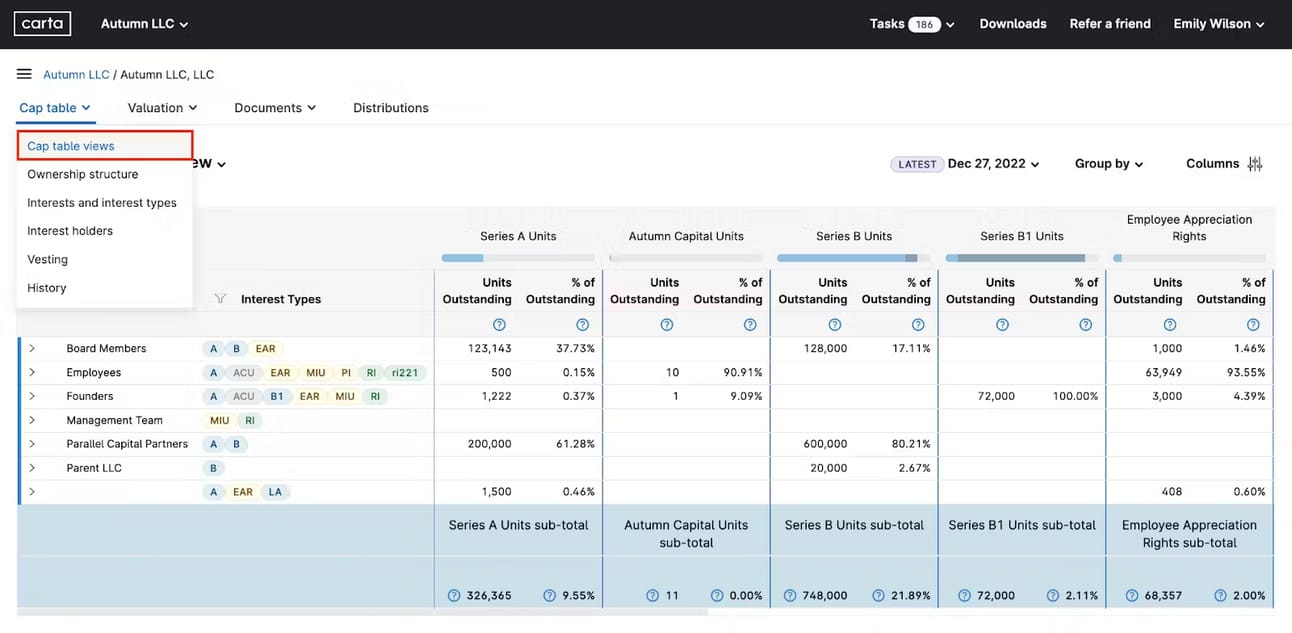

Carta provides cloud-based cap table management software to streamline equity ownership for private companies. Essentially, Carta helps businesses:

A. Cap Table Management

Centralize and manage the company's ownership data in real-time, including administering employee stock options and issuing new securities at new fundraising rounds. The platform includes integrated stakeholder communications, HRIS and payroll system integrations, and secure money movement via ACH and wire transfers as an SEC transfer agent.

B. 409A Valuations

Annual 409A valuations are legal requirements for private companies with over 10 employees and more than $5 million in fundraising. Carta's 409A Valuations product manages the expensing of stock-based compensation and simplifies the administrative process for employees to exercise incentive stock options (ISOs)

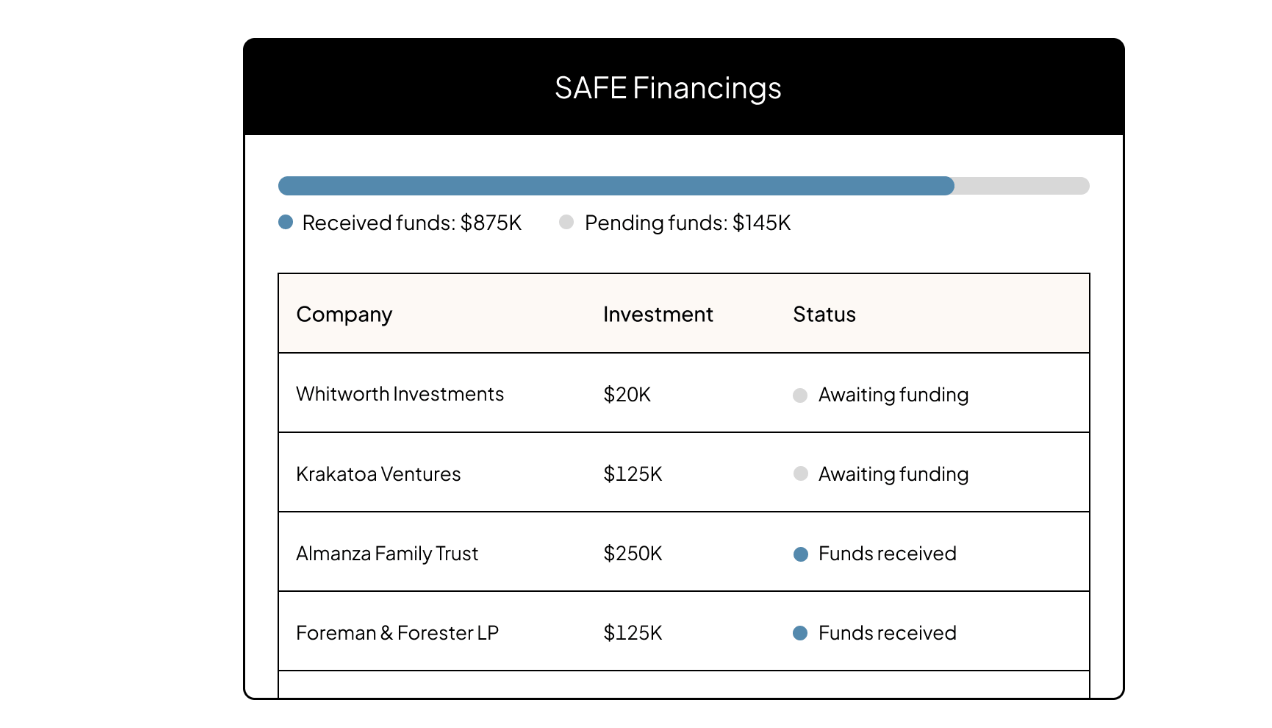

Dashboard Interface for SAFE Financing, Source: Carta

C. SAFE Financing

Facilitate the end-to-end process for Simple Agreement for Future Equity (SAFE) agreements, from contract creation to signature collection to funding distribution. Carta will connect and coordinate with investors and manage the transfer of funds.

