- Network Effects

- Posts

- a16z: Turning VC into a Network Effect business

a16z: Turning VC into a Network Effect business

Building the largest, most scalable preferential attachment machine in venture

Welcome to the 32nd Network Effects Newsletter.

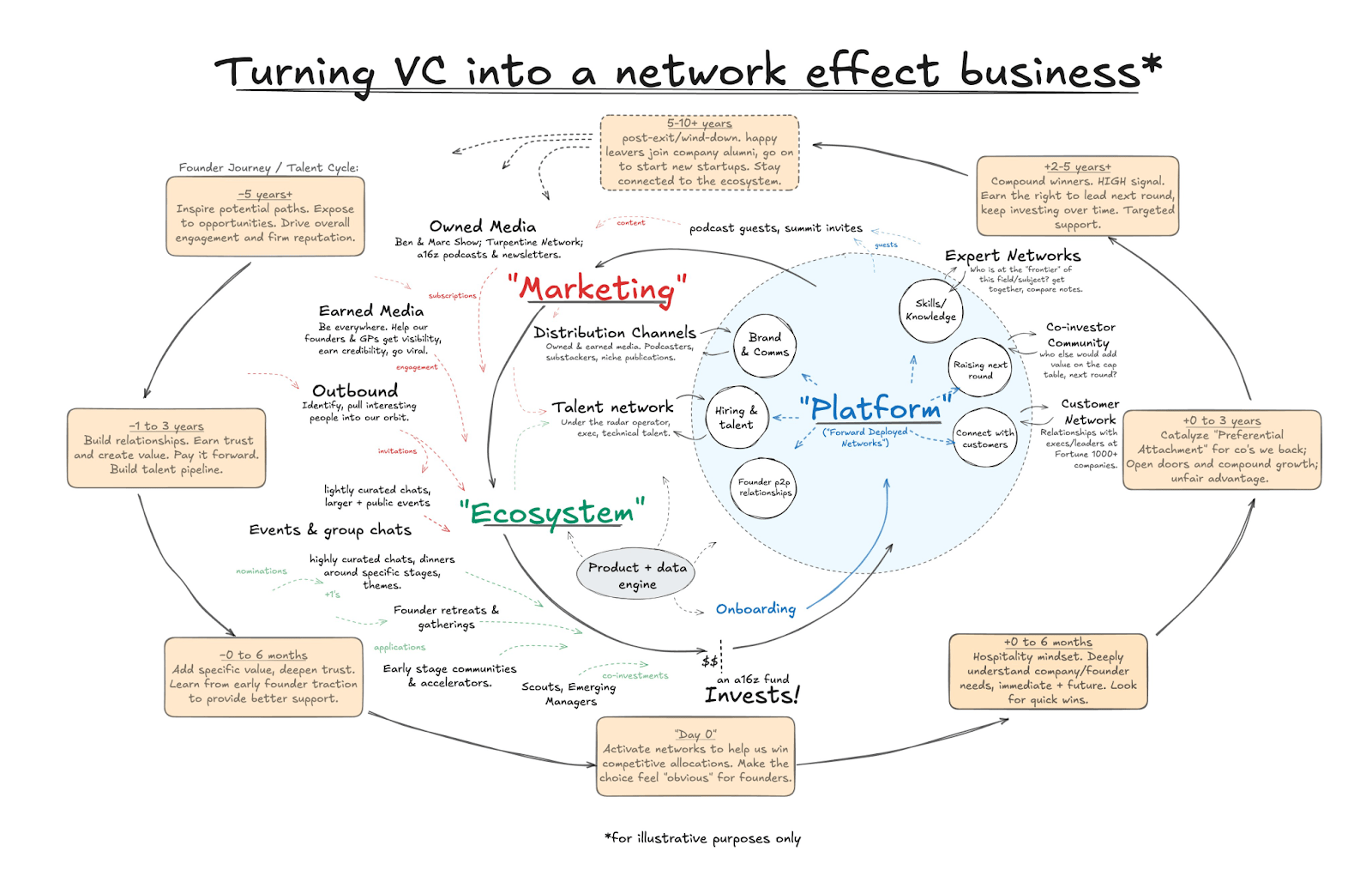

In October 2025, David Booth, Co-Founder and CEO of On Deck, announced he was joining Andreessen Horowitz (a16z) as Head of Ecosystem. In his announcement, Booth described a vision to scale a16z’s brand through three intertwined engines: Marketing, Ecosystem and Platform.

It marks one of the most important shifts in how venture capital operates, representing a shift from VC as a service business to a platform with compounding network effects

In this issue, we’ll unpack how a16z is building a network effects business, disguised as a venture firm.

Momentum is the Moat

Most startups, by definition, are “default dead”.

Every founder starts with zero momentum and a short runway. To survive, you must find a way to build a self-reinforcing loop where progress compounds and traction builds

Hiring A+ Talent

Closing Customers

Raising from Investors

Attracting Press & Coverage

Building Partnerships

As Bryan Kim from a16z said, “Momentum is the moat.”

Momentum creates the gravitational pull around a startup’s orbit. The rise of founder-led marketing, viral video launches, strategic press cycles, and flashy fundraising announcements has become a means to generate momentum for startup founders, to signal progress, attract attention, and build credibility before traction catches up.

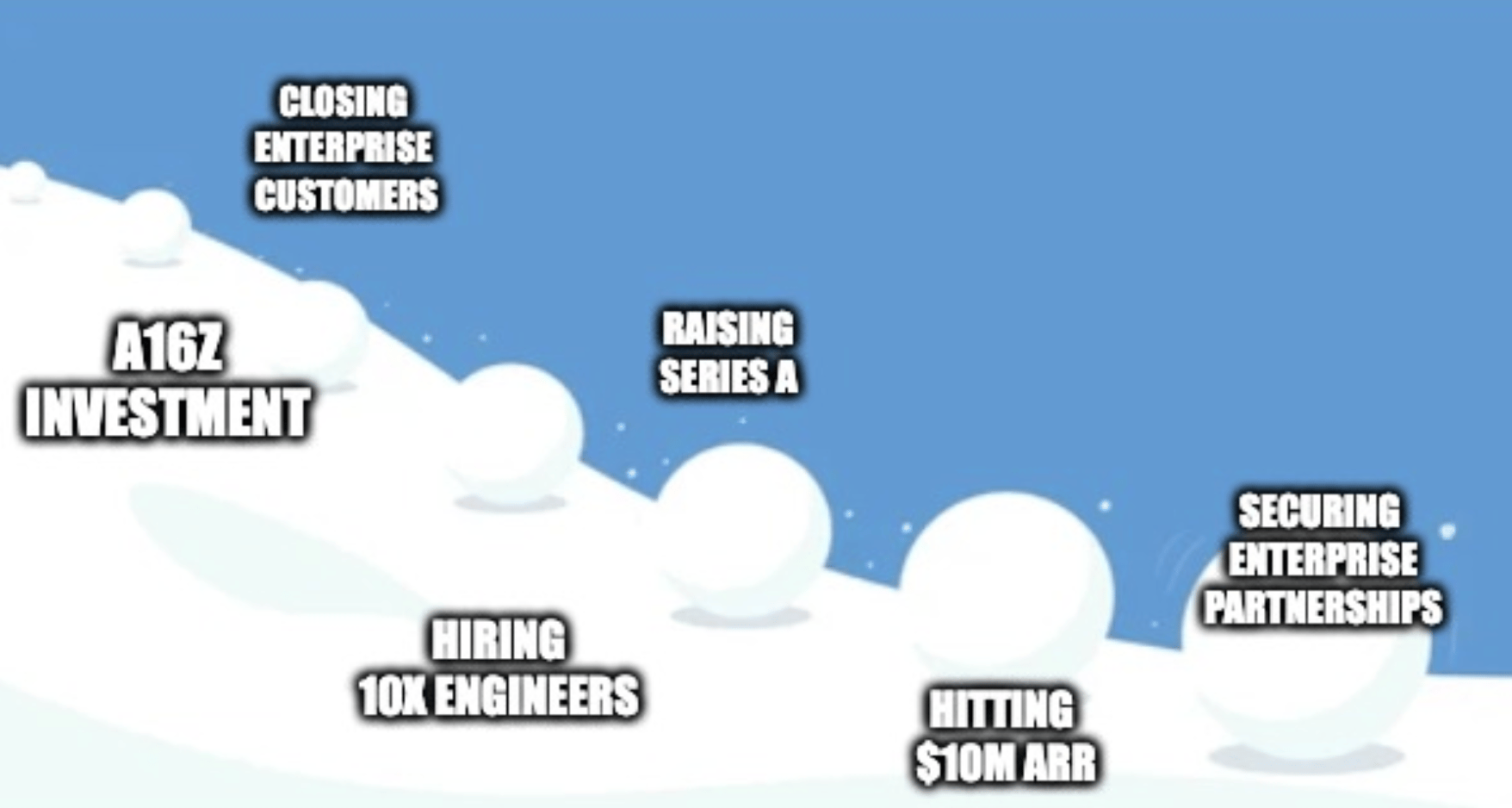

Then the question becomes, how do you build momentum? Enough to the point where the next resource that you need is more likely to attach to your startup, to get the positive momentum rolling. a16z calls it preferential attachment.

Seed and Series A rounds, then, are not just about capital. They represent inflection points for founders to build credibility with employees, investors, customers, and partners.

“Like a snowball, you’re either rolling down the hill, picking up resources, gaining size and scope and scale, power, credibility as you go... or you’re not–you’re stuck at the top of the hill as a snowflake, and you’re just not going anywhere."

“Raising from a top VC is a bridge loan of credibility at a point in time where a startup deserves credibility but doesn’t have it yet.”