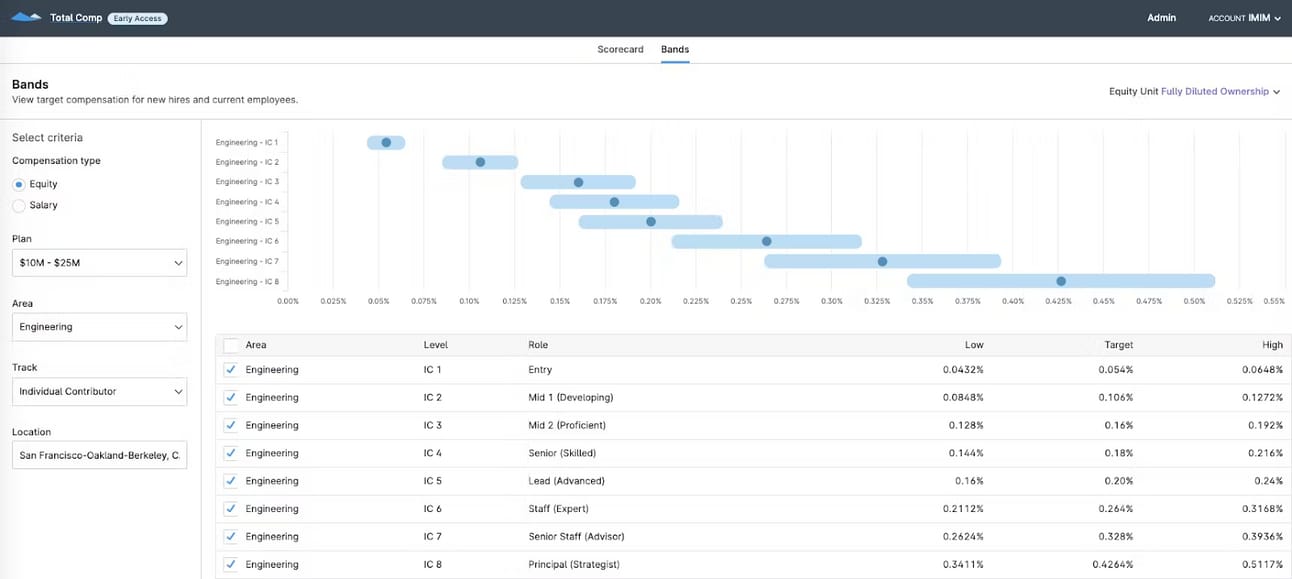

D. Total Compensation

Benchmark compensation packages against industry standards, develop and iterate on compensation plans, and address pay inequities. The benchmark product offers insights across various roles, levels, and regions, and is refreshed quarterly.

Interface for Company Shares Sellers, Source: Carta

E. Liquidity

Provides end-to-end control over the tender offer process (e.g., management and funds buying back shares from employees or other shareholders), from setting terms and selecting buyers to approving orders. It incorporates a user-friendly workflow management system that guides eligible sellers through offer review, document signing, and proceeds estimation through their accounts.

Interface for Equity Advisory (Formerly Year End), Source: Henry Wards Medium

F. Equity Advisory

Provide tax advisory services to startup employees, including tax analytics and one-on-one and education sessions, allowing employees to understand the costs associated with exercising options. This service is the result of the acquisition of YearEnd in 2021, which was founded by two former Carta employees.

G. Carta Conclusions

Carta provides founders with comprehensive guidance and handles all the operational busywork involved in dissolving a company. This service manages the entire complex process, including:

Creating employee severance packages.

Cancelling vendor agreements.

Unwinding customer contracts.

Filing IRS dissolution tax returns.

Tying up shareholder liabilities and returning money to shareholders.

Shutting down internal systems and bank accounts.

Notifying Delaware and all registered states of the dissolution.

This allows founders to navigate company dissolution efficiently and compliantly, minimizing stress and administrative burden.

Fund Management (Funds)