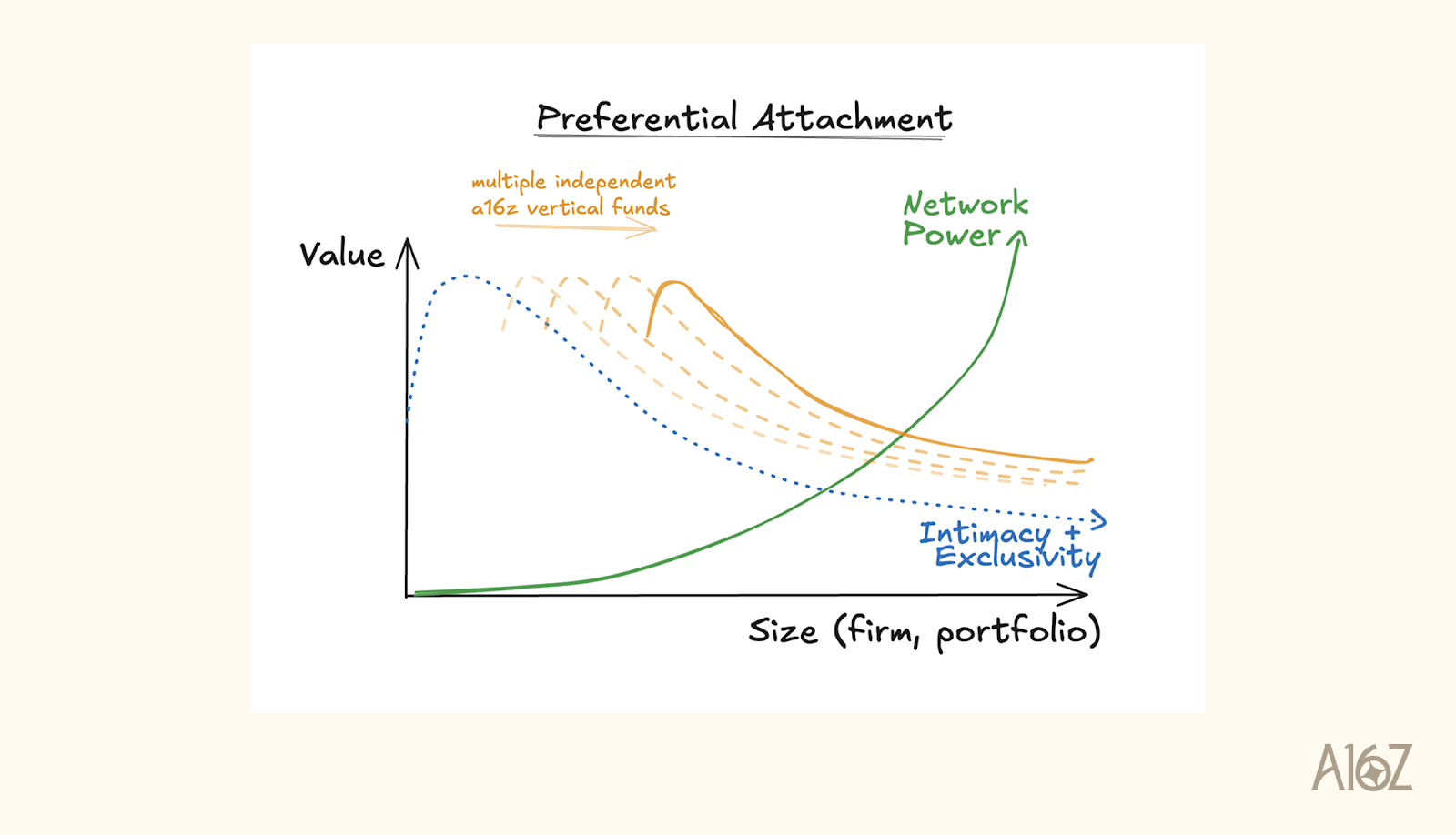

Venture Capital’s Scaling Paradox

From a venture capital firm’s perspective, competition often centers on access to the best startups. To differentiate, firms rely on personal trust and the hands-on involvement of their general partners.

A GP’s “value add” usually comes from their willingness to dedicate effort to:

Making key customer or partnership introductions

Leveraging their networks for future fundraising

Helping founders close gaps in hiring, go-to-market, or product development

Some funds, such as Felicis Ventures, would have a dedicated platform/founder success team to help build out new capabilities post-investments.

However, the paradoxical truth is that intimacy doesn’t scale. Each new investment is further dividing partner attention, and traditional ‘services’ approaches hit diminishing returns to scale.

As a result, a venture can feel like the opposite of a network-effect business: the bigger the portfolio, the more diluted your attention, and the less the value-add on their portfolios.

a16z Ecosystem Design

As a16z grew and became one of the largest venture fund managers with over $46 billion AUM. David and team have stepped back and rethought their business model:

How to build venture firms like networked products?

How to build systems where value compounds?

In David’s Tweet, he emphasized two big ideas: Brand and Networks.

a16z Brand: Brand amplifies visibility, attracts talent, and builds credibility. A strong brand signals to founders and LPs that the firm has earned trust, proven its judgment, and consistently delivered outcomes worth associating with.

a16z Networks: Each new participant increases the value of the whole. When a founder joins the a16z ecosystem, they gain access to a growing pool of advisors, operators, and partners whose collective experience compounds with every cohort.

The compounding happens when the two reinforce each other. A credible brand attracts great founders; great founders build great companies; great companies reinforce the brand.

A16z has operationalized this loop by institutionalizing what used to be personal favours into scalable infrastructure:

Knowledge: Playbooks, frameworks, and insights from operators.

Offers: Access to partner credits, banking offers, and computing resources.

Community: Events, peer groups, and investor networks that foster serendipity.

Components of the a16z Machine

The envisioned a16z model is an interconnected flywheels that turn venture into a networked product, which consists of three key functions: Marketing, Ecosystem and Platform.

A) Marketing is the top-down vector of storytelling.

Owned media, earned media, and outbound channels work in concert to signal credibility, attract attention, and seed the ecosystem with high-potential talent and founders. Marketing creates gravitational pull before any investment is made, building the anticipation that being invested by a16z will increase the likelihood of success.

B) Ecosystem is the bottom-up vector of trust.

It builds the connective tissue between founders, operators, and capital providers. Through curated events, group chats, retreats, early-stage communities, and accelerator programs, a16z nurtures relationships that compound over time. Founders are participating in a community that stretches over years, reinforcing loyalty, serendipity, and preferential attachment.

C) Platform is the forward-deployed network for value delivery

It operationalizes the firm’s expertise into scalable systems without diluting the personal touch. This includes access to expert networks, co-investor communities, customers, advisors, and domain specialists. Platform ensures that every founder can leverage the collective experience of the ecosystem at the moment they need it most

This philosophy represents a broader shift in how institutions scale in the network era. a16z is no longer relying on its investors to provide services to meet all its portfolio needs; rather, it builds infrastructure where talent circulates and helps each other.

If you found this valuable, consider sharing with a colleague or founder in vertical SaaS.

Have a product or case study worth profiling?

→ Reply to this email or reach out at [email protected]

Resources