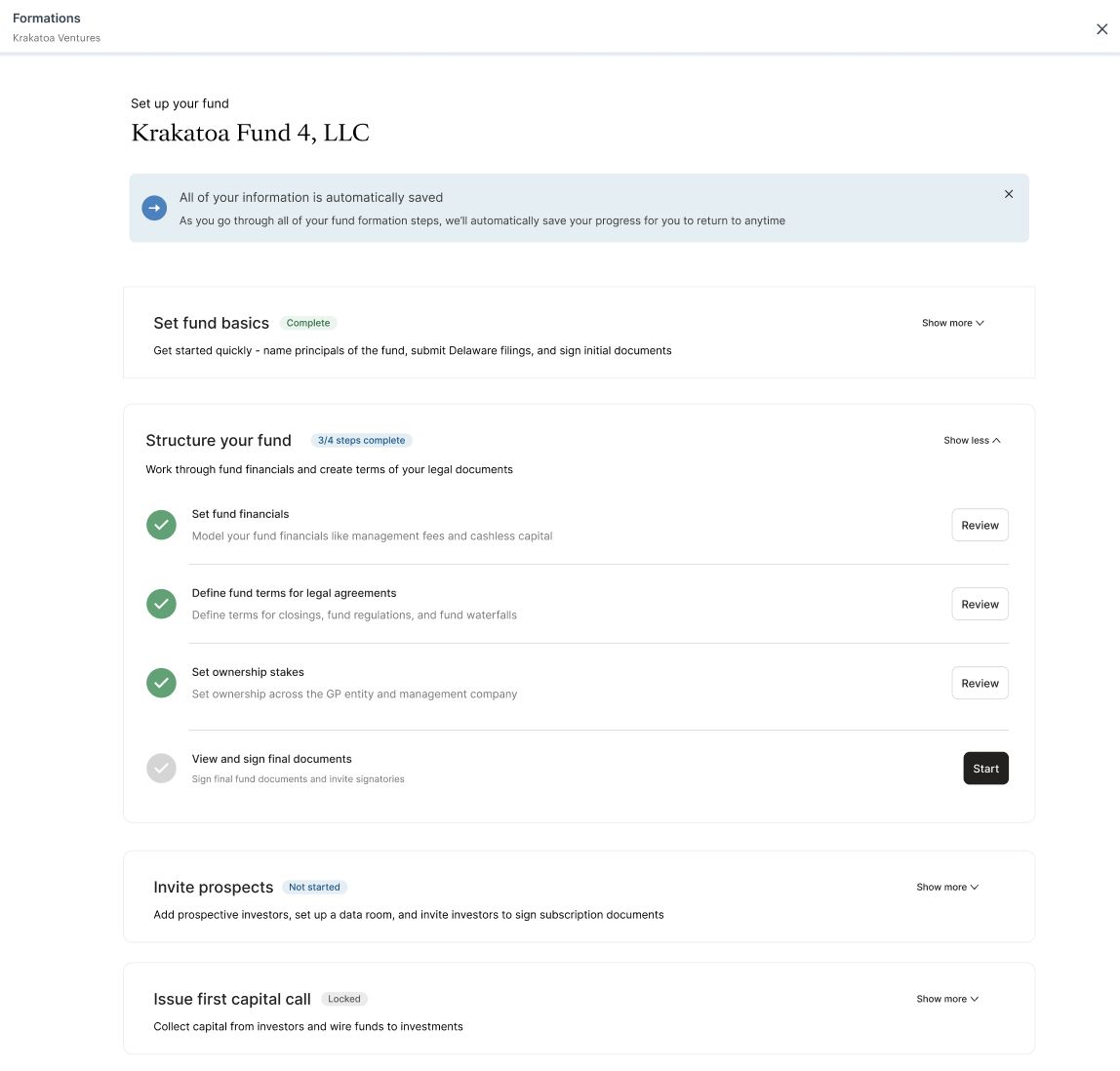

Fund Formation Onboarding Interface, Source: Carta

A. Fund Formation

Carta streamlines the process of establishing a fund's legal entity, from defining terms and planning capital calls to signing formation contracts and closing with LPs, typically within six weeks. Currently, Carta supports four fund types, as follows:

Venture Fund, formed as a limited partnership (LP)

General Partner Entity, formed as a limited liability company (LLC)

Management Company, formed as a limited liability company (LLC)

Special Purpose Vehicles (SPVs)

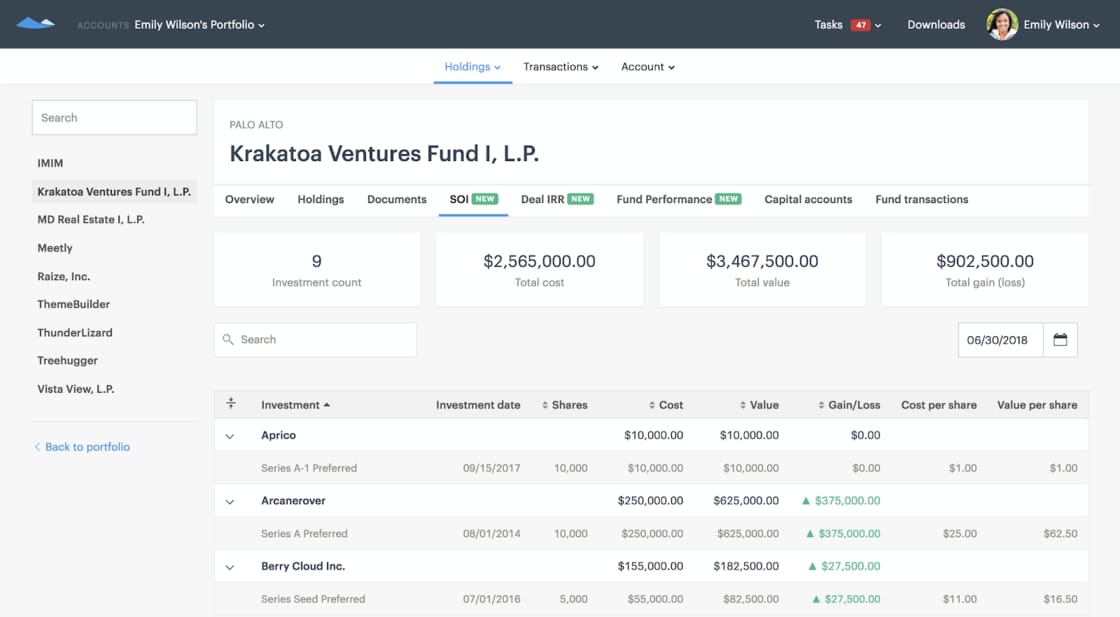

Fund Administration Portal, Source: Carta

B. Fund Administration

The fund administration platform is the core operating system for funds to manage capital portfolios, with a range of tools including:

Performance Analytics: Provides investors with real-time access to core fund performance metrics, including IRR, TVPI, DPI, and RVPI.

Waterfall Modelling: Enables detailed analysis of various fundraising and exit options, helping users understand potential financial impacts on all existing shareholders and limited partners.

Capital Calls & Distributions: Allows users to initiate and manage capital calls, distributions, and new investments directly.

Virtual Data Rooms: Features include integrated document tracking with access control, ensuring secure and organized sharing of sensitive fund for due diligence.

Investor Relations: Provides LPs with secure, personalized access to their investment performance and reports through a dedicated LP portal.

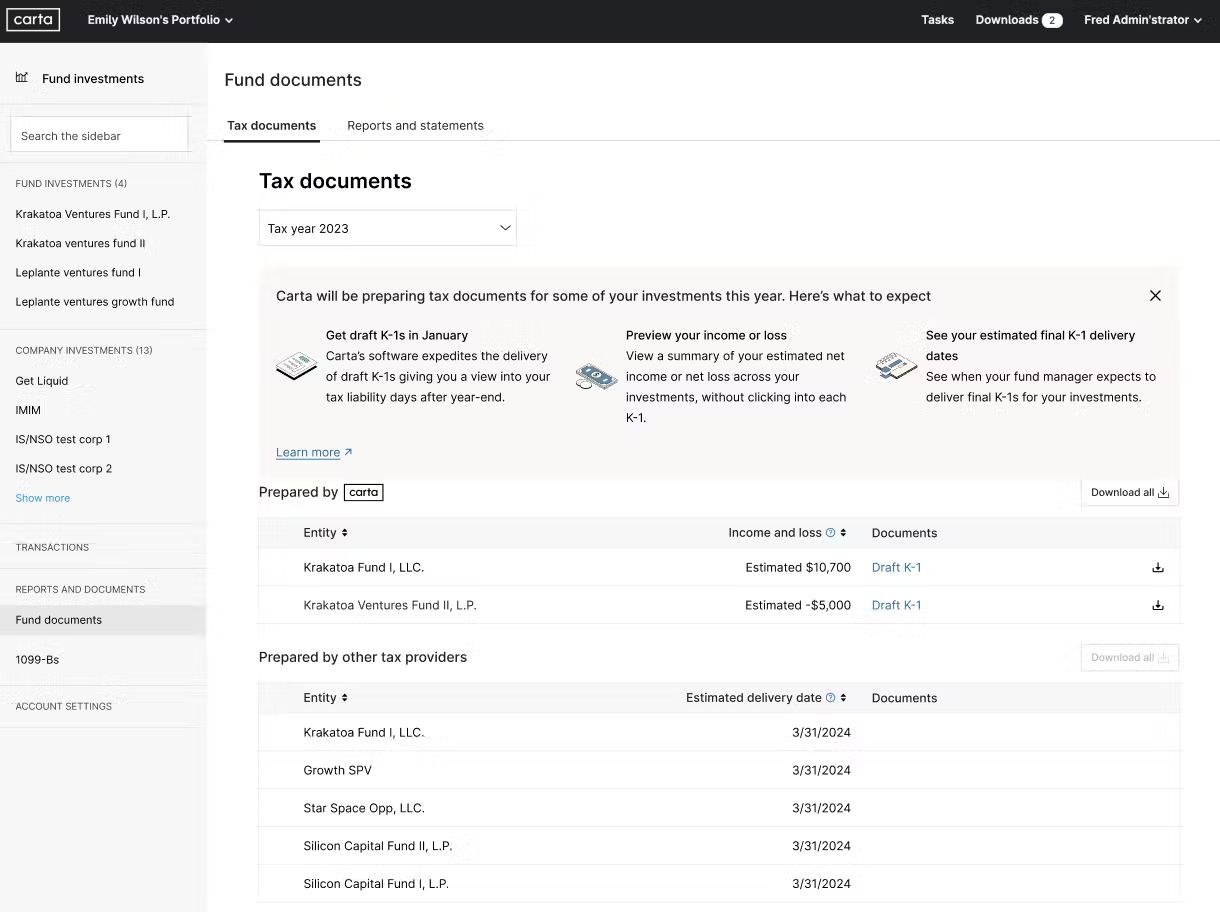

Interface for Fund Tax, Source: Carta

C. Fund Tax

Carta provides an integrated tax preparation and filing service, centralizing your fund's accounting and tax management for clear visibility. Work directly with Carta’s in-house tax teams to efficiently prepare Form 1065s and K-1s, ensuring compliance with tax obligations and optimizing potential tax savings.

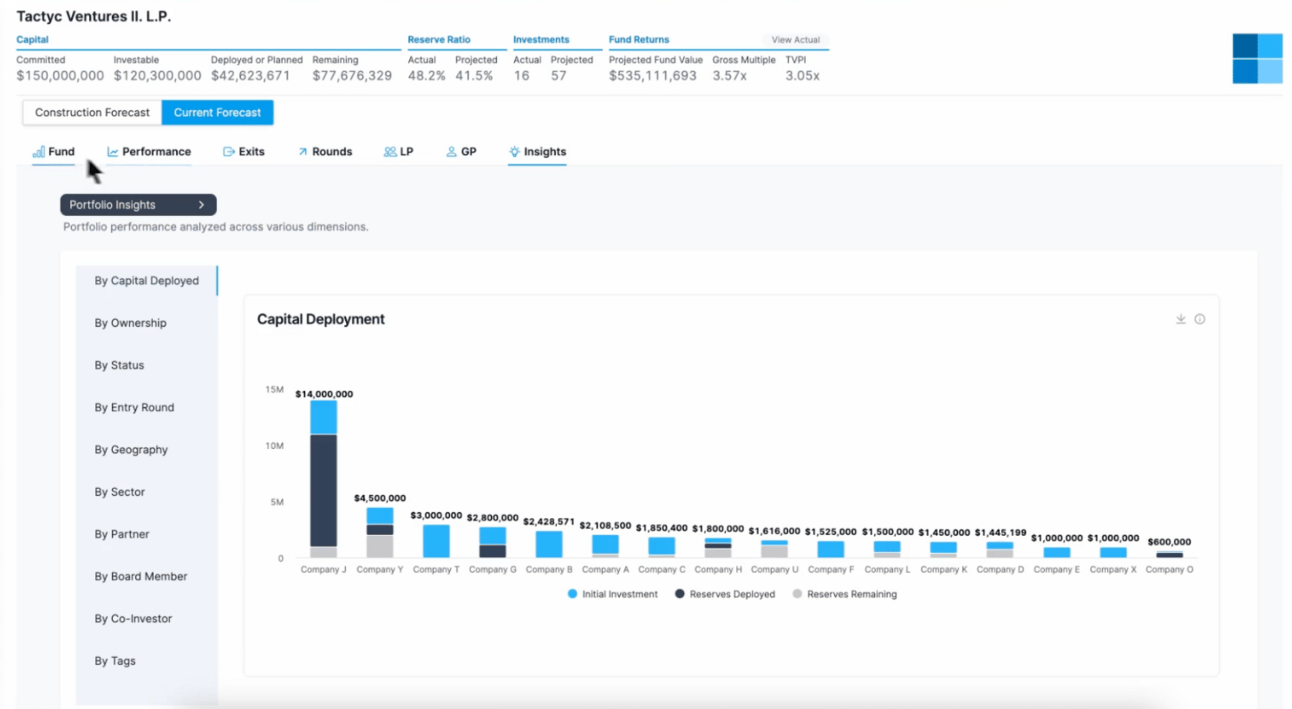

D. Tactyc Forecasting & Planning

Tactyc is a Unified platform for portfolio modelling, management & reporting, which includes three forecasting and planning modules:

Portfolio construction for building your fund strategy

Forecasting and planning for optimizing the performance of your portfolio after deploying capital

Portfolio insights for monitoring the KPIs of your portfolio companies.

Tactyc was acquired by Carta in October 2024 for an undisclosed amount. Tactyc was previously valued at $10M during its last capital raise in 2022.

🏢 Markets

Carta’s core customers are venture-backed startups and venture funds. Early-stage startups convert into paid customers as they grow and raise more capital, while investors engage in rounds with startups already using Carta for fund formation and administration.

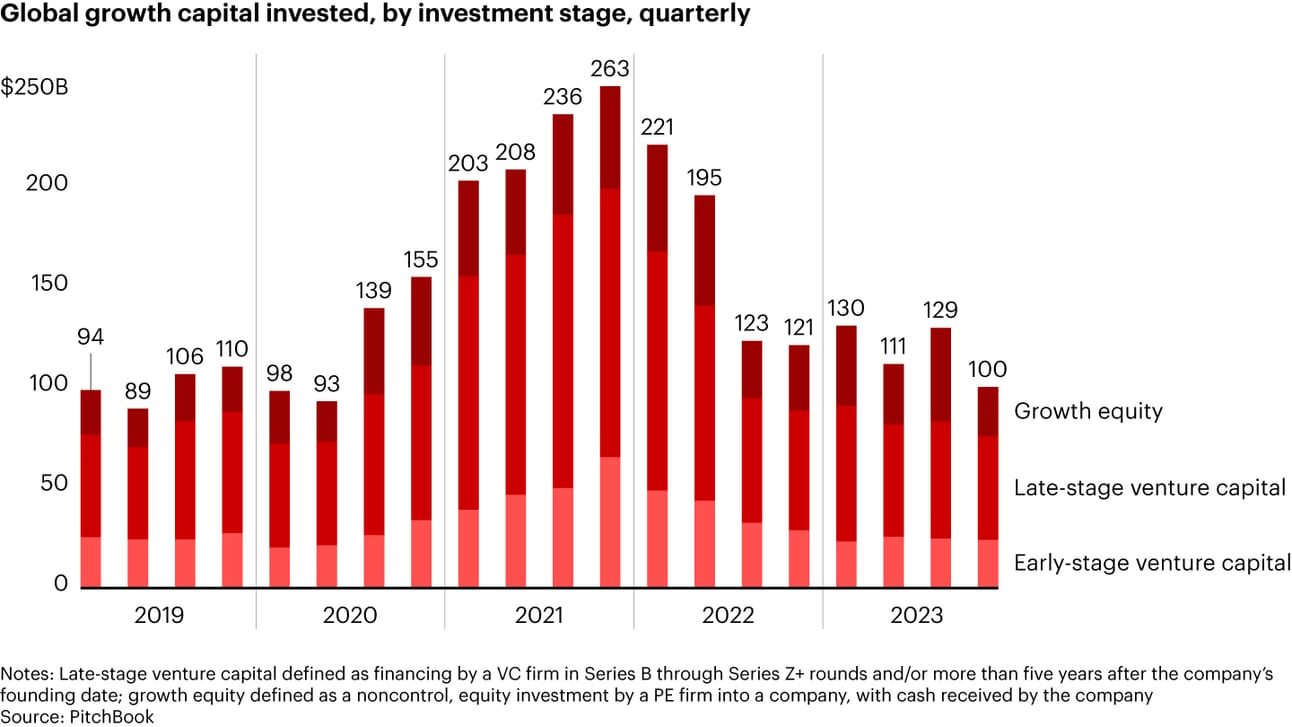

According to Bain & Company, investment activities in venture capital and growth equity have fallen to $100-120B per quarter, with both the growth and venture capital segments continuing to drift sideways. Both focus on riskier, earlier-stage companies whose growth-based valuations are particularly vulnerable to interest rate pressure.

The market opportunity for Carta is driven by the growth in venture-backed companies and venture funds. Venture capital funding has matured, with approximately $20B raised quarter over quarter, deploying into 1,000-1,500 fundraising rounds by venture-backed startups.

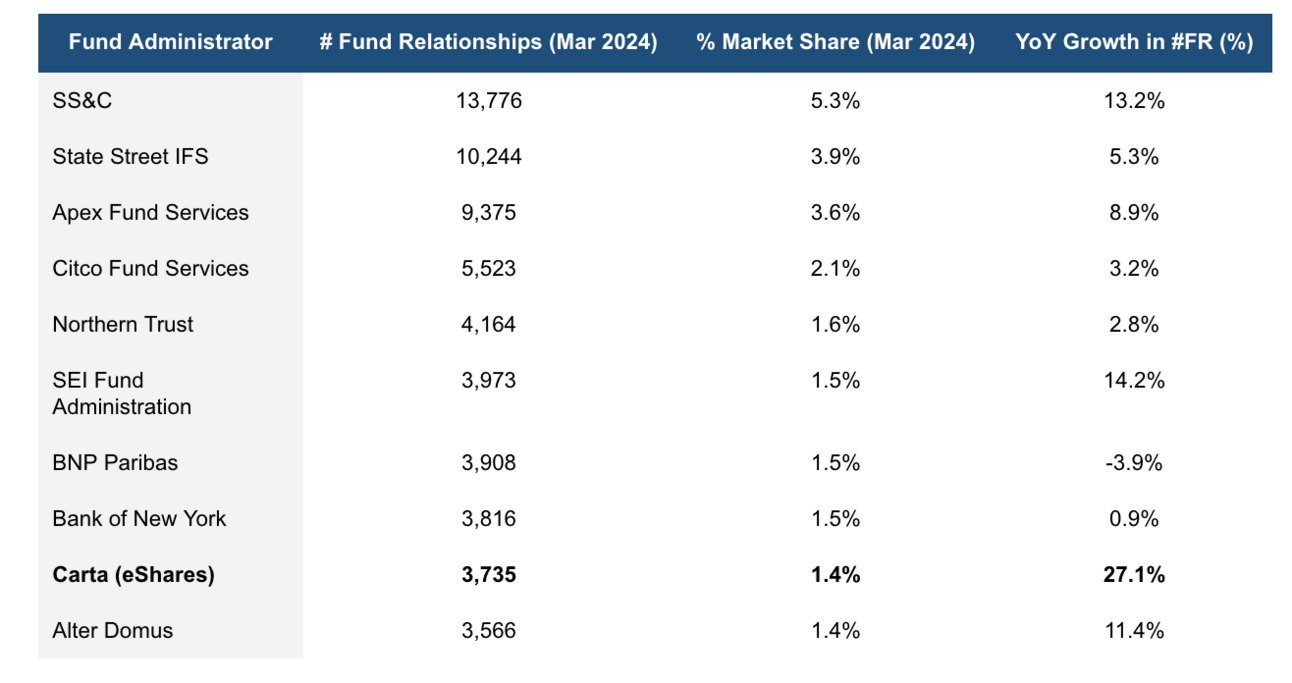

While Carta's penetration in startup cap table management is profound, its footprint in the broader fund administration market presents a different picture. Carta (Eshares) ranked 9th in March 2024 among fund administrators by fund relationships, holding a 1.4% market share with 3,735 fund relationships, behind incumbents such as State Street, SS&C, and Apex Fund Services. This is because fund administration is an established market servicing capital managers beyond venture funds, including private equity and multi-asset managers.

⚔️ Competitions

Carta's competitive story is one of dual fronts. They've earned market leader status in equity management for venture-backed startups, particularly cap table software. Other contenders include:

Pulley (~$250M valuation) is the most direct challenger, focusing on founder-friendly cap table solutions, intuitive UX, and often more attractive pricing for early-stage companies. They're actively chipping away at Carta's stronghold by emphasizing ease of use and dedicated support.

AngelList Equity (~$4B valuation) leverages its broader funder-startup network, offering competitive cap table services, notably by not charging for investor stakeholders—a significant cost saver for many funds and companies.

Pave (~$1.6B valuation) specializes in compensation management, providing deeper analytics and benchmarking beyond Carta's integrated offerings

Larger players like Shareworks by Morgan Stanley and Certent continue to serve more mature, often public, companies with complex equity structures and stringent compliance needs.

In fund administration, which includes funds beyond venture capital investors, Carta is ranked 9th with 1.4% market share and is rapidly growing against entrenched institutional giants

The Incumbents include SS&C Technologies, State Street, Apex Fund Services, Citco, and Northern Trust. They offer full-suite, institutional-grade services built over decades, with vast scale and deep regulatory expertise. They handle the complex accounting, reporting, and compliance for diverse private capital funds.

Specialized Platforms include Allvue Systems (for portfolio analytics and fund accounting) and Juniper Square (strong in real estate and broader private markets fund administration) offer sophisticated, integrated solutions.

⚙️ Business Model

Carta generates revenue through its product and services to both venture-backed startups, venture funds and private equity funds.

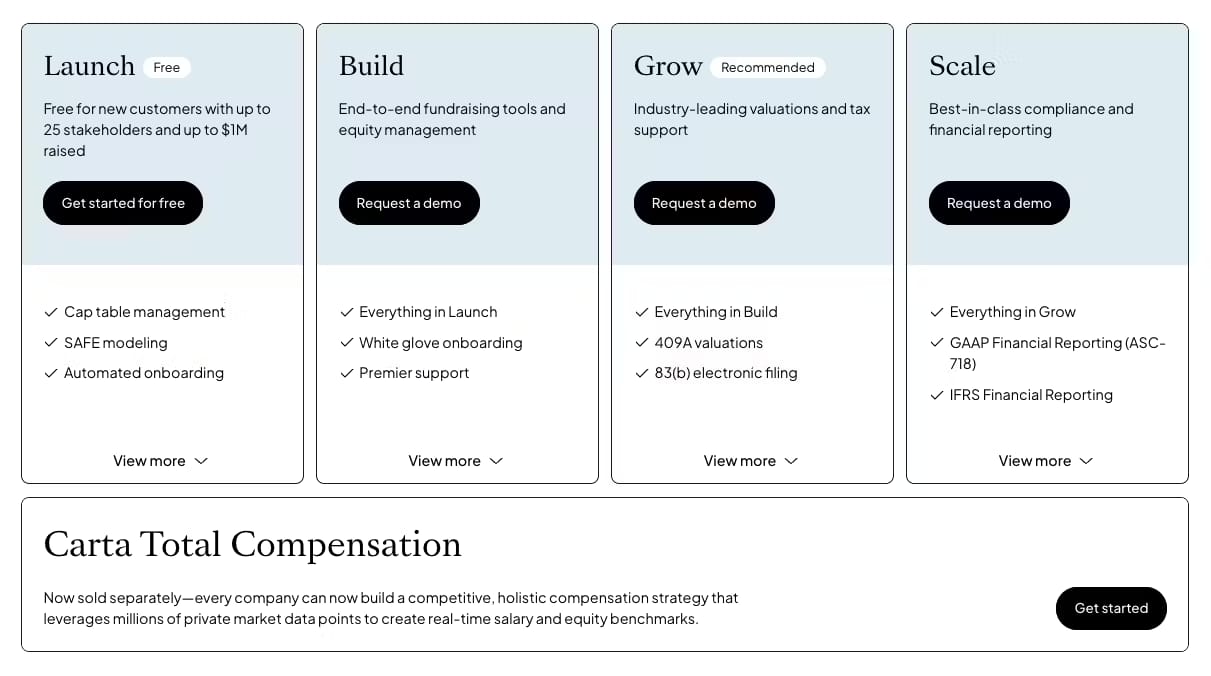

#1 Venture-Backed Startups (Subscription Plans + Add-Ons)

Carta offers four tiers of plans for private company equity management: Launch, Build, Grow, and Scale. The free tier, “Launch,” provides cap table management for smaller, newer startups. Each upgraded tier unlocks additional features, such as 409A valuations, exit modelling, and expense reporting. Customers can separately add liquidity programs, complex 409As, and advanced modelling to their plans.

Additional add-ons, including Carta Total Compensation, Equity Advisory, Liquidity Solutions and QSBS attestations, are sold separately on top of the core subscriptions.

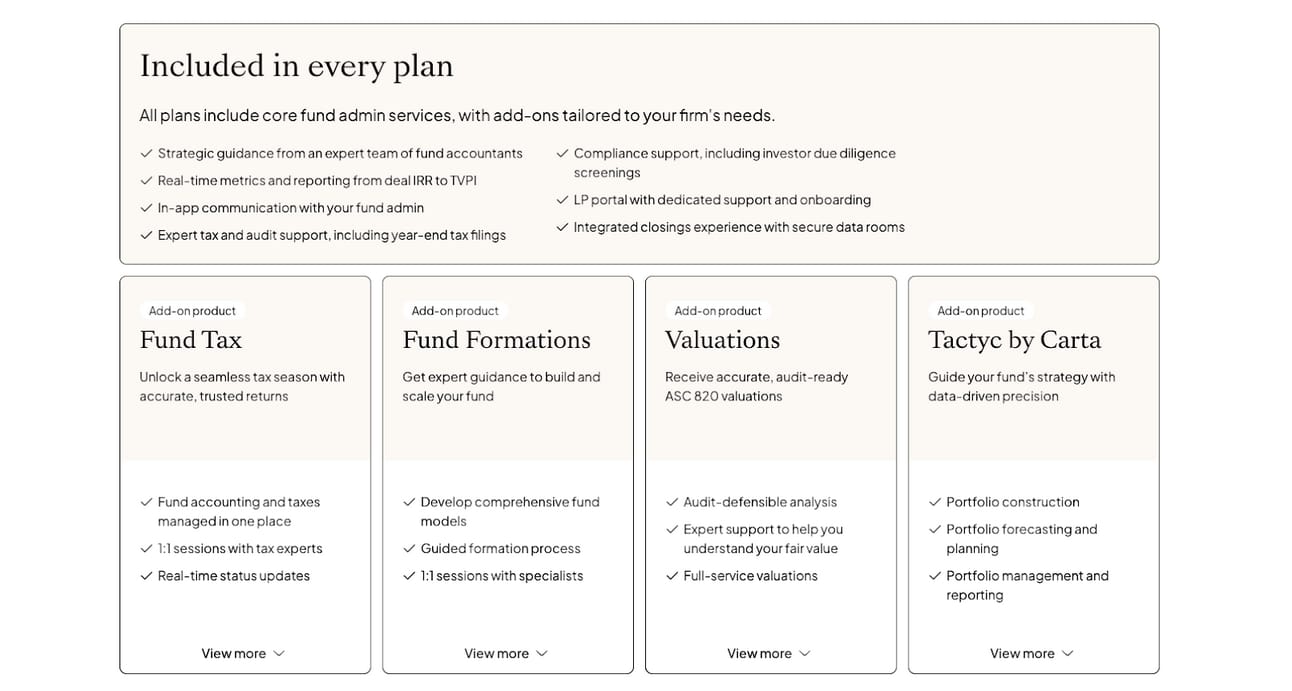

#2 Venture Fund Administration

There is a single subscription plan for fund administration services, which covers the performance analytics, LP communications, tax and audit support for fund managers to manage their portfolios. Additional add-ons include Fund Tax, Fund Formations, Valuations and Tactyc (Portfolio Analytics).

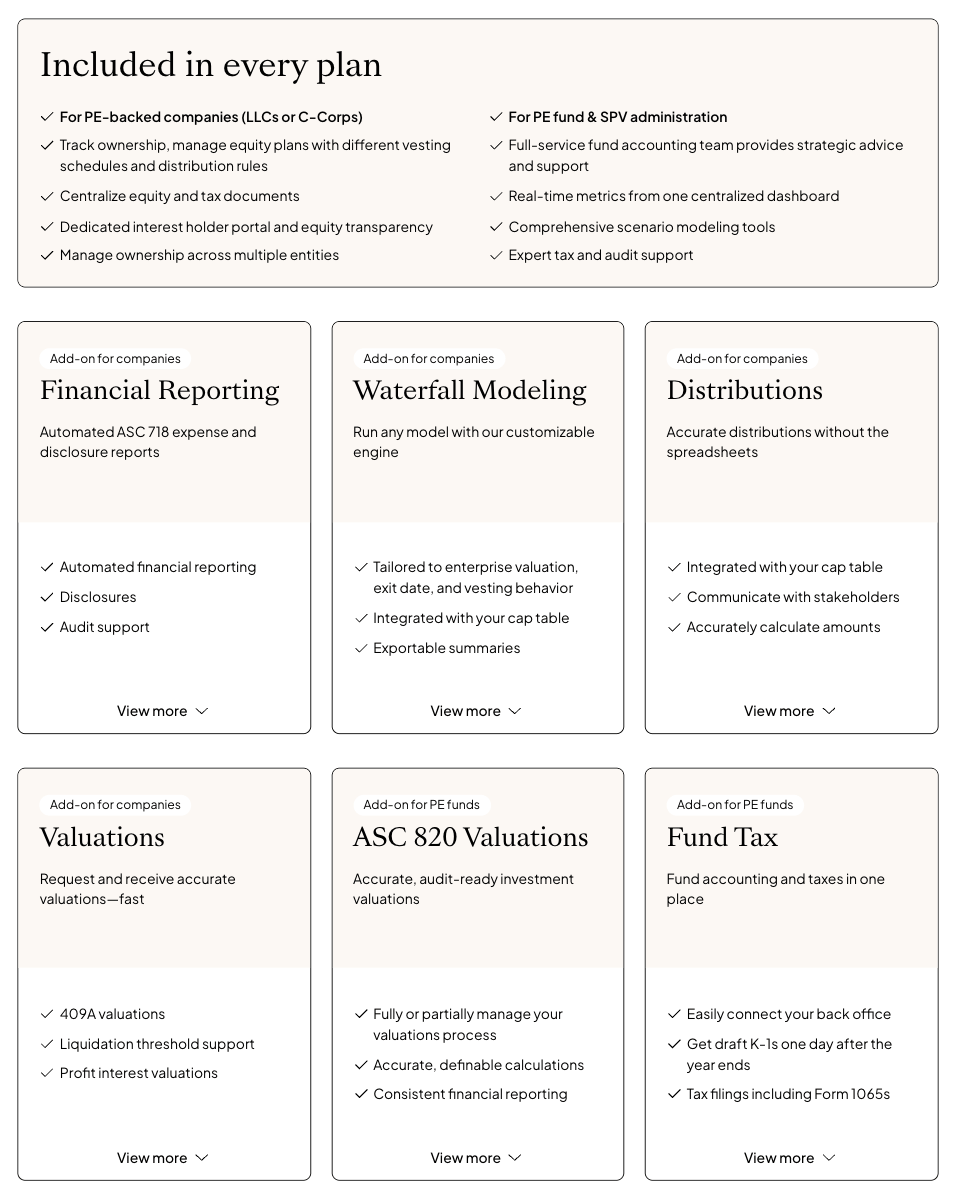

#3 Private Equity Administration

The private equity administration is an extension of the venture fund administration offering, with tailored services to private equity funds, including ASC 820 valuations and waterfall modelling.

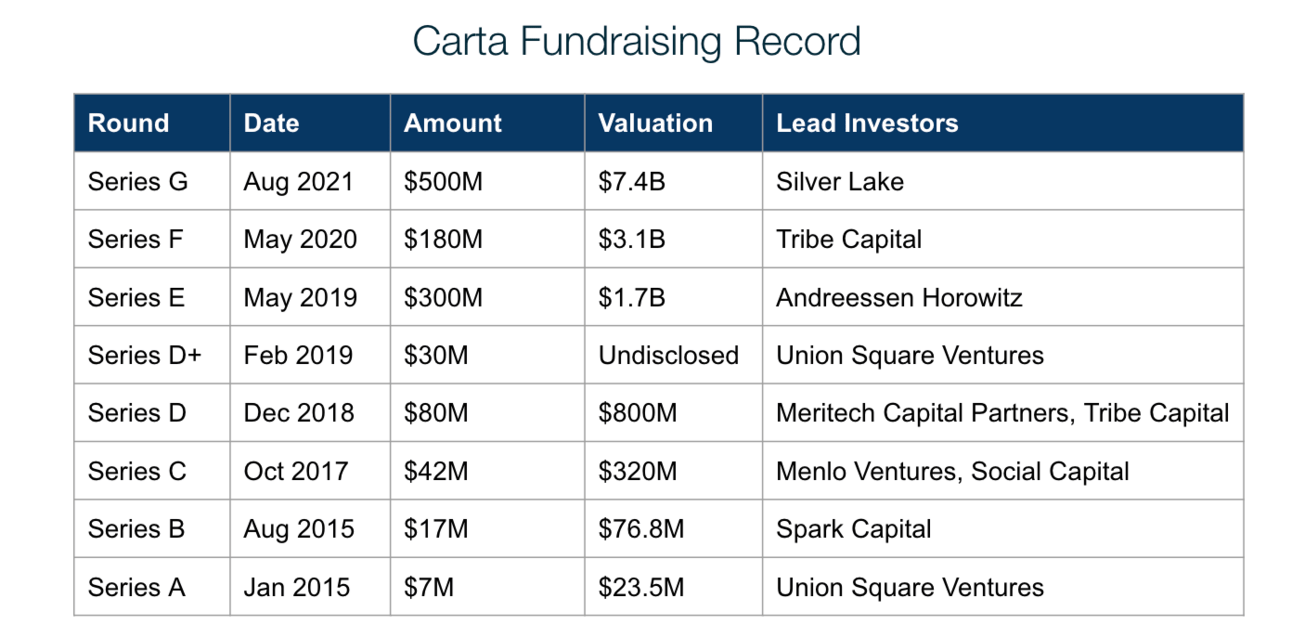

💰Valuations & Fundraising

In August 2021, Carta successfully closed a $500 million Series G round led by Silver Lake, valuing the company at $7.4B. The round took place shortly after a secondary auction held by Carta, valuing the company at $6.9B. This marked a peak in their private market valuation, reflecting the buoyant investment climate of that period.

However, in the subsequent market shift, particularly by January 2025, Carta's valuation on secondary markets reportedly saw a substantial adjustment, decreasing to approximately $3.5 billion. This represents a decline of ~53% from its Series G peak.

The lead investors for the previous round include Union Square Ventures (Series A), Spark Capital (Series B), Menlo Ventures (Series C), Meritech Capital Partners (Series D), Tribe Capital (Series D + F), a16z (Series E) and Silver Lake (Series G)

♟️ Key Opportunities

MENA Geography Expansion

In May 2025, Carta received Financial Services Permission (FSP) from ADGM’s Financial Services Regulatory Authority (FSRA), granting Carta regulatory approval to establish an office and operations in Abu Dhabi, the “capital of capital”. The United Arab Emirates (UAE) has become a significant capital provider in the Middle East, constituting 40% of all funding rounds in the region, with a 9% year-on-year increase.

Carta currently supports several prominent regional customers, including Global Ventures, BECO Capital, Cotu Ventures, Outliers VC, Dubai Future District Fund, and Middle East-based unicorns Foodics and Kitopi. The approval will further accelerate Carta’s ability to capture market shares from startups to capital providers.

Expansion in Portfolio Management (Construction, Modelling & Monitoring) Capabilities

In October 2024, Carta acquired Tactyc, a venture fund forecasting and portfolio construction platform, to further accelerate its product vision by enhancing its fund administration capabilities to include portfolio construction and modelling capabilities. As a result, customers will be able to directly feed portfolio company financial data into Tactyc’s planning and forecasting tools, allowing funds to make informed, real-time decisions on their fund. Over time, we’ll expand Tactyc’s existing product to cover management company budgeting and expand to cover more fund types outside of venture, allowing it to become a well-established FP&A tool in the private capital industry, vertically integrated with Carta’s fund administration platform.

Value Chain Expansion to Target LPs (Limited Partners)

As companies succeed in capturing market share in their primary markets, to further grow and solidify their market presence, companies tend to expand their product through the value chain. In Carta’s case, this means offering their products to Limited Partners (LPs), which are the capital providers to General Partners (GPs).

LPs are likely to have been exposed to Carta’s products and services through their interactions with funds and private companies that are already on Carta’s platform. In addition to their similar needs with GPs with capabilities like asset servicing and portfolio management. LPs have become a prime market for Carta to further solidify their market presence across the capital value chain from asset owners to managers to private companies.

Thanks for reading till the end of the issue. Subscribe to follow the next deep dive on Mindbody, the vertical software platform for the fitness and wellness industry

Resources